Stablecoin Regulation: How the US, EU, UK, and Asia Are Shaping 21st Century Digital Money

During US President Donald Trump’s second term, the world entered a new era of stablecoin regulation. What was once a largely unregulated corner of crypto finance has rapidly become the focus of comprehensive laws and international standards. The United States and European Union have implemented landmark frameworks – the GENIUS Act in the US and the MiCA regulation in the EU – marking the first coordinated global push to supervise stablecoins. Other jurisdictions like the UK and Hong Kong are following suit with their own rules and sandboxes.

This deep-dive article explores these developments, explaining how a “global stablecoin standard” is taking shape. We’ll unpack the new regulations, compare the US and EU approaches, and provide a checklist for issuers aiming to comply in this brave new world of stablecoin regulation.

Before diving into the specifics, it’s important to understand why regulators worldwide are so concerned with stablecoins in the first place.

Why Regulate Stablecoins? (Systemic Reasons)

Regulators are not cracking down on stablecoins arbitrarily – there are systemic motivations behind the new rules. Stablecoins (crypto assets pegged to currencies like the dollar or euro) grew into a major piece of the financial system, so officials want to ensure they are safe and transparent. Key reasons include:

- Preventing “Bank Runs” and Financial Instability: A sudden loss of confidence in a stablecoin can trigger a run (everyone rushing to redeem at once), which in turn could destabilize crypto markets or even ripple into traditional finance. For example, the collapse of the TerraUSD algorithmic stablecoin in 2022 highlighted how quickly billions in value can evaporate when a stablecoin’s peg breaks. New regulations aim to require robust backing and liquidity so that redemptions are always honored and panic is less likely. In essence, regulators want each stablecoin to be as safe as a bank deposit, with sufficient high-quality assets in reserve to meet withdrawals.

- Preventing Money Laundering and Illicit Use: Unregulated stablecoins could be misused for money laundering, sanctions evasion, or other financial crimes. Stablecoins allow instant, borderless value transfer – great for innovation, but also attractive to bad actors. Authorities are responding by bringing issuers into the regulatory perimeter (e.g. requiring Bank Secrecy Act compliance in the US) to enforce anti-money laundering (AML) and know-your-customer rules.

- Ensuring Monetary Sovereignty (Dollar and Euro Dominance): There’s a geopolitical angle too. Policymakers (especially in the US) see regulated stablecoins as a way to strengthen their national currencies’ dominance in the digital era. Dollar-pegged stablecoins in particular can bolster the U.S. dollar’s international reserve currency status by increasing demand for dollar assets. In fact, the GENIUS Act explicitly ties stablecoin rules to ensuring the continued global dominance of the U.S. dollar as the world’s reserve currency, by requiring dollar-backed coins to hold reserves mainly in U.S. Treasuries and cash. In the EU, regulators similarly want to maintain control over euro-denominated digital money through MiCA rather than let unregulated private coins undermine monetary policy. In short, governments are embracing stablecoin regulation as a means to shape the future of money in their favor, not cede it to unregulated crypto projects.

With these motivations in mind, let’s examine the major regulatory frameworks defining the new global standard for stablecoins.

United States – The GENIUS Act of 2025 (Federal Stablecoin Framework)

The United States took a significant leap in 2025 by enacting the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act). Signed into law in July 2025, the GENIUS Act represents the first federal regulatory framework specifically for payment stablecoins. Its passage marked a turning point from an enforcement-driven approach to a clear rules-based regime for stablecoins in the US.

Federal Licensing for Non-Bank Issuers

One of the GENIUS Act’s cornerstone features is that it creates a federal licensing path for non-bank stablecoin issuers. Prior to this Act, only banks or state-regulated entities had clear avenues to issue stablecoins, and even those were murky. The GENIUS Act changes that by defining who can issue “payment stablecoins” in the U.S. and under what conditions.

Under the Act, only approved entities can issue stablecoins redeemable at par value in the United States. These permitted issuers fall into a few categories:

- Bank subsidiaries and credit unions – Regulated depository institutions (and their subsidiaries) can issue stablecoins with approval from their banking regulators.

