Bitcoin Treasury Companies: The Corporate Bitcoin Standard Explained

In an era of persistent inflation and evolving monetary policy, a growing number of companies are embracing what might be called a “Corporate Bitcoin Standard.” This refers to the practice of holding Bitcoin — a digital asset with a fixed supply of 21 million — as part of corporate treasury reserves.

The idea is reminiscent of the Gold Standard of yesteryear, but updated for the digital age. Instead of gold bars in vaults, Bitcoin treasury companies are increasingly considering Bitcoin on balance sheets as a strategic reserve asset.

The movement was pioneered by companies like Strategy Inc. (formerly MicroStrategy), which transformed its balance sheet by accumulating Bitcoin in lieu of excess cash.

Proponents argue that BTC”s unique monetary properties (strict scarcity, decentralization, and global liquidity) make it an ideal store of value for preserving purchasing power over the long-term. Critics, however, note the crypto’s volatility and the need for prudent risk management.

In this comprehensive guide, we delve into the first principles driving the Corporate Bitcoin Standard, the recent accounting changes that have paved the way for broader adoption, real-world case studies (like Strategy’s bold bet), regulatory and fiduciary considerations, and a checklist for CFOs contemplating a Bitcoin treasury allocation.

Why Companies Are Embracing Bitcoin in Treasury Reserves

Corporate treasurers and CFOs are fundamentally charged with capital allocation and fiduciary responsibility – ensuring that a company’s cash reserves are managed wisely for long-term stability and growth. Traditionally, this meant parking excess cash in “safe” instruments like bank deposits, money market funds, or short-term bonds. However, over the last decade, structural economic trends have prompted a re-evaluation of what safe means. Unprecedented monetary expansion and fiscal stimulus have raised concerns about currency debasement, while near-zero interest rates (until recently) often meant that cash holdings yielded virtually nothing. When inflation spiked to multi-decade highs in 2021–2022, the purchasing power of corporate cash eroded at an alarming rate. Even in 2023, with inflation moderating to ~3–4%, it remained above historic norms, ensuring that cash continues to lose real value. In essence, many corporate balance sheets were “melting ice cubes” – a vivid phrase coined by Strategy’s CEO Michael Saylor to describe how idle cash dwindles in value under inflation.

Preserving Purchasing Power: Bitcoin’s Monetary Properties

At its core, Bitcoin was designed as sound money. It is hard-capped at 21 million coins, making it immune to the dilution that affects fiat currencies which can be printed in unlimited quantities.

That verifiable scarcity, enforced by a decentralized network, gives Bitcoin a built-in resistance to inflation. No central bank or authority can increase its supply beyond the algorithmic schedule.

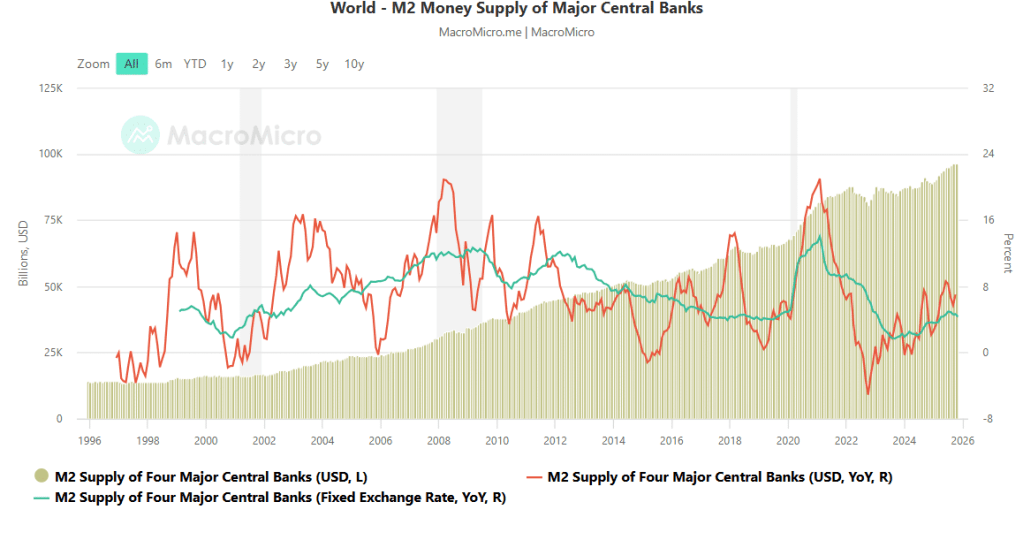

By contrast, major fiat currencies saw unprecedented expansion of the money supply in the past decade – for example, trillions of dollars were created in response to the 2008 financial crisis and the 2020 COVID-19 pandemic.

