Why Tokenized Treasuries Are Becoming the Backbone of On-Chain Finance

Tokenized Treasuries – digital tokens representing U.S. government bonds – have rapidly evolved from niche experiments into core components of blockchain-enabled finance. By late 2025, the market capitalization of tokenized U.S. Treasuries and money-market funds reached about $9 billion, up from roughly $2 billion just 18 months earlier.

Tokenized Treasuries in the US (Source: RWA.xyz)

The milestone shows the permanent shift toward an on-chain capital base: instead of a passing trend, tokenization is a lasting upgrade to financial infrastructure, offering unparalleled capital efficiency, collateral mobility, and atomic settlement.

Institutional players have taken note: products like BlackRock’s BUIDL fund and Franklin Templeton’s BENJI illustrate two distinct approaches to bringing highly regulated assets on-chain. These advances – coupled with foundational initiatives like DTCC’s partnership with the Canton Network – signal that tokenized Treasuries are integral to the finance ecosystem of 2030 and beyond.

What Are Tokenized Treasuries?

Tokenized Treasuries are blockchain-based digital representations of U.S. Treasury securities, backed 1:1 by the same underlying government debt held in custodian accounts. In practice, when a traditional issuer like an asset manager acquires Treasuries, they can mint blockchain tokens to represent ownership. Each token corresponds to a pro-rata claim on the real-world bill, preserving the safety and liquidity of sovereign debt while adding blockchain benefits. By design, these tokens inherit the credit quality of U.S. government debt and maintain regulatory compliance: issuers operate under SEC oversight and funds remain U.S.-registered.

The key innovation is not just creating a digital wrapper, but leveraging on-chain mechanics. Investors now gain 24/7 global access to buy, sell, or use Treasuries as collateral. A tokenized T-bill can trade outside traditional market hours and settle instantly on public chains, a capability impossible in legacy markets.

Moreover, digital oracles (e.g. Chainlink) continuously verify Treasury values on-chain, and smart contracts can automate yield distributions and compliance checks. In short, tokenized Treasuries combine the stability of government bonds with transparent, programmable finance – a structural evolution, not a fleeting “crypto” fad.

Market Growth and Key Milestones

Institutional adoption of tokenized Treasuries has accelerated sharply in 2024–2025. According to industry trackers, roughly $9 billion worth of tokenized Treasuries and related cash equivalents are on-chain as of late 2025.

That growth is five-fold in under two years, making Treasuries the “spine” of the emerging on-chain Real-World Asset (RWA) economy. By comparison, Ethereum-based RWAs (including Treasuries) held over $11 billion by mid-2025.

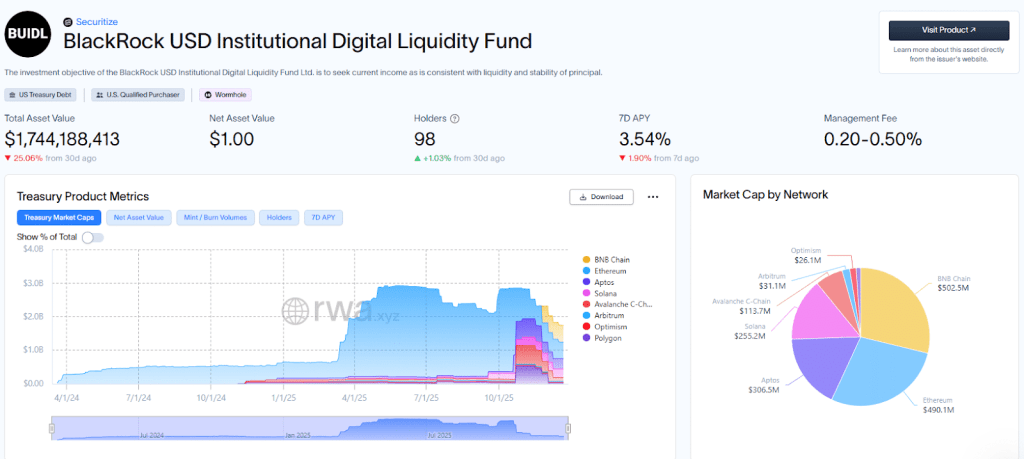

Major asset managers have led issuance. BlackRock’s BUIDL token fund – essentially a blockchain fund holding Treasuries, cash, and repos – has swelled to nearly $3 billion in assets.