- Non-bank fintech companies – For the first time, a non-bank company can become a federally qualified payment stablecoin issuer by obtaining a license from the Office of the Comptroller of the Currency (OCC). This is a new federal charter specifically for stablecoin issuers, bringing them under federal oversight without requiring them to become full banks.

- State-authorized issuers with federal approval – States can still charter stablecoin issuers (e.g. under state money transmitter laws or special crypto frameworks), but those issuers must have their state regimes certified as equivalent by a federal committee. Large state-approved stablecoin issuers (over $10 billion in circulation) will eventually have to transition to a federal license. This mechanism aligns state and federal rules, ensuring no regulatory arbitrage.

In practice, that means a company like a fintech or crypto exchange can apply to the OCC for a stablecoin issuer license instead of needing a traditional bank charter. It opens the door for fintech firms to compete directly with banks in issuing digital dollars – a point not lost on the industry. Banks, naturally, have been watching this development closely, since a successful fintech-issued stablecoin could draw users (and deposits) away from traditional bank accounts.

Reserve Requirements and Prudential Standards

At the heart of the GENIUS Act is a set of strict prudential requirements intended to ensure that each stablecoin truly lives up to its name – stable. The Act mandates a 100% reserve backing of all stablecoins in circulation, using only high-quality liquid assets. In formula form, regulators expect a reserve ratio of 100%.

Every dollar of stablecoin issued must be matched by at least $1 of eligible reserve assets. Acceptable reserves are spelled out in the law: mainly cash held in insured banks, U.S. Treasury bills with maturities under 3 months, or other liquid government-backed instruments. By driving issuers to hold Treasuries and cash, the rule not only protects stablecoin holders but, as mentioned, also reinforces demand for the dollar in global markets.

To promote transparency and trust, the GENIUS Act requires ongoing disclosures and audits of reserves. Issuers must publicly disclose their reserve composition monthly (e.g. posting on their website a breakdown of assets backing the stablecoin) and provide regular attestations of the reserve levels. Large issuers above certain thresholds must even undergo annual independent audits of their financial statements. These measures are designed so that both regulators and users can verify that a stablecoin is fully backed at all times – no hidden leverage, no fractional reserves. Essentially, regulators want stablecoins to operate with the transparency of a money market fund and the safety of a narrow bank.

Redemption rights are another important aspect of stability. Under the Act, authorized issuers must be able to redeem stablecoins promptly at their face value (1 coin for $1) upon request. This assures consumers they can exit a stablecoin investment at any time at no loss, which is crucial for maintaining confidence. If an issuer fails to honor redemptions, it would be in violation of its license.

Moreover, stablecoin holders get priority in bankruptcy: in the unlikely event an issuer becomes insolvent, the law gives stablecoin holders first claim on the reserve assets above all other creditors. This kind of protection is analogous to deposit insurance in spirit – it puts the customer’s money first – although it’s achieved by structuring claims in insolvency rather than an insurance fund.

Beyond reserves and redemption, the GENIUS Act limits what activities stablecoin issuers can engage in. Permitted issuers are generally restricted to the business of issuing stablecoins, managing reserves, processing redemptions, and providing custody services. They cannot loan out the reserves or use them for risky investments, nor can they commingle the stablecoin business with unrelated commercial activities. These limits keep the issuers focused on maintaining stability and liquidity. In a sense, a licensed stablecoin issuer under the Act starts to resemble a narrow-bank or a regulated trust company that only does payments, not lending.

Consumer Protections and Conduct Rules

The GENIUS Act is notably heavy on consumer protection rules – a response to concerns about past stablecoin operators and crypto firms acting irresponsibly. Some key conduct provisions include:

- No interest or yield for coin holders: Issuers are explicitly prohibited from paying interest on stablecoin balances. This ban on yield-bearing stablecoins means users won’t be enticed into treating stablecoins as investment products – they are meant to be just digital cash. Policymakers included this to prevent a scenario where stablecoins compete with bank deposits by offering higher interest via riskier strategies, which could undermine banks and encourage runs (as was feared with some crypto platforms offering stablecoin lending yields). By banning interest, the Act keeps stablecoins in the lane of payments and value transfer, not speculative investment.

