Best Crypto Exchange: A Complete Guide to Fees, Security, and Features

Choosing the best crypto exchange is one of the most important decisions any crypto user will make. Whether you’re buying Bitcoin for the first time, trading altcoins daily, or managing a diversified long-term portfolio, the exchange you use affects your costs, security, and overall experience.

Over the years, the crypto exchange landscape has matured significantly. Major platforms now serve hundreds of millions of users worldwide, offer access to thousands of digital assets, and provide everything from simple buy-and-sell tools to advanced derivatives trading, staking, and Web3 integration.

At the same time, regulatory scrutiny has increased, making trust, transparency, and compliance more important than ever.

This guide compares the best cryptocurrency exchanges, with a global focus and an emphasis on:

- Low trading fees

- Wide cryptocurrency support

- Ease of use for beginners

- Advanced tools for experienced traders

- Security and reliability

We start with a comparison table for a quick overview, then dive into detailed reviews of each exchange, followed by global regulatory considerations.

What Is a Crypto Exchange and Why Does It Matter?

A cryptocurrency exchange is a platform (website or app) where you can buy, sell, or trade digital currencies like Bitcoin, Ethereum, and others.

In simple terms, it functions like an online stock brokerage but for crypto assets – matching buyers and sellers and facilitating transactions. Exchanges come in two main types: centralized exchanges (CEX) and decentralized exchanges (DEX).

A centralized exchange is run by a company (similar to a bank or brokerage), which holds users’ funds and executes trades on their behalf.

Decentralized exchanges, by contrast, run on blockchain protocols (smart contracts) and let users trade directly from their own crypto wallets without an intermediary. Each model has trade-offs: centralized platforms are usually easier to use and support fiat currency deposits (e.g. USD, EUR), while decentralized exchanges offer greater user control and privacy but can be less beginner-friendly.

Choosing the right crypto exchange is crucial for anyone involved in crypto trading or investing. The platform you use will impact:

- Fees: Every trade can incur fees that eat into your profits. High fees can significantly reduce gains, especially for frequent traders. Selecting an exchange with low trading fees (and minimal deposit/withdrawal charges) helps you keep more of your money.

- Supported Cryptocurrencies: Not all exchanges list every coin. If you want access to a variety of altcoins or the latest token launches, you’ll need a platform known for broad coin support. Some exchanges focus on major coins, while others offer hundreds of tokens including new projects. The right exchange will have the assets you’re interested in.

- User Experience: The interface and tools can make a huge difference. Beginners benefit from a simple, intuitive app with easy buy/sell options, while advanced traders might require sophisticated charting, order types, and maybe features like margin or derivatives trading. A good user experience also includes reliable customer support, fast performance, and a robust mobile app for trading on the go.

- Security & Trust: In the wake of past exchange hacks and collapses, security is paramount. Reputable exchanges implement measures like cold storage (offline wallets for most funds), two-factor authentication (2FA), withdrawal whitelists, and proof-of-reserves audits to prove customer assets are safely backed. Regulatory compliance and insurance on fiat balances (where applicable) also add trust. Choosing a well-established exchange with a strong security record can literally protect your investments.

- Payment Methods & Fiat Access: If you need to deposit or withdraw traditional money (like USD), you’ll want an exchange that supports convenient methods (bank transfers, credit cards, PayPal, etc.) at low cost. Not all exchanges operate globally – some cater to certain countries or have separate entities (for example, U.S. versions of global platforms). It’s important to pick an exchange that legally services your region and offers the currency on/off-ramps you need.

In summary, picking the right exchange means finding a balance that suits your needs: low fees so you’re not overpaying, a good selection of coins that match your interests, and a platform experience (UI, support, features) that you are comfortable with.

In the following sections, we’ll compare the top crypto exchanges on those criteria and more. We’ll start with a comparison table for a quick overview, then dive into individual reviews (with pros and cons), and finally cover global availability and common FAQs like KYC, security, and using mobile apps.