Global M2 money supply chart as of 23/12/2025 (Source: MacroMicro)

Such expansion has few historical parallels. The predictable result of too many dollars (or euros, yen, etc.) chasing a fixed amount of goods is a decline in currency purchasing power.

While Bitcoin’s price can be volatile in the short term, its trajectory over the last 10+ years shows a remarkable capacity to outperform inflation and appreciate in real terms. A clear way to understand this is through the lens of real returns.

BTC price chart since 2009 (Source: BitBo)

Bitcoin delivered substantial positive returns during most of the past decade as well. Even accounting for periods of decline, its long-term upward trend has meant that a small allocation a few years ago could have significantly grown in value.

Fidelity analyzed a thought experiment: if an average S&P 500 company had put just 1% of its $10 billion treasury into Bitcoin in mid-2019, that $100 million investment (at ~$10k/BTC) would have swelled to about $700 million by mid-2024 – despite intervening volatility. The implication is powerful: Bitcoin can preserve and enhance purchasing power where cash will not, provided the company can weather short-term price swings.

Beyond its supply cap, Bitcoin’s monetary properties include censorship-resistance and global liquidity. It can be transferred 24/7, 365 days a year, without reliance on any single bank or government. This means corporate treasurers have access to liquidity that isn’t tied to banking hours or specific geographies.

That constant liquidity and borderless nature can act as a hedge against local currency crises or banking system failures. Indeed, after several high-profile bank failures in 2023, many treasury executives sought to diversify counterparty risk – holding some Bitcoin is one way to reduce reliance on traditional banks, since Bitcoin isn’t someone else’s liability or subject to another party’s solvency.

Asymmetric Risk-Reward and Fiduciary Duty

From an institutional investor’s perspective, one of the most attractive aspects of Bitcoin is its asymmetric risk-reward profile. In simple terms, a relatively small allocation to Bitcoin can have an outsized impact on returns if Bitcoin’s value increases dramatically, while the downside is limited to that small allocation (should Bitcoin’s price go to zero, the loss is capped at the size of the position).

Corporate finance leaders like CFOs are naturally conservative, but they also have a duty to prudently manage shareholder value. This means considering not just the risks of action, but also the risks of inaction. In a world where fiat cash is steadily losing value, not exploring higher-yielding or appreciating stores of value could be seen as a lapse in fiduciary responsibility.

Bitcoin’s risk-reward dynamic has been likened to early-stage tech investments: potentially transformative upside with manageable downside. Michael Saylor of Strategy put it this way when his company made Bitcoin its primary reserve asset: holding cash was a guaranteed losing proposition (the melting ice cube), whereas Bitcoin offered a chance to significantly outperform due to its scarcity and growing adoption. He and others have even compared Bitcoin’s upside to the emergence of big tech companies in the 2000s – an opportunity that, if realized, could dwarf the returns of traditional assets.

Of course, with potential high reward comes volatility. Bitcoin regularly experiences 50% drawdowns, and its price can whipsaw in response to macroeconomic news or regulatory developments. For corporate treasuries, this volatility translates to fluctuations in the value of holdings quarter-to-quarter. But if the allocation is sized appropriately (usually a modest percentage of total reserves) and the time horizon is long-term, the volatility can be managed.

It’s notable that Bitcoin’s correlations with traditional assets are generally low. This means Bitcoin can act as a diversifier – its price movements are not tightly coupled with equities, bonds, or other assets. By adding an uncorrelated asset, companies can potentially improve risk-adjusted returns on their overall treasury portfolio. The key is proper position sizing and not relying on Bitcoin for near-term liquidity needs; essentially, treat it as a long-term reserve within a broader liquidity management strategy.

From a fiduciary standpoint, any significant treasury move (especially something as novel as Bitcoin) must be justified to the board of directors and shareholders. Here, clarity of purpose is crucial. Some companies view holding Bitcoin as a hedge against macroeconomic uncertainty – a sort of insurance policy against worst-case scenarios of currency debasement or financial instability. Others see it as aligning with a vision of technological innovation, appealing to tech-savvy investors or signaling that the company is forward-looking in embracing digital assets.

There’s also an argument that holding Bitcoin can expand a company’s investor base: for instance, when Strategy announced its Bitcoin plan towards the end of 2020, it attracted shareholders who wanted exposure to Bitcoin but perhaps were restricted from holding the asset directly.

In that sense, a company can almost become a proxy for Bitcoin investment, which might boost its stock liquidity and valuation (as indeed happened with Strategy’s stock in the wake of its Bitcoin purchases).