- Truth in marketing: Issuers must follow strict marketing and disclosure rules. They cannot mislead consumers about the nature of the coin – for example, it’s forbidden to claim a stablecoin is government-insured or risk-free. Any suggestion that a stablecoin has official status as legal tender or has federal backing is off-limits. The goal is to ensure users understand that stablecoins are private digital money, not FDIC-insured bank deposits.

- Anti-money laundering compliance: Stablecoin issuers are classified as “financial institutions” under the Bank Secrecy Act, bringing them squarely under AML/CFT regulations. This means issuers must implement know-your-customer programs, monitor transactions for suspicious activity, report large or suspicious transactions, and comply with sanctions requirements – just like banks do. The Act even requires that stablecoin platforms have the technical ability to “freeze or seize” coins if directed by lawful authorities (for instance, to interdict funds linked to terrorism or hacking). These requirements address a common criticism that crypto dollars could enable crime; under the new regime, a licensed stablecoin firm has the same obligations to prevent illicit use as any mainstream financial institution.

- No tying or forced bundling: The law forbids a stablecoin issuer from requiring customers to buy other products or services in order to get stablecoins. This prevents anti-competitive behavior (for example, a tech company issuer couldn’t force you to use its app or hardware as a condition to use its stablecoin).

Through these measures, the U.S. framework aims to make stablecoins safer for users and for the financial system. The GENIUS Act’s approach can be summarized as bringing stablecoins into a regulated, bank-like regime without stifling the core innovation. As of late 2025, federal regulators (the OCC, Federal Reserve, FDIC, etc.) are writing detailed rules to implement the Act’s mandates. The law itself will fully take effect by 2026, but the market is already adapting. Major stablecoin issuers like Circle (issuer of USDC) and new entrants like PayPal (which launched its own USD stablecoin) are restructuring their operations to seek federal licenses. In the coming sections, we’ll see how the U.S. approach compares to developments in Europe and beyond.

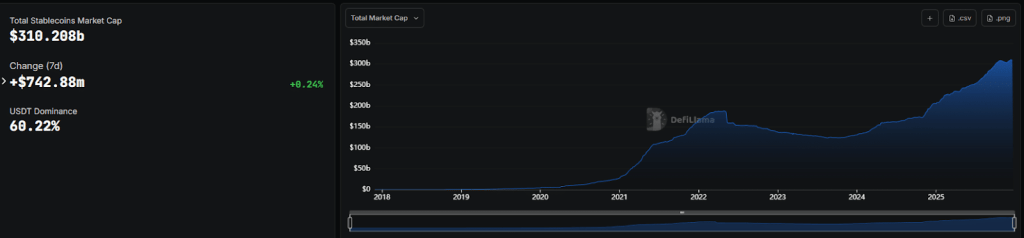

The signing of the GENIUS Act into law served as a catalyst for the stablecoin market’s growth. In the months that followed, billions of dollars flowed into the space. In fact, the capitalization for the sector broke above $300 billion for the first time ever this year.

Stablecoin market as of 23/12/2025 (Source: DeFiLlama)

European Union – MiCA and the New EU Stablecoin Regime

Across the Atlantic, the European Union has been crafting its own comprehensive crypto regulation. The Markets in Crypto-Assets (MiCA) regulation, finally implemented in 2024-2025, is the EU’s answer to bringing crypto-assets (including stablecoins) under a unified regulatory framework. By late 2025, MiCA is fully in force across all 27 EU member states, representing one of the world’s first region-wide crypto laws.

While MiCA covers everything from utility tokens to crypto-asset service providers, one of its most crucial aspects is stablecoin regulation – which MiCA terms “asset-referenced tokens” and “e-money tokens” (depending on whether they are pegged to a single currency like the euro or to a basket of assets). Let’s break down how MiCA handles stablecoins and what its enforcement in 2025 has meant for the industry.

Full Reserve Backing and Transparency Requirements

Similar to the U.S. approach, the EU’s MiCA regime insists on strong reserve backing for stablecoins. Under MiCA, any stablecoin (e-money token) pegged to a fiat currency must be fully backed by an equal amount of reserve assets at all times. Partial reserves or algorithmic balancing acts are not allowed for a token marketed as “stable” in value. The reserves must be of high quality and liquidity – for example, largely consisting of cash or cash-equivalent assets. This ensures that if all holders of a euro stablecoin (say, a EUR-backed token) wanted to redeem at once, the issuer would have the funds to meet those redemptions. MiCA’s intent is to eliminate the risk of a run by mandating that stablecoins function like a one-to-one money market fund.