Best Crypto Exchange Comparison Table (Fees, Coins, Features)

To help you scan the field, the table below summarizes the best cryptocurrency exchanges and how they stack up on key factors: trading fees, number of supported cryptocurrencies, user interface, and notable features. All figures are in USD or percentages, and fee tiers are for basic accounts (higher-volume traders often get discounts).

| Exchange | Supported Cryptos | Trading Fees (Spot) | User Experience | Notable Features |

| Binance (Global) | 600+ coins (1500+ pairs) | 0.1% per trade (maker & taker) – tiered discounts with BNB token; 0% on select pairs | Advanced & feature-rich (may overwhelm beginners) | Huge liquidity (41%+ of global volume), futures up to 125×, staking & earn products, NFT marketplace, crypto Visa card |

| Coinbase | ~250+ coins | 0.4%/0.6% maker/taker (starting on “Advanced Trade”); ~1% or spread on simple buys | Extremely beginner-friendly interface; separate advanced trading UI available | Regulated U.S. exchange (public company), FDIC-insured USD balances up to $250k, robust security record, staking for rewards, Coinbase Learn resources |

| Kraken | 500+ coins | 0.16%/0.26% maker/taker on Kraken Pro (competitive low fees) | Clean, intuitive platform; Kraken Pro for advanced tools & charts | One of the longest-running exchanges (since 2011), very strong security (Proof of Reserves audits, 2FA), margin & futures trading, 24/7 live support |

| Bybit | 700+ coins (spot & derivatives) | 0.1% spot trading fee; derivatives ~0.02% maker / 0.055% taker (base tier) | Designed for traders – sleek interface, advanced charts; may be complex for newbies | Massive derivatives exchange (second by volume), up to 100× leverage, copy-trading feature, no U.S. clients (offshore), fee discounts with MNT token |

| Bitstamp (by Robinhood) | 100+ coins | 0.25% taker / 0.10%–0.25% maker (tiered by volume) | Simple, no-frills interface; great for basic trading (no chaos) | Oldest running exchange (since 2011), high trust and transparency, strong EUR/USD fiat support (bank transfers, card), offers crypto staking, now backed by Robinhood (acquisition in 2025) |

| OKX | 350+ coins | 0.08% maker / 0.10% taker (base tier) – lower fees with OKB token or volume | Polished UI with customizable trading panels; geared to intermediate and advanced users | Comprehensive suite: spot, futures, options, an integrated Web3 wallet & DEX aggregator, NFT marketplace, high liquidity in markets, proof-of-reserves published |

| KuCoin | 1000+ coins (huge altcoin range) | 0.1% trading fee (maker/taker); pay with KCS token for ~20% discount | User-friendly for basic use with rich features available; moderate learning curve | “The People’s Exchange” – known for early listings of new gems, features trading bots, margin trading, crypto lending, no U.S. license (KYC optional for small trades), community-driven offerings |

| Gemini | ~100 coins (highly curated) | 0.2%/0.4% maker/taker on ActiveTrader; higher fees on standard app | Very easy for beginners; smooth interface; also has an ActiveTrader pro platform | Fully regulated in the U.S. (NYDFS BitLicense), top-notch security (cold storage, insurance), offers Gemini Dollar (GUSD stablecoin), crypto rewards credit card, strong compliance focus |

| Crypto.com | 400+ coins | 0.2%/0.4% maker/taker (base rate) – discounts if staking CRO token | Mobile-first app with simple buy/sell; also has a web exchange for advanced trading | Known for its crypto Visa card (cashback rewards in CRO), integrated app offering trading, staking (earn), NFTs, and Pay services; widely marketed, complies with security standards (ISO 27001 certified) |

| Bitget | 700+ coins | 0.1% spot fees (maker/taker); 0.08% with native BGB token; futures 0.02%/0.06% | Advanced trading interface similar to Binance/Bybit; copy-trading UI for followers | Fast-growing exchange (20M+ users globally), famous for copy trading (follow elite traders), strong futures platform (up to 125×), $600M user protection fund & proof of reserves, not available in US/Canada |

Notes: Maker/taker fees refer to whether you add liquidity (maker) or remove liquidity (taker) with your order – most exchanges charge slightly less for makers.