Case in Point: Strategy’s “Bitcoin Standard” Strategy

No discussion of corporate Bitcoin treasuries is complete without Strategy Inc. – the enterprise software company formerly known as Strategy. In August 2020, Strategy made headlines as the first public company to adopt Bitcoin as a primary treasury reserve asset.

At the time, the firm had hundreds of millions in excess cash and faced a low-yield environment. CEO Michael Saylor, concerned about impending inflation and currency debasement, convinced his board that their cash was better deployed into Bitcoin. The initial purchase was $250 million worth of BTC (around 21,454 coins) in the summer of 2020.

Strategy announcing its first BTC purchase (Source: SEC)

That was quickly followed by additional buys – Strategy essentially shifted its entire treasury (and more, via debt raises) into Bitcoin over the next couple of years.

By December 2025, the company held about 617,268 bitcoins on its balance sheet, a stash that at that time was valued at roughly $58.7 billion. This jaw-dropping accumulation (financed through a combination of cash, convertible notes, and even Bitcoin-backed loans) has made Strategy a poster child for the Corporate Bitcoin Standard.

Strategy’s BTC holdings (Source: Bitcoin Treasuries)

The impact on the company has been dramatic. Strategy’s stock (ticker MSTR) became tightly correlated with Bitcoin’s price – often moving in tandem with crypto markets. In fact, since the company adopted its Bitcoin strategy on Aug. 10, 2020, the stock’s performance went on to outshine virtually every asset and index in the market. This was partly due to the leverage-like effect (MSTR traded almost like a leveraged Bitcoin ETF) and partly due to increased investor interest. By late 2024, MSTR shares were up over 2,700% from the strategy’s start, vastly exceeding Bitcoin’s own (~650%) gain in that period and leaving the S&P 500 (~78%) far behind.

In the second half of 2025, MSTR has however been on a decline amid a broader crypto market slump, which has seen the share prices of other Bitcoin treasury companies slide as well.

MSTR price over the past 6 months (Source: Google Finance)

The company also rebranded itself as “Strategy” in 2025, underscoring how central Bitcoin had become to its identity.

Originally a business intelligence software firm, it now markets itself as “a Bitcoin treasury company” in filings and public statements. Saylor frequently describes Bitcoin as a superior reserve asset – “harder” than gold due to its absolute scarcity – and a network growing faster than big tech did in their early days. The corporate narrative became not just preserving value, but actively embracing Bitcoin’s potential growth.

It’s important to note that Strategy’s journey wasn’t without challenges. The company had to carefully communicate its strategy to shareholders and regulators, starting with modest allocations and then increasing over time.

They also invested in secure custody solutions and navigated accounting rules that initially were unfavorable (more on that in the next section). But the end result has been transformative: Strategy now effectively holds one of the largest Bitcoin troves of any institution, giving it a balance sheet asset that management believes appreciates in value rather than depreciates in the long run. Its bold move has inspired other firms and opened the conversation in boardrooms about whether a small Bitcoin allocation could similarly protect and enhance shareholder value.

While Strategy is the most prominent example, it’s not alone.

Corporate BTC statistics (Source: Bitcoin Treasuries)

Tesla made waves in early 2021 when it bought $1.5 billion of Bitcoin for its corporate treasury, citing a desire for “more flexibility to further diversify and maximize returns on our cash” in an SEC filing.

Tesla’s buy lent mainstream credibility to the idea of Bitcoin as a treasury asset, though the company later sold a portion of its holdings. Block, Inc. (formerly Square) is another example: the fintech firm invested $50 million (then about 1% of its assets) in Bitcoin in 2020, followed by $170 million in 2021. Block’s rationale was aligned with its mission of economic empowerment – effectively putting its money where its mouth was since it also builds Bitcoin-friendly financial services.

By 2024 Block even announced it would routinely put 10% of its yearly profit into Bitcoin, essentially dollar-cost averaging into a larger position. Other public companies such as Stone Ridge Holdings (an asset manager parent company) and Semler Scientific (a small-cap healthcare firm) have also disclosed Bitcoin holdings as primary treasury reserves, explicitly citing concerns about fiat inflation and the attraction of Bitcoin’s finite supply.

In an October 2025 report, Forbes noted that at least 228 public companies worldwide had announced digital asset treasury strategies, collectively holding around $148 billion in Bitcoin and other crypto assets. This suggests that what was once a fringe idea has gained significant momentum, although those companies range from crypto-native businesses (like miners and exchanges) to operating companies in various sectors that decided to diversify their reserves.