Transparency is a big theme here as well. Issuers have to publish a detailed white paper and regular updates outlining how the coin works, what rights users have, and most importantly the nature of its reserves. MiCA enhances reserve transparency requirements by obligating stablecoin issuers to disclose their reserve holdings and have appropriate audits in place. In other words, European users and regulators should be able to readily verify that a stablecoin is solvent and backed. This was a reaction to past concerns where some stablecoin issuers (like Tether in earlier years) were less forthcoming about their reserves. Under MiCA, such opacity would not fly – opaqueness would be a compliance violation.

MiCA also enshrines investor protections like guaranteed redemption rights. If you hold an EU-regulated stablecoin, you have a legal right to redeem it at face value (1 token = €1 for an e-money token) directly with the issuer, at least under normal circumstances. The issuer must honor redemption requests within a short timeframe. This gives holders confidence that the “stable” in stablecoin is credible. Additionally, MiCA imposes strict governance and prudential standards on issuers – they must be legal entities located in the EU, pass fit-and-proper management checks, and maintain adequate capital and liquidity reserves beyond just the backing assets.

Enforcement Begins: Delisting Non-Compliant Coins

The EU gave a transitional period for existing crypto-asset service providers and coin issuers to come into compliance with MiCA. By late 2025, that transition period has ended, meaning enforcement is in full swing.

One immediate impact has been on exchanges and trading platforms in Europe: tokens that did not meet MiCA’s requirements have been delisted or made unavailable to EU customers. In the stablecoin context, this means some popular stablecoins that are issued by companies outside the EU or that didn’t seek proper authorization can no longer be offered by EU-regulated exchanges.

For instance, consider a well-known U.S. dollar stablecoin that’s issued by a company with no EU license – European exchanges would have to halt trading of that token for EU users unless the issuer gets MiCA authorization or falls under an exemption. According to industry reports, early MiCA enforcement led to some major players delisting non‑compliant stablecoins for EU customers, underscoring the regulation’s real-world bite. Even algorithmic stablecoins or crypto-collateralized stablecoins have largely vanished from legitimate EU markets, as they don’t meet the fully-backed requirement and thus cannot be marketed as stable value tokens.

On the flip side, MiCA has encouraged new entrants that play by the rules. By providing a clear framework, MiCA has stimulated new MiCA-compliant stablecoins (including euro-pegged ones) to launch in the EU, offered by firms that obtained the required license. For example, we saw the introduction of Euro-denominated stablecoins, which proudly advertise their fully regulated status. MiCA essentially leveled the playing field: instead of an unregulated token having an advantage of laxity, being regulated is becoming an advantage since exchanges and users prefer compliant tokens that won’t suddenly get banned.

Another outcome is a bit of regulatory competition within Europe. Under MiCA, a stablecoin issuer or crypto company can get licensed in one EU member state and then “passport” their services across all member states. This has led countries like Germany, France, and Malta to compete to attract stablecoin issuers for licensing, offering efficient approval processes. By late 2025, over a dozen stablecoin issuers have secured licenses under MiCA across Europe. The harmonization means a French-regulated euro stablecoin can be used in all of Europe seamlessly, which is part of the EU’s goal to integrate the digital market.

In summary, the EU’s MiCA regime converges with the US approach on the core principles: full reserves, transparency, redemption rights, and oversight of issuers. Both are pushing for what might be dubbed a “gold standard” for stablecoins globally – if you want to issue a widely-used stablecoin, you should hold high-quality reserves and open your books.

Where MiCA differs is in its scope (covering a broad range of tokens and services) and its multinational nature, which introduces that passporting dynamic. But in terms of outcomes: European consumers now have more assurance that any stablecoin they use in the EU is thoroughly vetted and truly backed, or else it won’t be on the market. Non-compliant tokens have been shown the door, and the era of opaque stablecoin operations in Europe is effectively over.

United Kingdom – On the Cusp of a Stablecoin Framework

Though no longer part of the EU, the United Kingdom has been charting its own path to regulate stablecoins.