BUIDL overview (Source: RWA.xyz)

Franklin Templeton’s BENJI token, on the other hand, represents roughly $800 million in a U.S. government money-market fund.

Other issuers include Circle (USD Coin collateralized by Treasuries), JPMorgan’s $100M on-chain fund, and others reaching similar scales. Collectively, these products offer on-chain access to high-quality collateral. The richness of this ecosystem is evident: tokenized Treasuries are now widely accepted as margin collateral on exchanges and in DeFi protocols, replacing synthetic assets and bootstrapping a crypto repo market.

Critically, the infrastructure around tokenized Treasuries is maturing. In 2025 the SEC granted a no-action letter allowing DTCC to pilot tokenizing DTC-custodied securities. DTCC’s ComposerX platform will mint a subset of DTC-held Treasuries on the privacy-enabled Canton Network, with a minimum viable product targeted for early 2026. This partnership – involving Digital Asset and major banks – shows that tokenized Treasuries are now viewed as systemic, not experimental. Industry consensus holds that these infrastructure projects bring collateral mobility (the ability to re-use on-chain collateral instantly) and operational efficiency that will persist through 2030 and beyond.

Institutional Products: BUIDL vs BENJI

Two flagship products illustrate different tokenization models. BlackRock’s BUIDL fund is a tokenized institutional liquidity fund on Ethereum (and other chains) managed by Securitize, with BNY Mellon custody.

Investors buy BUIDL tokens which effectively represent shares in a cash-and-Treasury fund. Redemptions occur in USDC (a stablecoin) on-chain, and the fund’s underlying ledger is held by traditional custodians. In other words, BUIDL is a tokenized share: the blockchain token mirrors ownership, but the official share registry remains off-chain under fund administration. BUIDL’s scale (nearly $3B) and acceptance on exchanges demonstrate that tokenized fund shares can serve as high-grade, dollar-denominated collateral in crypto markets.

In contrast, Franklin Templeton’s BENJI employs a native on-chain ledger. BENJI is an on-chain U.S. Government Money Market Fund where one share equals one BENJI token, and all transfer and record-keeping happens on a public blockchain. The fund itself remains a regulated U.S. MMF, but instead of maintaining ownership records in a legacy transfer-agent database, it lives on-chain. This means the blockchain itself is the primary register of investor balances. As Franklin Templeton notes, the innovation is in where the ledger lives. This fully on-chain approach promises maximum interoperability: BENJI tokens can move across networks and integrate into DeFi as native assets, rather than relying on off-chain redemption processes.

In summary, the tokenized share model (BUIDL) and the on-chain ledger model (BENJI) both achieve compliance and safety, but have different trade-offs. The tokenized share route often preserves much of traditional infrastructure (custody, redemptions, KYC) and is a known quantity for regulators and investors. The native on-chain ledger route foregoes some legacy plumbing in favor of full blockchain settlement – a bet that public chains can serve as their own trust layer. Both, however, are expected to coexist, enriching the tokenized ecosystem.

Blockchain Infrastructure & Partnerships

Institutional-grade tokenized Treasuries rely on robust blockchain infrastructure. Two networks stand out as the primary settlement layers for tokenized RWAs: Ethereum (often via Layer-2 solutions) and Solana. Ethereum has historically led the RWA market with its large ecosystem and security guarantees: as of mid-2025, it hosted over $11 billion in tokenized assets and roughly 72% of the tokenized Treasury market.

Many major tokenized funds (including BUIDL and earlier Franklin Templeton funds) launched on Ethereum first, leveraging its established compliance tooling and investor familiarity. However, Ethereum’s gas fees and throughput limits can hamper high-frequency Treasury operations.

Solana has emerged as the high-throughput challenger. Engineered for speed and scale (tens of thousands of transactions per second), Solana offers near-instant settlement at micro-cent fees. This makes it ideal for tokenizing large-volume assets like Treasuries, enabling use cases such as constant liquidity pools, yield automation, and high-frequency repo trading.