The 2025 Accounting Pivot: Fair Value Rules Change the Game

One of the biggest developments catalyzing corporate Bitcoin adoption has been the change in accounting standards. In the United States (and many other jurisdictions following U.S. GAAP), prior to 2025 Bitcoin was classified as an indefinite-lived intangible asset for accounting purposes.

That meant that if the price of Bitcoin dropped below the company’s purchase cost at any point in a quarter, the company had to impair the value of its holdings on the balance sheet to that lower value – recognizing a loss. However, if the price went up, the rules did not permit marking it up. Gains could only be recognized if and when the Bitcoin was sold. This asymmetrical accounting treatment often led to financial statements that underreported the economic value of Bitcoin holdings. For example, during the 2021–2022 volatility, companies like Strategy took large impairment charges when Bitcoin’s price fell, even though they hadn’t sold a single satoshi – their balance sheet Bitcoin was shown at a low value, and no upward revisions were allowed when the price recovered. This not only looked bad on earnings reports (massive paper losses), but could dissuade corporate treasurers who didn’t want such accounting headaches and volatility on their income statements.

Enter the Financial Accounting Standards Board (FASB) with a long-awaited fix. In December 2023, FASB approved new guidance (Accounting Standards Update 2023-08) effective for fiscal years beginning after Dec 15, 2024 (i.e., effectively 2025) that allows companies to use fair value accounting for certain crypto assets, including Bitcoin. Under these new rules, companies will measure Bitcoin holdings at fair market value on each reporting date, both up and down. Unrealized gains and losses will flow through the income statement (or other comprehensive income in some cases), giving a more accurate reflection of the current value of digital assets on the balance sheet. In short, no more one-way impairment ratchet – you mark to market like you would for tradable securities.

This is a permanent game-changer for corporate adoption. Fair value accounting resolves a major deterrent that previously hung over corporate Bitcoin treasuries. As Michael Saylor enthusiastically noted when the update was issued, “This upgrade to accounting standards will facilitate the adoption of Bitcoin as a treasury reserve asset by corporations worldwide”.

Companies can now carry Bitcoin on financial statements in a way that reflects economic reality, rather than a potentially very understated book value. For CFOs, this increases the appeal of holding Bitcoin because the transparency is improved – investors and analysts will see the true market value (and volatility) of holdings, not just a lowest-of-the-quarter peg. It also means that quarters of price increases will show income gains, which can help offset losses in down quarters, smoothing out some of the previous skew toward only showing negatives.

There are implications to the change: earnings will be more volatile from Bitcoin market swings, as gains and losses hit the P&L. Companies adopting the fair value approach must be prepared for that volatility and communicate to investors appropriately (much like companies holding large investment portfolios do).

But importantly, the balance sheet will now carry Bitcoin at fair value, which bolsters measures like equity and retained earnings when Bitcoin’s price rises. In fact, when Strategy adopted the standard on Jan. 1, 2025, it recorded a cumulative adjustment increasing its retained earnings by $12.7 billion – essentially reversing years of prior impairment charges and marking its BTC up to market. This one change swung the company from large accumulated accounting losses to a healthier equity position. It’s easy to see why Saylor and others lobbied FASB for this outcome.

For companies considering Bitcoin, 2025’s accounting pivot removes a key excuse not to hold crypto. Previously, a CFO could argue that “even if we believe in Bitcoin long-term, the accounting treatment will punish our reported results.”

That argument no longer holds – now Bitcoin will be treated similarly to other financial assets. We should note that outside the U.S., accounting standards are still catching up. Under IFRS (international standards), as of 2025 crypto is usually still treated as intangible (unless perhaps held by certain investment entities). But with the U.S. moving to fair value, there may be pressure on other standard-setters to follow suit, especially as multinational companies push for consistency. At the very least, the FASB move is influencing best practices and gives comfort that regulators are adapting to digital assets rather than ignoring them.

Regulatory Landscape and Institutional Tailwinds

Beyond accounting, the broader regulatory environment for corporate crypto holdings has significantly improved in the past few years. In the early 2010s, Bitcoin existed in a legal gray zone; by the late 2010s, regulators began providing guidance, and by mid-2020s we have much more clarity (though not without some uncertainty in specific areas).

In the United States, regulators and policy makers have taken steps that, in aggregate, create a more hospitable landscape for institutional Bitcoin adoption. For instance, the U.S. Securities and Exchange Commission (SEC) in 2024 approved the first spot Bitcoin exchange-traded fund (ETF) after years of delay. This ETF approval (combined with other developments like futures-based ETFs earlier) signaled a normalization of Bitcoin as an investable asset for institutions.

