Bitcoin Treasuries Boom Faces First Major Meltdown

The once-hyped Bitcoin treasury experiment at Nakamoto Holdings has unraveled in dramatic fashion, sending shockwaves across the corporate crypto sector.

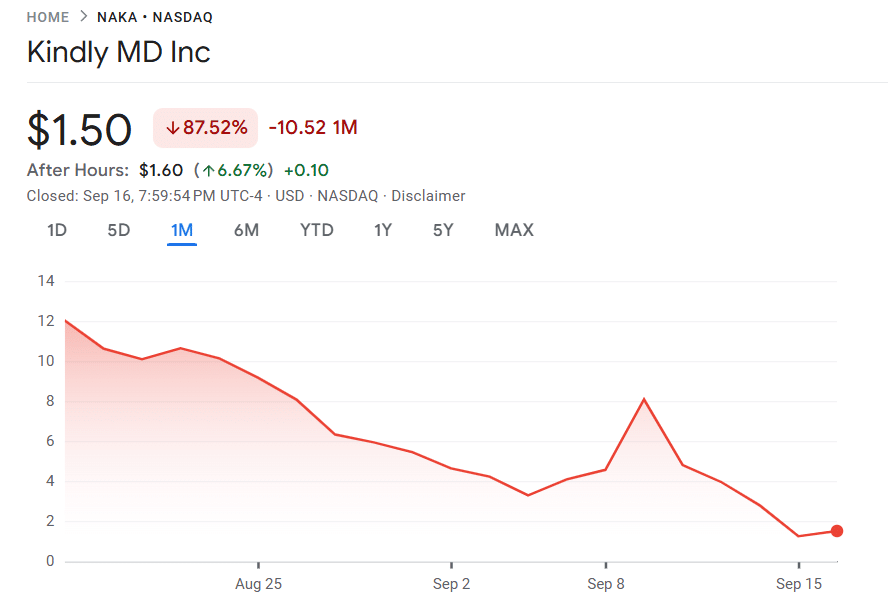

After merging with healthcare company KindlyMD in August, Nakamoto’s stock price has collapsed more than 50% in a single day and now sits 96% below its May peak, trading at just $1.50.

KindlyMD share price (Source: Google Finance)

The implosion follows last week’s PIPE (Private Investment in Public Equity) unlock, which allowed insiders to sell stock they had acquired at bargain prices. The mass sell-off triggered what analysts describe as the sharpest collapse yet in the ongoing corporate Bitcoin treasury boom.

The First Blowup in the Bitcoin Treasury Rush

Nakamoto’s downfall marks the first major implosion in a sector that has seen over 170 companies add Bitcoin to their balance sheets, collectively holding more than 1 million BTC.

But cracks are appearing beneath the surface. According to analysts, one in three Bitcoin treasury companies now trade below the value of the Bitcoin they own, and some are resorting to accounting maneuvers to avoid delisting from major exchanges.

Renowned crypto trader Scott Melker captured the mood bluntly:

“Hoe-Lee-Smokes. The crypto treasury narrative has been annihilated.”

PIPE Dreams Turn to Panic

The collapse can be traced directly to Nakamoto’s PIPE deal. Investors purchased shares at $1.12, watched them soar to nearly $34 in May, and then cashed out as soon as restrictions were lifted last week.

David Bailey, the company’s high-profile leader and an advisor to Donald Trump’s pro-crypto push, attempted to calm investors with a late-night letter. He framed the sell-off as part of “establishing our base of aligned shareholders,” but the reassurance rang hollow as shares continued to freefall.

BTC Holdings vs. Hype

Despite the crash, KindlyMD/Nakamoto remains a sizable player in BTC treasuries. The firm has acquired 5,765 BTC worth about $665 million, placing it 16th among corporate Bitcoin holders.

Top twenty largest corporate BTC holders (Source: Bitcoin Treasuries)

Yet the timeline of events underscores how much of the stock rally was driven by hype rather than fundamentals. The merger was announced in May but not completed until mid-August — and the company didn’t actually purchase its first Bitcoin until after that.

In essence, investors piled into the stock on the mere prospect of future Bitcoin purchases, rather than existing treasury strength.

Warning Signs for BTC Treasury Firms

The Nakamoto collapse highlights broader risks for the corporate BTC trade. Companies with little revenue or sustainable business models are attempting to ride the Bitcoin wave, much like the SPAC boom of 2021.

- KindlyMD reported less than $10 million in Q2 revenue before embarking on its BTC spree.

- Other firms, including Metaplanet and GameStop, have pursued similar treasury-driven strategies with little connection to core business growth.

Veteran short seller Jim Chanos warned earlier this year, “We are seeing SPAC-like 2021 numbers in the Bitcoin treasury market right now.”

A Painful Lesson for Retail Investors

Nakamoto’s crash will not end the Bitcoin treasury movement — companies like Strategy continue to hold billions in BTC and inspire imitators. But the sharp collapse is a cautionary tale for retail investors swept up in speculative hype.

The BTC treasury model has transformed balance sheets into trading desks. For some, it’s been lucrative. For others, like Nakamoto’s shareholders, it has turned into a brutal wipeout.