In 2025 Solana’s RWA market is growing rapidly – its tokenized Treasury volume has climbed significantly even if Ethereum still has the overall lead. The network also natively supports advanced features (like its Token-2022 standard) to embed compliance and identity checks.

Both chains are expected to remain dominant through 2030. Ethereum brings the trust of a decades-old ecosystem, an active developer base, and deep liquid markets. Solana brings raw performance and cost-efficiency for complex financial primitives. Importantly, interoperability protocols (e.g. Wormhole) allow Treasuries issued on one chain to be used on the other, combining liquidity. In practice, many tokenized Treasury issuers now deploy across multiple chains for multichain resilience.

DTCC and the Canton Network

A watershed development in 2025 was DTCC’s public announcement of a partnership with Digital Asset’s Canton Network to tokenize U.S. Treasuries custodied at DTC. This initiative represents a direct bridge between TradFi clearinghouses and blockchain rails. The first phase – slated for 2026 – will see a subset of US Treasuries “minted” on Canton, a privacy-preserving blockchain designed for regulated finance. The Securities and Exchange Commission even issued a no-action letter for this tokenization service, signaling regulatory approval of the concept.

Canton’s design is notable: it allows banks and custodians to control data visibility (important for privacy) while still enabling atomic settlement. In Canton, assets and obligations can move together, settlement can occur atomically, and reconciliation processes can be streamlined without exposing sensitive market data. For tokenized Treasuries, atomic settlement means the cash leg (USD) and security leg (T-Bill) transfer in a single transaction, eliminating principal risk. DTCC’s vision is that tokenization will become a standard part of back-office infrastructure, enhancing operational efficiency and capital efficiency for all participants.

Traditional vs Tokenized T-Bills

Tokenization introduces concrete improvements over conventional Treasury trading. The table below highlights key differences:

| Feature | Traditional T-Bills | Tokenized T-Bills (On-Chain) |

| Settlement Time | Usually T+1 (next day) or longer (T+2 for interdealer) | Instant (near real-time, often T+0) on blockchain |

| Trading Hours | Limited to business hours (≈ 7am–3pm EST) on primary market; OTC liquidity drops after hours | 24/7 global trading, including nights and weekends |

| Accessibility | High minimum lots; mainly institutions and governments | Fractional ownership possible; open to any accredited or retail investors via digital platforms |

| Collateral Utility | Used in repo markets, but movement between institutions takes days; siloed by jurisdiction | Native on-chain collateral, instantly reusable across DeFi platforms and networks |

These distinctions translate to tangible benefits. Instant settlement and 24/7 liquidity enable truly global capital efficiency: collateral is never idle, and supply can move where it’s needed without delay. Digital access and fractionalization democratize Treasury exposure, while maintaining sound credit protections. Above all, the key is atomic delivery-versus-payment, which removes traditional “float” time and counterparty risk.

Yield and Valuation on Tokenized Treasuries

Tokenized Treasuries pay yields just like their legacy counterparts. Their price dynamics follow standard bond math.

On-chain, these mechanics are implemented via smart contracts. Some tokens rebase interest (automatically crediting holders with accrued yield), while others increase token price to reflect accrual.

In either case, the underlying yield corresponds to the credit risk and interest rate of U.S. debt. As of mid-2025, tokenized Treasuries offered roughly 4.5%–5.2% annualized yield, comparable to traditional Treasury yields, but available 24/7 to on-chain investors. These yields accrue continuously: a holder could convert yield into stablecoins or other tokens instantly, or compound it within DeFi.

One might wonder if on-chain tokens introduce extra risk. In practice, well-structured products maintain the same regulatory safeguards as traditional funds. For instance, custodians (e.g., BNY Mellon) hold the actual bills, and token issuers are SEC-registered funds.

In fact, U.S. regulators have explicitly endorsed the concept: the Treasury Department’s 2024 TBAC report noted that responsible tokenization of Treasury securities could expand participation in government debt markets while maintaining robust investor protections. This recognition reinforces that tokenized Treasuries preserve the core value of government debt while enabling new efficiencies.