It also provides corporations with another avenue to gain Bitcoin price exposure (via buying ETF shares) if they prefer that to holding the asset directly. The current U.S. administration and regulators have also voiced support for innovation in blockchain and digital assets, aiming to keep the U.S. competitive in this field. This policy stance, along with clearer guidelines from agencies like the OCC for banks dealing with crypto, has given companies more confidence that owning Bitcoin won’t lead to a regulatory backlash.

Europe, meanwhile, implemented the MiCA (Markets in Crypto-Assets) regulation – a comprehensive legal framework that came into effect in 2024, which provides rules for custody, disclosure, and issuance of crypto assets. MiCA’s passage is often cited by corporate treasurers in the EU as removing a layer of uncertainty; it defines how companies can handle crypto on their balance sheets and the protections in place. Countries like Germany even allowed certain investment funds to allocate up to 20% to crypto starting in 2021, indicating a receptive stance at policy levels.

However, regulatory considerations are not just about broader policy – companies must also consider securities law and industry-specific regulations. One pertinent question is: could holding a large amount of Bitcoin inadvertently trigger status as an “investment company” (under the 1940 Act in the U.S.)?

Generally, if a public company’s assets become mostly investment securities and it’s not primarily operating a business, it might fall under that act. Strategy addressed this by continuing to emphasize its software business revenues, but a pure Bitcoin-holding SPAC or shell company would have to be careful (some have gone the route of becoming a publicly traded Bitcoin holding company via SPAC merger). Public companies also need to ensure they’re not holding or issuing any digital asset that could be deemed an unregistered security by the SEC – sticking to Bitcoin (which is widely considered a non-security commodity) is a safer harbor than dabbling in various tokens that might attract regulatory scrutiny.

Another regulatory aspect is disclosure. The SEC has made it clear, through comment letters and guidance, that if you hold material crypto assets, investors should be informed about it. Companies are expected to disclose not only the amount of digital assets they hold but also the nature of their strategy (why they are holding it), how they are keeping it secure, and the risks involved.

For example, public filings should mention the risk of price volatility, potential for hacks or loss, regulatory changes, etc., as these can all affect the firm’s financial condition. Thus, a company adopting a Bitcoin standard must be prepared for a bit of extra compliance work: robust risk factor disclosures, expanded financial statement notes (including how they custody the Bitcoin and how fair value is determined), and maybe even fielding questions from analysts on earnings calls about crypto strategy.

On balance, though, the regulatory trajectory has been a tailwind. Each piece of clarity – whether in accounting, fund products, or legal classification – reduces the career risk for CFOs and treasurers. It’s often said that no one wants to be first, but everyone wants to be second. Strategy’s bold move made it “acceptable” for others to follow, and now with frameworks in place, we’re likely to see more companies dip their toes in the water over the next decade. The structural trend of the last 10 years (Bitcoin maturing from a fringe experiment to a recognized asset held by some of the world’s largest financial institutions) is poised to continue into the next 10 years. Many analysts predict that by 2030s, having a slice of Bitcoin in treasury might be as commonplace as having some exposure to foreign currencies or commodities is today – not a bet-the-company move, but a standard element of prudent diversification and inflation hedging.

Bitcoin Treasury Policy Checklist for CFOs and Boards

For any CFO or corporate treasurer considering adopting a “Bitcoin Standard” for their company’s treasury, there are several critical considerations to address beforehand. Implementing a Bitcoin treasury strategy is not as simple as deciding to buy some BTC on a whim – it requires a structured policy, stakeholder alignment, and robust risk management. Below is a checklist of key elements and questions to guide the development of a Treasury Policy for Bitcoin:

- Strategic Rationale and Objectives: Clearly define why your company is considering holding Bitcoin. Is it primarily for an inflation hedge and preservation of purchasing power? A diversification play to reduce reliance on traditional assets? Part of an innovation branding strategy? Ensuring that the rationale aligns with the company’s broader business strategy and risk philosophy is the first step. The board and executive team should discuss and agree on the goals (e.g., “We want to hedge X% of our cash against inflation over 10 years” or “We want to be seen as a tech-forward organization embracing new asset classes”).

- Board and Fiduciary Oversight: Involve the board of directors early and ensure they are educated on the digital asset market. Board approval is often needed for significant treasury changes. Directors have fiduciary duties to shareholders, so they must be comfortable that adding Bitcoin is in the company’s long-term interest and that they can oversee this strategy properly. Regular updates to the board on the Bitcoin position and market developments will be necessary for ongoing oversight.