As of 2025, the UK is on the cusp of implementing a regime for “Digital Settlement Assets” (its terminology for stablecoins used in payments). While the UK’s framework is not fully in force yet, significant steps were taken through 2024 and 2025 to prepare the ground:

- Financial Services and Markets Act 2023 (FSMA 2023): This legislation gave UK regulators (the Bank of England, Prudential Regulation Authority, and Financial Conduct Authority) new powers to oversee stablecoins used as payment. It essentially recognized stablecoins as a form of digital money that could fall under payments regulation. The law paved the way for making certain stablecoins subject to oversight similar to e-money and payment systems.

- Bank of England Consultations: In late 2025, the Bank of England (BoE) released a consultation paper on a proposed regulatory regime for sterling-denominated stablecoins that could be deemed “systemic”. A systemic stablecoin in UK parlance means a stablecoin widely used enough that its failure could impact financial stability. The BoE’s proposals outline how such stablecoin issuers would be regulated akin to payment systems, with the BoE ensuring they meet capital and liquidity requirements, and the FCA handling conduct and investor protection. The consultation, according to the BoE’s Deputy Governor for Financial Stability, is a pivotal step toward rolling out formal rules in 2026.

- FCA Regulatory Sandbox for Stablecoins: In November 2025, the UK’s Financial Conduct Authority launched a special sandbox “stablecoin cohort” to let firms test stablecoin products under regulatory supervision. This sandbox is essentially a safe environment where companies can pilot their stablecoins and payment services with real users on a small scale, while the FCA observes and provides feedback. The FCA described it as a “unique chance for innovative companies to test their stablecoin products and services under the UK’s evolving regulatory regime.” It complements earlier innovation initiatives like the Digital Securities Sandbox. The goal is to both spur innovation and ensure new stablecoins can meet expected rules once they go live. The fact that the FCA dedicated a sandbox cohort specifically to stablecoins by 2025 shows how important this area has become.

- Interim Guidance and Registration: The FCA has also been consulting on crypto asset marketing rules and registration requirements for firms, which include stablecoin issuers and wallet providers. Starting in 2024, the UK required crypto firms (including those dealing with stablecoins) to register and comply with AML requirements. By 2025, the FCA’s consultations (such as “Stablecoin issuance and cryptoasset custody” in mid-2025) have given issuers a clearer preview of the rules coming. The writing is on the wall: stablecoin issuers will likely need to be authorized (probably as e-money institutions or payment institutions) and will face safeguarding requirements for customer funds.

In summary, the UK is a step behind the US/EU in implementation, but it is catching up quickly. The coordinated approach between the Bank of England and FCA means that stablecoins will be treated as part of the formal financial system. Notably, if a stablecoin becomes large in the UK (systemic), the Bank of England will oversee its stability, similar to how it oversees major payment systems today. Meanwhile, the FCA’s sandbox and rule proposals are prepping the industry for compliance. By opening a sandbox now, the UK is signaling to companies: “come innovate, but in a way that’s compatible with the rules we’re about to roll out.”

Hong Kong – From Sandbox to Licensing: A Case Study in Progress

Hong Kong presents another interesting example of the global stablecoin regulatory push. As a major financial center, Hong Kong in 2024–2025 actively developed its own regime to regulate stablecoins, aligning with international standards but tailoring to its market.

Early 2024 saw the Hong Kong Monetary Authority (HKMA) launch a Stablecoin Issuer Sandbox arrangement. The sandbox was timed with the HKMA’s consultation on a regulatory framework for stablecoin issuers. Through this sandbox, the HKMA invited companies interested in issuing fiat-backed stablecoins in Hong Kong to participate in a controlled environment. The goal was twofold: regulators could communicate their supervisory expectations clearly, and industry participants could provide feedback on what the rules might mean in practice. This collaborative approach helped Hong Kong refine a “fit-for-purpose and risk-based” regulatory regime, as described by HKMA Chief Executive Eddie Yue.