Many platforms offer tiered fee discounts based on your 30-day trading volume or if you hold/use their exchange token (like BNB for Binance, OKB for OKX, KCS for KuCoin, etc.). Always check the latest fee schedule on the exchange’s website, as fees can change or special promotions (like zero-fee pairs) may apply.

The number of supported cryptocurrencies can also change as exchanges add or delist assets. Leading exchanges like Binance and KuCoin list hundreds of coins, giving traders access to many altcoins (including new launches), whereas more conservative platforms like Gemini or Bitstamp list fewer, focusing on well-established assets.

Finally, user experience is somewhat subjective. Platforms like Coinbase and Gemini are praised for simplicity and are great for beginners, while ones like Binance, Bybit, or OKX pack in advanced features that experienced traders love (but might overwhelm newcomers). Many exchanges offer both a “basic” interface and a “pro” or “advanced” trade interface – allowing users to choose what suits their skill level.

In-Depth Reviews of the Top Cryptocurrency Exchanges

In this section, we’ll provide individual reviews of each featured exchange, highlighting their strengths and weaknesses.

We’ve prioritized well-known global platforms – both centralized exchanges (CEX) and a mention of decentralized options – to give a well-rounded picture. For each exchange, we discuss trading fees, coin selection, user experience, special features, and pros/cons.

Binance (Global) – Largest Exchange with Low Fees and Huge Coin Selection

Binance is the world’s largest cryptocurrency exchange by trading volume and user base.

Launched in 2017, Binance grew explosively and now serves over 280 million users in 190+ countries. It regularly handles a significant share of global crypto trading (over 40% of spot volume in mid-2025).

Binance’s popularity stems from its comprehensive offerings: you can trade more than 600 different cryptocurrencies on the platform (with 1,500+ trading pairs) – by far one of the widest selections in the industry.

Whether you’re into large caps like BTC and ETH or tiny altcoins, Binance likely has it.

Fees: Binance is known for ultra-low trading fees. The standard spot fee is just 0.1% per trade (for both makers and takers), which is much lower than the 0.5–1% charged by some competitors.

On top of that, Binance uses a tiered fee structure: high-volume traders get fees reduced further, and if you pay fees using Binance’s native token (BNB), you receive a 25% discount (bringing fees down to 0.075%). Binance even offers zero-fee trading on certain popular pairs (for example, some BTC stablecoin pairs) as promotions.

Beyond trading fees, most crypto deposits are free, and withdrawals incur only blockchain network fees or small fixed fees – Binance is quite reasonable on these as well. Supported Coins: Binance’s breadth of supported coins is a major draw. It lists hundreds of cryptocurrencies, from all the top market cap coins to newly launched tokens.

Binance supports on the order of 600+ distinct coins (and even more trading pairs when you count different token combinations). This means you can often find hot new tokens on Binance early.

Some of the crypto supported on Binance (Source: Binance)

The trade-off is that some very risky or obscure tokens might appear, but Binance does perform due diligence before listing. Still, the sheer variety is fantastic for traders looking to diversify or access DeFi, GameFi, and other niche crypto sectors on a single platform.

User Experience: Binance is feature-rich, which is a double-edged sword. On one hand, you have an incredible suite of tools and products: spot trading interface with advanced charts, Binance Futures platform for leveraged trading up to 125×, margin trading, a built-in P2P exchange for fiat trades, staking and savings programs (Binance Earn), an NFT marketplace, Binance Visa card for spending crypto, and more.

It’s basically an all-in-one crypto ecosystem. However, all these options can make Binance’s interface feel overwhelming for newcomers. There is a simpler “convert” and “Lite” mode for beginners, but the main interface is geared toward experienced users with its multitude of charts and menus. The learning curve is somewhat steep if you’re brand new to crypto – but for seasoned traders, Binance’s interface is highly customizable and powerful.

Mobile apps are available and include most features, although similarly packed with options. Overall, Binance excels in functionality; just be prepared to spend time learning if you’re a novice.