- Policy Scope and Limits: Draft a treasury policy document that outlines what digital assets are allowed and in what amounts. Many companies will choose to stick to Bitcoin only (avoiding more speculative altcoins). Define the maximum allocation (e.g., “up to 5% of cash” or “up to $X million”), and whether you will acquire in one lump or over time. The policy should also state under what conditions, if any, the company might sell Bitcoin – for instance, is this a long-term hold unless there’s a need for liquidity, or will you actively trade around volatility? Having clear parameters helps manage expectations and risks.

- Acquisition and Financing Plan: Decide how the company will obtain Bitcoin. Will you use existing cash on the balance sheet to purchase? If so, through which exchanges or brokers (ensure they are reputable and regulated)? Alternatively, some companies raise capital specifically to buy Bitcoin – for example, via issuing debt (convertible bonds, notes, etc.) or equity and then deploying the proceeds into BTC. If you plan to raise funds, consider the market implications (dilution, interest costs) and ensure you disclose the intent clearly to investors. Some companies, like Strategy, used a mix of cash and debt to continually increase their holdings. The financing approach should be part of the strategic plan.

- Custody and Security: Determine how and where the Bitcoin will be custodied. This is a critical operational decision – losing the private keys would be disastrous. Options include using regulated third-party custodians (many offer institutional-grade cold storage solutions), using a prime broker or bank that provides crypto custody, or self-custody with in-house generated keys (usually not recommended unless the company has serious crypto security expertise). Many treasurers opt for third-party custody to minimize legal and security risks. Whichever route, implement robust controls: multi-signature approvals, role-based access (no single employee can move funds unilaterally), and perhaps insurance coverage for the holdings. Periodic audits of the controls are advisable.

- Risk Management and Controls: Augment your internal controls to account for digital asset risks. This includes cybersecurity measures (protection against hacking attempts if any systems connect to wallets), procedures for authorizing transactions, and monitoring of the Bitcoin market. Consider the worst-case scenarios (e.g., a rapid price crash) and ensure the position size is such that it won’t threaten the company’s liquidity or operations. Stress-test what would happen if Bitcoin lost, say, 50% of its value – would the company still be fine? If the plan is to never sell, ensure you don’t put yourself in a position where you have to sell (for example, avoid using Bitcoin as collateral for loans that could be margin called unexpectedly, unless carefully managed).

- Accounting and Audit Readiness: With the new FASB rules, accounting is easier, but your finance team still needs to be prepared to handle mark-to-market accounting each quarter. Ensure your accounting policies are updated for ASU 2023-08 adoption (fair value for crypto). You’ll need to get periodic fair values (likely from reputable exchanges or indices) and report unrealized gains/losses. Coordinate with your external auditors early – choose an audit firm (or ensure your current auditors) have expertise in crypto accounting. Auditors will likely scrutinize existence (prove the company actually holds X BTC – possibly via an attestation from the custodian or signing a message from the wallet) and valuation methods. Be ready to provide documentation for all these.

- Regulatory Compliance: Check the regulatory implications specific to your industry and jurisdiction. For example, if you are a financial institution, are there limits or capital charge implications for holding crypto? If you operate internationally, is holding or transferring Bitcoin restricted in any countries where you do business? Also, ensure that holding Bitcoin won’t inadvertently make your company subject to additional regulations (like the Investment Company Act as mentioned earlier – usually not an issue unless crypto becomes a dominant asset on your balance sheet relative to operating assets). Engaging legal counsel with crypto expertise to review your plans is prudent.

- Disclosure and Investor Relations: Plan out your disclosure strategy. Material Bitcoin holdings should be disclosed in your financial statements (balance sheet, footnotes, MD&A section of filings) along with discussion of risks. The SEC has explicitly outlined that companies need to describe their digital asset strategies, how they’re financed, how they custody the assets, and how it impacts the business. Beyond filings, consider how you’ll communicate this to investors and analysts. It’s often wise to hold a call or publish a shareholder letter explaining the rationale (especially if the move is significant relative to your company size). Proactive communication can frame the narrative (why this is good for long-term value) and address concerns up front.

- Ongoing Governance and Adaptation: Finally, treat the Bitcoin treasury strategy as an evolving program, not a one-off stunt. Assign clear responsibility – e.g., a treasury committee or a designated executive – to monitor the crypto market and regulatory developments. Establish a cadence for reviewing the strategy (at least annually, if not quarterly with the board). As conditions change (market, regulatory, or company’s financial condition), you may tweak the approach. For example, if Bitcoin’s value grows substantially, you might rebalance to cap it at a certain percentage of assets (or maybe not, if the goal is to maximize Bitcoin holdings). Alternatively, success might lead you to expand into other digital assets or related strategies (though caution is warranted). The key is to continuously align the strategy with the company’s overall risk tolerance and goals, and make adjustments in a controlled, well-communicated manner.