By August 2025, Hong Kong moved from sandbox testing to actual implementation. The government introduced new legislation bringing stablecoin issuers into the regulatory perimeter, which took effect in August 2025. Under this regime, issuers of fiat-referenced stablecoins in Hong Kong must be licensed by the HKMA. The HKMA published detailed guidelines on the supervision of stablecoin issuers and related AML/CFT (anti-money laundering and counter-financing of terrorism) obligations. Key points of Hong Kong’s framework include:

- Reserve and Capital Requirements: Much like the US/EU rules, Hong Kong mandates reserve backing and quality standards for stablecoins. Issuers have to hold reserve assets of specified quality (likely emphasizing HKD or USD cash and equivalents) to ensure redeemability. They also set capital requirements – meaning issuers need to have a minimum capital buffer on top of reserves, to absorb operational losses. This adds an extra layer of financial soundness.

- Licensing and Supervision: Only a “licensed stablecoin issuer” can operate, and the HKMA limited the number of licenses initially (indicating a cautious approach). Licensed issuers are subject to ongoing supervision by the HKMA, similar to how banks or stored-value facility providers (like payment wallets) are supervised. They must submit to regular audits and inspections.

- AML/CFT Measures: Hong Kong’s regime places heavy emphasis on robust AML controls, in line with its status as a global finance hub. The rules explicitly require issuers to have strong internal controls to prevent money laundering and terrorist financing, and they coordinate with global standards (FATF recommendations). Hong Kong wants to support innovation but not at the expense of becoming a hotspot for illicit flows, so the compliance bar is set high.

The HKMA’s efforts quickly earned attention in the region. Hong Kong’s stablecoin framework became a regional benchmark in Asia in 2025. Other financial centers, like Singapore and Japan, have been observing and in some cases coordinating on similar standards.

Hong Kong demonstrated that by combining a sandbox approach with clear rule-making, you can attract crypto innovation while still imposing order. Several firms participated in the HKMA’s sandbox and have indicated interest in applying for full licenses. Hong Kong’s message is clear: it aims to be a crypto-friendly hub but only under a regime of “responsible innovation.”

MiCA vs. GENIUS Act: A Comparison of EU and US Approaches

The regulatory frameworks for stablecoins in the EU (MiCA) and the US (GENIUS Act) share common goals but also have differences in implementation. The table below summarizes a comparison of these two major regimes on key points:

| Category | EU – MiCA (2024/2025) | US – GENIUS Act (2025) |

| Primary Regulator | National competent authorities in each EU member state, under uniform MiCA rules (with the European Banking Authority overseeing “significant” stablecoins for extra supervision) | Federal banking regulators: Office of the Comptroller of the Currency (OCC) for non-bank issuers’ licenses, and the Federal Reserve/FDIC/NCUA for banks and credit unions. A federal Stablecoin Committee coordinates with state regulators. |

| Reserve Requirements | Full 100% reserve backing required with high-quality liquid assets. Reserves must equal or exceed the outstanding stablecoin supply at all times. Assets typically in fiat currency and low-risk investments; regular reporting to ensure compliance. | 1:1 reserve backing mandated with only specified liquid assets (e.g. USD cash, short-term U.S. Treasuries). Monthly disclosures of reserve holdings are required, with larger issuers undergoing independent audits. Regulators can add rules on diversification of reserves. |

| Consumer Protections | Redeemability: Holders have the right to redeem at par (1:1) from the issuer. Transparency: Issuers must publish white papers and frequent updates on reserves. Accountability: Management of issuer must meet fit and proper criteria; issuers liable for losses if reserves mismanaged. Non-compliant coins cannot be offered in the EU, protecting consumers from unbacked tokens. | Priority Claims: Stablecoin holders have first claim on reserves if an issuer fails. No Interest to Holders: Prohibition on paying interest/yield protects consumers from risky schemes. Disclosure: Clear marketing rules to prevent misleading claims (not FDIC-insured, etc.). AML and Sanctions: Issuers must implement strict KYC/AML, protecting users and broader society from illicit finance risks. |

Table: Comparing EU’s MiCA and US’s GENIUS Act on key aspects of stablecoin regulation.

Despite differences in structure, both regimes emphasize stability, transparency, and accountability. Both demand that a stablecoin be fully reserved and that users have confidence in redemption. Both also incorporate consumer protection and anti-abuse measures (whether it’s banning misleading advertising or enforcing AML rules).

In effect, the EU and US are converging toward what might be seen as a global baseline for stablecoin regulation. This baseline is influencing other jurisdictions as well – many countries are looking at MiCA and the GENIUS Act as templates for their own laws.