Additional Features: Binance’s list of features is very long.

A few highlights: It offers derivatives (futures and options) with deep liquidity, making it a go-to for pro traders. It has staking and lending where you can earn yield on holdings. It runs Launchpad token sales for new projects. Security-wise, Binance has a Secure Asset Fund for Users (SAFU) – an emergency fund (valued at $1 billion+) to cover losses in extreme cases.

Binance underwent proof-of-reserves reporting after 2022 and claims to hold user assets 1:1. That said, Binance is not without controversy: it has faced regulatory crackdowns in multiple countries. The platform is not available in the United States; U.S. users must use Binance.US, a separate entity with a much smaller selection (around 120+ coins) and slightly higher fees. In some regions (UK, Europe) Binance has had to restrict certain services like derivatives due to regulations. Always ensure Binance is legally accessible in your jurisdiction.

Pros:

- Lowest trading fees among major exchanges (0.1% standard).

- Extensive range of cryptocurrencies (600+ coins, including many new launches).

- High liquidity and tight spreads – easy to execute large trades without much slippage.

- Rich feature set: spot, futures, margin, staking, NFTs, card payments – a one-stop platform.

- Strong security infrastructure (SAFU fund, 2FA, withdrawal protections) and proactive proof-of-reserves audits.

Cons:

- Not beginner-friendly by default – the interface can be complex and intimidating.

- Regulatory issues: Banned or restricted in multiple countries (users may face outages or need to switch to regional versions).

- Customer support can be slow during peak times, according to user reports (due to sheer size of user base).

- Heavy use of its BNB ecosystem for discounts and DeFi might not appeal to all (holding BNB is needed to maximize benefits).

- Centralized risk: As with any CEX, users must trust Binance’s custody; past incidents (e.g. a 2019 hack of 7,000 BTC) did occur, though Binance covered users’ funds and improved security.

To start trading on Binance, use our referral link to receive a $100 trading rebate voucher within 48 hours of purchasing crypto worth more than $50!

Coinbase – Best for Beginners and Regulatory Compliance

Coinbase is often the go-to exchange for beginners and those who prioritize a regulated, user-friendly experience.

Founded in 2012 and headquartered in the U.S., Coinbase is one of the most established crypto exchanges and became a publicly traded company in 2021. It serves over 100+ countries and has around 110 million verified users globally.

Coinbase’s brand is synonymous with trust and ease-of-use in the crypto space.

Fees: Coinbase’s fee structure is a bit higher than some competitors, but they have been improving it. If you use the main Coinbase app or website for instant buys, fees can be around 0.5% (50 basis points) plus a spread (and small flat fees for small transactions) – in other words, casual users pay for convenience.

However, Coinbase now encourages users to use Coinbase Advanced Trade (the replacement for Coinbase Pro), which has a tiered maker-taker fee schedule. On Advanced Trade, fees start at 0.40% maker / 0.60% taker for the lowest volume tier, and decrease for larger 30-day volumes. While this is higher than Binance or Kraken, it’s more reasonable than the old consumer rates.

Also, Coinbase doesn’t charge extra to deposit/withdraw via bank (ACH in the U.S. is free, SEPA in EU has a small fee, etc.), though debit card purchases carry ~3.99% fee (typical for card use). Crypto withdrawals incur network fees.

Overall, fees are not Coinbase’s strong suit – you pay a bit of a premium for the simplicity and regulation. Frequent traders might find it pricey unless they switch to the advanced interface.

Supported Coins: Historically conservative in listings, Coinbase now offers 250+ cryptocurrencies on its platform. This includes virtually all major coins and a growing number of mid-cap and smaller altcoins. Coinbase focuses on assets that meet legal and security standards, so you won’t find the absolute micro-cap meme tokens here, but the selection is quite broad (from large caps to DeFi tokens, NFTs, and some newer ones).

They add new coins regularly, albeit often later than more aggressive exchanges. Still, for an average investor, Coinbase’s list is more than sufficient, covering all popular cryptocurrencies. Each listed asset comes with an informational page and “learn and earn” content, reflecting Coinbase’s educational bent.