By following a checklist like the above, CFOs and boards can approach Bitcoin integration methodically, fulfilling their fiduciary duties while harnessing the potential benefits. The overarching theme is good governance – with sound policies, controls, and transparency, a corporate Bitcoin strategy can be executed in a responsible way. As one law firm’s guidance succinctly put it, it’s about aligning the decision with corporate goals and ensuring robust oversight, so that the company can reap rewards while mitigating risks.

Ecoinimist Analysis

We believe that Bitcoin treasury companies have opened up a new channel for traditional investors to gain exposure to the crypto market in a regulated way. However, the launch of spot Bitcoin ETFs (exchange-traded funds) serve somewhat of a similar role to these crypto treasury companies now.

Strategy stood out prior to 2024, which was before the ETFs launched, because it was one of the only ways for traditional investors to buy into BTC. However, the ETFs have chipped away at this utility. What’s more, several other corporate BTC treasury firms have launched, such as Metaplanet, Twenty One Capital, and others.

On top of that, Bitcoin treasury vehicles offer investors leveraged BTC exposure. While this means that gains can be amplified if BTC’s value rises, the inverse is true as well. This is why new entrants to the space have struggled to gain traction. Strategy continues to buy Bitcoin and holds a commanding lead in the market, but, as mentioned, has seen its price tumble in recent months alongside Bitcoin’s price drop.

Frequently Asked Questions

What is a “Bitcoin treasury” strategy for a company?

It refers to the practice of a company holding Bitcoin (or other digital assets) as part of its treasury reserves or cash management strategy. Instead of keeping 100% of corporate liquidity in traditional forms like cash or short-term investments, the company allocates a portion to Bitcoin. The goal is often to hedge against inflation/currency risk, diversify assets, or capitalize on Bitcoin’s potential appreciation. In essence, the company is treating Bitcoin as it would any reserve asset (like a foreign currency or commodity) on its balance sheet.

Why would a company invest in Bitcoin instead of cash or bonds?

There are a few reasons. First, Bitcoin has a finite supply (21 million), so supporters argue it’s immune to the debasement that fiat currencies suffer when central banks print money. That makes it attractive as an inflation hedge – the idea is that Bitcoin’s value should hold up or increase as currencies lose purchasing power. Second, Bitcoin’s historical returns have been much higher than traditional assets (albeit with volatility), so a small allocation could significantly boost long-term returns if Bitcoin’s growth continues. Third, Bitcoin offers diversification: its price movements aren’t closely correlated with stocks or bonds, so holding some can potentially reduce overall portfolio risk. Finally, some companies also invest in Bitcoin to signal tech-forward thinking or to support the crypto ecosystem if it aligns with their business (for example, fintech or crypto-related firms do this to “put skin in the game”). All that said, companies still keep the majority of treasury assets in conventional low-risk instruments; Bitcoin would usually be a minority portion aimed at long-term benefits.

What are the main risks for a company holding Bitcoin?

The risks include price volatility – Bitcoin’s market price can swing wildly, which could lead to significant fluctuations in the company’s reported earnings and asset values. If the company ever needs to liquidate during a downturn, it could realize big losses. There’s also security risk: holding digital assets comes with the risk of hacks or theft if not properly secured. Companies must invest in secure custody solutions to protect their coins (unlike cash in a bank, Bitcoin is bearer-based – if you lose the keys, you lose the asset). Regulatory risk is another factor: the legal environment for crypto is still evolving, and changes (or a sudden ban in a jurisdiction) could complicate things. However, for just holding Bitcoin, the regulatory risk is relatively low in most countries – it’s more pertinent if the company were actively trading or using it in products. Finally, there’s reputational and stakeholder risk: some shareholders might oppose the strategy, seeing it as too speculative, which could affect stock perception. It’s important for companies to communicate their rationale clearly to mitigate this.

How do the new 2025 accounting rules affect companies holding Bitcoin?

The new FASB rules (effective 2025) allow companies to use fair value accounting for Bitcoin and certain crypto assets. This is a huge improvement. Under old rules, companies had to mark down the value if Bitcoin’s price fell (impairment), but couldn’t mark it up when it rose – so financial statements often showed an artificially low value for Bitcoin holdings. Now, with fair value, each quarter the Bitcoin will be reported at current market price, and any change (up or down) goes into earnings. This means no more permanent impairment drag on books; instead, you’ll see both the gains and losses. It makes earnings more volatile (because Bitcoin’s price fluctuates), but it also means the balance sheet reflects true value. Companies like Strategy that have large holdings saw their equity jump on adoption of the new standard, because they could write up the value of their Bitcoin significantly. In summary, the 2025 rule change gives more transparency and arguably removes an accounting disincentive – it’s generally viewed as crypto-friendly and has been welcomed by CFOs holding crypto.