Structural Advantages of Tokenization

The shift to tokenized Treasuries is not a fad; it rests on structural advantages that will endure for decades. Key benefits include:

- Capital Efficiency: Instant settlement means cash and securities never leave each other’s custody independently, reducing counterparty risk and margin requirements. Liquidity providers can deploy assets more aggressively, and global pools of capital can participate with confidence. Blockchain networks allow automated collateral reuse—tokenized T-Bills used as collateral in DeFi can be immediately re-pledged, effectively increasing the velocity of high-quality capital.

- Collateral Mobility: TradFi collateral is often trapped in siloed custodial chains or regulatory domains. On-chain tokens break these barriers. A tokenized T-Bill on Ethereum can serve as collateral not only in U.S. repo markets but also in crypto derivatives, on lending platforms, or even on foreign blockchain networks via cross-chain protocols. For example, the Canton Network landmark deal demonstrated that UST (on Canton) can be financed against USDC on another network, achieving 24/7 atomic DvP across chains. This instant collateral mobility leads to more efficient balance sheets and lower financing costs industry-wide.

- Atomic Settlement: Perhaps the most fundamental advantage is the elimination of settlement lag. On public ledgers, trades can settle in a single atomic transaction: both asset and cash tokens move simultaneously or not at all. This dramatically reduces settlement risk. Blockchain-enabled trades outside market hours have proven 24/7 liquidity and atomic settlement, meaning the asset and payment transfers occur together. In a traditional context, this would require complicated escrow or clearing procedures.

- Composability: Tokenized Treasuries are programmatic money. Smart contracts can automatically update holders’ balances with coupon accruals, support instant redemptions, or be integrated into higher-level financial structures. For instance, tokenized yields can feed into stablecoins, structured products, or DeFi protocols without manual intervention. By 2030, we expect tokenized Treasuries to be standard plumbing: they can be whitelisted for wholesale DeFi applications, pooled in on-chain money funds, or even hold down the denominator in stablecoin algorithms.

- Regulatory Alignment: From the outset, tokenized Treasuries are designed to fit within existing frameworks. Issuers file documents with regulators, KYC/AML is enforced either through permissioned chains or embedded tokens, and tokens trade on regulated venues (e.g. SEC-registered ATS platforms). This alignment means tokenization can deliver innovation without upending legal foundations. The U.S. Treasury and other regulators continue to draft guidance (e.g. the GENIUS Act in the U.S., MiCA in the EU) that treat tokenized securities as first-class tradable instruments. Thus, these efficiency gains come with sound oversight, making them truly permanent improvements.

In summary, tokenizing Treasuries leverages blockchain technology to re-wire how capital moves, without sacrificing security. Investors benefit from faster settlement, enhanced liquidity, and new access, but still rely on the established creditworthiness of U.S. debt. These structural advantages are durable: even as technology evolves, the fundamental gains in speed, transparency, and programmability will remain.

Future Outlook: Tokenized Equities and Indices

If Treasuries were the first big wave of tokenization, the next is arguably equities and index funds. In 2025 the industry saw significant moves in this direction.

The rationale is clear: equities are a much larger market than Treasuries, so even a small tokenized slice of large cap stocks could represent trillions of dollars. We expect broader rollout of tokenized stocks and ETFs over the next five years. Already, stablecoin-like tokens representing baskets of stocks have been piloted, and infrastructure for tokenizing corporate shares (including shareholder registry tokenization) is being standardized. By 2030, the largest indices (S&P 500, Nasdaq 100, etc.) are likely to have on-chain fund equivalents, just as benchmarks like LIBOR or SPDR S&P 500 ETFs became standard trading mechanisms in earlier eras.

In practice, this means a unified vision: programmable money meets tradable markets. Just as tokenized Treasuries provide the bedrock of dollar liquidity on-chain, tokenized equities and indexes will extend blockchain finance into the stock market.

Investors could trade fractional shares of Apple or Microsoft in minutes via smart contracts, while algorithms seamlessly reconstitute index tokens to meet demand. The structural drivers – efficient price discovery, instantaneous settlement, composability into derivatives – will be the same features that made tokenized Treasuries transformative. Institutional participants (stock exchanges, fund managers, regulators) are preparing to embrace these changes.