Checklist for Compliant Stablecoin Issuers

For stablecoin issuers (or projects aspiring to issue a stablecoin), the new global regulatory environment can seem daunting. However, it boils down to a set of fundamental principles that are shared across jurisdictions. Below is a checklist for issuers to ensure they remain compliant and aligned with the emerging global standard:

- Obtain the Proper License or Authorization: Before issuing any stablecoin, secure approval from the relevant regulator. In the US, this means getting a federal payment stablecoin issuer license (or qualifying under an approved state regime). In the EU, acquire authorization under MiCA as an e-money or asset-referenced token issuer. Other locales (UK, HK, etc.) have their own licensing – engage regulators early (e.g. via sandboxes) to get the green light.

- Maintain 100% High-Quality Reserves: Always back your stablecoin with an equivalent amount of high-quality liquid assets. This typically means fiat currency in bank accounts, government bonds, or similar low-risk assets. Aim for a 1:1 reserve ratio at all times – if you issue $100 million in coins, hold at least $100 million in approved reserves. No fractional reserves, no risky collateral. Document these reserves meticulously.

- Implement Robust Reserve Audits and Disclosures: Be transparent. Establish monthly (or quarterly at minimum) disclosure reports that detail your reserve assets. Engage an independent auditor to attest to the reserves regularly. Publish certificates or reports for public and regulatory scrutiny. This transparency is not just legally required in many jurisdictions – it’s crucial for user trust.

- Establish Redemption Policies and Liquidity Management: Put in place clear procedures for users to redeem stablecoins on demand at par value. Ensure you have the operational capability (and reserve liquidity) to meet large-scale redemptions if needed. Having lines of credit or liquidity arrangements can be wise, even with full reserves, to manage timing mismatches. Prompt redemption builds confidence and may be legally mandated (e.g. MiCA and GENIUS Act require prompt redemption rights).

- Comply with KYC/AML and Sanctions Requirements: Treat your stablecoin platform with the same rigor as a bank would. This means verifying your customers’ identities, monitoring transactions for suspicious activity, filing required reports, and having sanctions screening in place. Regulators will expect nothing less. Implement robust compliance programs and consider using blockchain analytics tools to track illicit activity (since on-chain transparency can be an advantage in compliance).

- Protect Consumers and Be Truthful: Market your stablecoin honestly. Do not over-promise or make claims that could mislead (for example, don’t say or imply the coin is “insured” or “cannot lose value” beyond what your legal obligations guarantee). Provide educational materials so users understand how your coin works. Additionally, institute strong cybersecurity and operational safeguards – protecting consumer assets from hacks or losses is part of regulatory expectations (often falling under “operational risk management”).

- Limit Activities to Permitted Scope: If you’re a regulated stablecoin issuer, avoid deviating into prohibited activities. This generally means do not lend out reserves, do not commingle stablecoin funds with risky investments, and don’t offer ancillary financial products without approval. Stick to issuing, burning, and managing the stablecoin, plus holding its backing assets. Any yield generation or other financial services should be approached carefully and likely require separate approvals (and remember, paying interest to users on stablecoin holdings is disallowed under several regimes).

- Engage with Regulators Proactively: The landscape is evolving. Maintain an open dialogue with regulators in the jurisdictions you operate. Participate in sandboxes or pilot programs (like the UK’s FCA stablecoin cohort or Hong Kong’s pilot regime) if available. Proactive engagement can not only prevent compliance missteps but also shape better regulations through feedback.

By following the above checklist, stablecoin issuers can position themselves as compliant and trustworthy players in this new era. The cost of compliance is significant, but so are the stakes – the stablecoin market is moving from a Wild West environment to an integrated part of the mainstream financial system. Those who meet the “global stablecoin standard” are likely to thrive, while those who don’t will find themselves unable to operate in major economies.

Conclusion: Towards a Global Stablecoin Standard

In 2025, stablecoins have graduated from being a novel experiment to being treated as a matter of national and international importance. The GENIUS Act in the U.S. and MiCA in the EU together set a de facto global standard: any widely used stablecoin should be fully backed, transparently managed, and issued by accountable institutions under oversight. This standard is reinforced by parallel moves in the UK, Hong Kong, and many other jurisdictions around the world. Regulators have converged on the view that stablecoins can bring efficiency and innovation to payments – but only if proper safeguards are in place to protect users and the financial system.