How does a company actually buy and hold Bitcoin? Do they just use a crypto exchange?

Typically, companies will use institutional-grade services. They won’t have the CEO log into a retail exchange with a credit card! Instead, they might engage an OTC (over-the-counter) trading desk or a brokerage that specializes in large crypto trades to purchase Bitcoin in bulk without moving the market too much. For holding, many use third-party custodians that offer cold storage (offline wallets) with high security. These custodians often are regulated entities or trust companies with insurance, whose business is safeguarding crypto for institutions. Some big banks and financial institutions have also started offering crypto custody for corporate clients. The company will have a custody agreement and typically some sort of multi-signature scheme – for example, it might take 3 out of 5 designated officers to sign off on any movement of the coins. This all falls under the earlier “Custody and Security” planning. So, in practice, a company’s treasury department would coordinate with these professional service providers to handle the technical aspects of buying and storing Bitcoin.

Won’t Bitcoin’s volatility hurt a company’s financial stability?

Volatility is definitely a factor, which is why most companies keep Bitcoin as a small percentage of holdings relative to stable assets. The idea is that if, say, 95% of your treasury is in cash and short-term bonds and 5% in Bitcoin, a 50% drop in Bitcoin translates to only a 2.5% hit to total reserves – not ideal, but not catastrophic for operations. Companies also usually treat Bitcoin as a long-term investment, meaning they intend to hold through volatility cycles. They are not depending on Bitcoin’s value for day-to-day liquidity; they have adequate cash for that. In essence, you isolate Bitcoin as a non-critical portion of the treasury that you hope will appreciate over years, accepting that quarter-to-quarter it will bounce around. Moreover, as noted, accounting now reflects volatility on paper, but it’s up to the company to manage the real-world impact. Some might even use financial hedges (like derivatives) if they want to dampen volatility, though that introduces complexity and cost. The bottom line is that yes, Bitcoin is volatile, but with prudent position sizing and a strong cash buffer, companies can handle it. Many CFOs view it similar to how an endowment or long-term fund would view a volatile asset – potentially very rewarding if you look out far enough and stomach the ride.

Are companies using Bitcoin for transactions, or just as a reserve asset?

The focus of this guide (and generally in the corporate context) is on Bitcoin as a reserve asset – meaning it’s mostly sitting on the balance sheet as a store of value/investment. There are a few companies that have tried using Bitcoin for transactions (like paying vendors or accepting customer payments in Bitcoin), but that’s relatively rare and usually confined to crypto-native businesses. One reason is accounting complexity – using Bitcoin in operations could trigger lots of small gains/losses every time it’s used due to price changes. Another reason is that most vendors and employees still prefer fiat currency for practical reasons (stable value in the short term). So, generally, companies segregate the Bitcoin treasury from day-to-day working capital. It’s analogous to how a company might hold some gold or a foreign currency: it’s not paying suppliers in gold, but holding it as a long-term store and maybe converting small amounts to cash if needed. That said, some forward-looking firms are exploring things like using Bitcoin as collateral for loans (to raise cash if needed without selling the asset) or lightning network payments for specific use cases, but these are not yet widespread.

What kind of companies are most interested in a Bitcoin treasury strategy?

Early adopters were often in the tech sector – firms like Strategy in software, or Jack Dorsey’s Block (payments), or Tesla (automotive but led by an innovative tech-driven leadership) led the charge. Crypto industry companies (exchanges, miners, blockchain companies) also naturally hold Bitcoin since it’s core to their business (for example, Coinbase holds crypto, mining companies like Marathon or Riot keep a portion of mined Bitcoin, etc.). Outside of tech, we have seen a few others: some industrial or financial companies in regions with currency instability have looked at Bitcoin as a way to protect value. A notable example is Stone Ridge (traditional finance firm) as mentioned, or a medical device company like Semler Scientific – it really comes down to having leadership that is philosophically on board. As Bitcoin gains mainstream financial acceptance, we may see more blue-chip type companies take small positions, especially if they have large cash piles that they worry about inflating away. But it’s true that, so far, the pioneers have been those with either tech-forward mindsets or direct involvement in the crypto sector. Over the next ten years, that could broaden, much like how in the early internet days adoption started in tech companies and then became universal.