In short, the trajectory set by tokenized Treasuries extends logically to equities. The ‘tokenization revolution’ will not stop at bonds: instead, it will spawn new asset classes (and new ways to trade them) across the entire financial spectrum. This journey promises broader liquidity and access for all investors, all built on the same blockchain infrastructure that powers tokenized Treasuries today.

Ecoinimist Analysis

We at Ecoinimist believe that tokenized treasuries have played a major role in bringing traditional finance firms on-chain, alongside stablecoins. While US treasuries account for the majority of the market, we predict that other countries will follow suit in the years to come as finance becomes more intertwined with blockchain.

Frequently Asked Questions

What exactly is a tokenized Treasury?

A tokenized Treasury is a blockchain asset that represents ownership of a U.S. government bond or bill. The tokens are backed 1:1 by real Treasuries held in custody by a regulated institution. On-chain, these tokens can be bought, sold, or used as collateral just like cryptocurrencies, but their value is linked directly to the underlying U.S. Treasury security.

How do tokenized Treasuries differ from traditional ones?

The underlying economics (credit risk, coupon, maturity) are identical to traditional Treasuries. The difference lies in settlement and access. Traditional T-bills settle days after trade and trade only during business hours, whereas tokenized versions can trade 24/7 and settle nearly instantly in a single on-chain transaction. This atomic, around-the-clock trading unlocks much greater liquidity and capital efficiency.

Are tokenized Treasuries safe?

Yes. They are backed by the full faith and credit of the U.S. government via custodied real Treasuries. Regulatory oversight ensures issuers follow securities laws. As long as the issuer and custodian are reputable, the on-chain tokens carry the same safety as conventional Treasuries. In fact, the U.S. Treasury has affirmed that tokenization could broaden access while maintaining protections.

Who can invest in tokenized Treasuries?

That depends on the product and jurisdiction. Many tokenized funds have high minimums (e.g. $250k for BUIDL) and are aimed at institutional investors. However, platforms like INX.one offer SEC-registered exchanges where qualified individuals can buy. Regulations often allow participation by both accredited and retail investors via alternative trading systems, similar to private offerings.

What is “atomic settlement”?

Atomic settlement means an exchange where money and securities transfer simultaneously or not at all. On blockchain, this is routine: a single smart contract can move a token and a stablecoin together, leaving no gap for one party to default. This eliminates settlement risk inherent in batched, delayed processes of traditional markets.

Why are Ethereum and Solana important for this space?

These two chains currently host most tokenized real-world assets. Ethereum offers broad infrastructure and institutional familiarity, while Solana provides high throughput and low costs for heavy trading volumes. Both ecosystems are evolving with better compliance tools, and many tokenized Treasuries now exist on multiple chains to capture the best of both.

Will tokenized Treasuries replace traditional trading?

Tokenization is not about replacement but enhancement. Traditional markets and regulators will continue to exist, but tokenized Treasuries will become an increasingly important parallel system. As on-chain infrastructure matures, we expect more trades and liquidity to migrate into tokenized markets because of their efficiency and flexibility. By 2030, tokenization will likely be a standard complement to conventional trading, much like electronic trading has supplemented but not eliminated stock exchanges.

How is yield paid on a tokenized Treasury?

Yield is typically distributed in one of two ways: by rebasing (increasing your token balance as interest accrues) or by price appreciation (each token’s value grows over time). Both reflect the same underlying interest payment from the Treasury. In either case, smart contracts ensure yield is applied according to the bond’s terms, and the total return matches the published yield-to-maturity of the security.

Where can I get started with tokenized Treasuries?

Institutional investors can approach major fund issuers (e.g. BlackRock, Franklin Templeton) or trade on regulated digital asset venues (like INX.one) that list these tokens. Careful due diligence is key: check that the issuer is licensed, that the custody is reputable, and that the token’s smart contract has transparency.

Is the move toward tokenization a bubble?

We believe it is not. The convergence of technology, regulatory approval (like the SEC’s TBAC statements), and enormous on-chain adoption signals that tokenization addresses real inefficiencies in global finance. By solving those inefficiencies, tokenized Treasuries lay a foundation that will still be relevant in 2030, much as electronic trading remains essential today.