We are witnessing the formation of a Global Stablecoin Regulation framework, not through one supra-national law but through the alignment of many. International bodies like the Financial Stability Board (FSB) are also pushing for consistency, emphasizing common pillars such as reserve sufficiency, redemption rights, and financial crime prevention across all regimes. It’s an evergreening strategy: by focusing on core principles (preventing runs, stopping illicit use, maintaining monetary integrity), these regulations aim to remain relevant even as technology evolves.

For investors and crypto enthusiasts, the upside is greater confidence in the stablecoins they use – knowing that a dollar or euro stablecoin is truly backed by those currencies and overseen by regulators.

For the crypto industry, it means clearer rules of the road: the era of regulatory uncertainty is ending, and the era of regulated innovation is beginning. Projects that embrace compliance are finding it easier to integrate with traditional finance and attract institutional adoption, while those that resist are finding themselves sidelined (as seen by exchange delistings in Europe).

The new rules do impose constraints – some worry about reduced privacy, or the loss of algorithmic “decentralized” stablecoins that can’t meet these standards. However, the overall trend suggests that regulated stablecoins will be the primary model moving forward, likely strengthening the bridge between crypto and fiat finance.

As we look to the future, one can envision a world where sending a stablecoin is as ordinary as swiping a debit card – with the same confidence in stability and acceptance. The regulatory groundwork laid in this “new era” is what will make that possible. By protecting against the major risks (runs, misuse, and systemic threats) while allowing innovation, the global stablecoin standard being forged now could indeed unlock the promise of stablecoins as a reliable component of the future financial system.

In conclusion, the genie is out of the bottle – and thanks to new regulations, that genie (or GENIUS, in the US case) is being carefully guided to ensure stablecoins fulfill their potential in a safe, sustainable way, across the globe.

Ecoinimist Analysis

Stablecoins, in our opinion, are one of the strongest use cases for blockchain and crypto, other than tokenization. We have used stablecoins to pay global vendors and receive payments from international clients over the years. We adopted the technology after we saw how much simpler cross-border payments were with the tokens compared to traditional bank payments.

We do, however, believe that countries and non-US jurisdictions will eventually start to clamp down on tokens pegged to the US dollar, as part of an effort to prevent the greenback from sneaking into their territories.

After speaking to several experts in the industry in the past few months, we believe that US-pegged stablecoins will likely maintain their dominance in the market. Not only do these tokens, such as leaders USDT and USDC, have an already-dominant position in the market. The administration under Donald Trump is also actively embracing the digital asset sector, especially stablecoins. However, the latter could change if a new administration takes office, the experts we spoke to have warned.

Frequently Asked Questions

What is global stablecoin regulation?

Global stablecoin regulation is the growing set of laws and supervisory standards that govern how stablecoins are issued, backed, redeemed, and monitored across major jurisdictions, aiming to create consistent rules for “digital money” that behaves safely at scale.

Why are regulators cracking down on stablecoins now?

Because stablecoins have become large enough to pose systemic risks. Regulators want to reduce “run” risk during market stress, curb money laundering and sanctions evasion, and protect monetary sovereignty (especially around dollar and euro influence in digital payments).

What does the U.S. GENIUS Act change for stablecoins?

It creates a clearer federal framework for payment stablecoins, including licensing pathways (including for non-bank issuers via the OCC), strict reserve and disclosure expectations, and consumer protection rules like prompt 1:1 redemption and limits on risky activities with reserves.

How does the EU’s MiCA framework affect stablecoins and exchanges?

MiCA requires stablecoin issuers and service providers to meet authorization, reserve backing, transparency, and governance standards. In practice, it pushes platforms to restrict or delist stablecoins that aren’t compliant for EU users, while encouraging the launch of regulated, MiCA-compliant alternatives.

What’s the bottom-line compliance checklist for stablecoin issuers?

Get properly licensed, maintain 100% high-quality liquid reserves, publish regular reserve disclosures with audits/attestations, guarantee prompt redemption at par, and run full AML/KYC and sanctions compliance—then engage regulators early (including sandboxes in places like the UK and Hong Kong).