User Experience: This is where Coinbase shines. The interface is extremely intuitive and beginner-friendly. The mobile app and website have a clean design with simple prompts to buy or sell. There’s a dashboard that shows your portfolio balance and performance over time. Coinbase also integrates educational content – for example, tutorials and quizzes that earn you small amounts of crypto (Coinbase Earn).

Coinbase Learn screen (Source: Coinbase)

The emphasis is on being approachable for non-experts: you can sign up, link your bank or card, and buy crypto with just a few clicks. For those who need more, the Advanced Trade interface (accessible from the same login) provides candlestick charts, order books, and the ability to place limit and stop orders – enough for intermediate trading needs, though it’s not as advanced as something like Binance’s interface. Notably, Coinbase’s mobile apps (iOS and Android) are highly rated for their smooth experience.

Furthermore, Coinbase offers good customer support including a help center, email support, and even phone support for certain regions – an area many exchanges struggle with. Overall, Coinbase is arguably the easiest ramp into crypto for new users who might be overwhelmed by other platforms.

Additional Features: Despite its simple appearance, Coinbase has a few additional offerings. It provides staking for certain coins (e.g. ETH, ADA, SOL) allowing users to earn rewards by locking assets, and these are done in a compliant manner (though U.S. staking rewards came under regulatory scrutiny in 2023–2024, Coinbase continues to offer staking outside the U.S. and under a revamped service in the U.S.).

Coinbase has also introduced derivatives trading (futures) for international users on a separate Coinbase International Exchange (launched in 2023) – but U.S. customers cannot trade crypto derivatives on Coinbase due to regulations.

Other features include the Coinbase Card (a Visa debit card that lets you spend crypto from your account and earn crypto rewards), and Coinbase Wallet (a separate self-custody app) which is great for DeFi and NFTs. Security-wise, Coinbase is top-tier: 98%+ of customer funds are held in cold storage, they carry crime insurance on custodial assets, and U.S. dollar balances are FDIC-insured up to $250k.

Coinbase has never been hacked in its core operations. It is also highly compliant – being a U.S.-regulated, publicly listed company means it undergoes regular audits and disclosures. The trade-off of regulation is that Coinbase enforces strict KYC verification and complies with tax reporting, etc., but for many users that’s reassuring.

Pros:

- Extremely easy to use, making it ideal for beginners entering crypto.

- Strong regulatory compliance and trustworthiness – a licensed, public company in the U.S., with audited security (no major hacks) and insured USD funds.

- Good selection of cryptocurrencies (250+), covering all mainstream needs without being too overwhelming.

- Robust security practices (mostly cold storage, 2FA, withdrawal address whitelisting, etc.) and an overall safe reputation.

- Quality mobile app and user education resources (tutorials, Coinbase Earn) to help newcomers learn and engage.

Cons:

- Higher fees than many competitors, especially for small/simple trades (the default buy/sell can cost ~0.5% or more).

- Advanced Trade fees (0.4–0.6%) are better but still above industry leaders.

- Limited advanced trading features – no built-in margin trading for U.S. users, derivative access only for some international users via separate platform. Seasoned traders might find Coinbase too basic.

- Slower coin listings – doesn’t list some micro-caps or very new tokens until they have some track record (could be a pro for safety, but a con for those seeking the newest coins).

- Customer support has improved but historically had complaints about slow response during high-traffic periods.

- Identity verification is mandatory and thorough, which is good for compliance but may deter those seeking privacy or anonymity (common to all regulated exchanges).

Kraken – Secure and Feature-Rich, with Competitive Fees

Kraken is a veteran crypto exchange that has been operating since 2011.

It’s U.S.-based (headquartered in San Francisco) but serves clients worldwide and has a reputation for high security, transparency, and strong support for both beginners and advanced traders.

Kraken has consistently been ranked among the top exchanges, and it remains a top choice, often praised for its security standards and low fees. Notably, Forbes Advisor named Kraken the “Best Overall Crypto Exchange of 2025”, highlighting its all-around strengths.

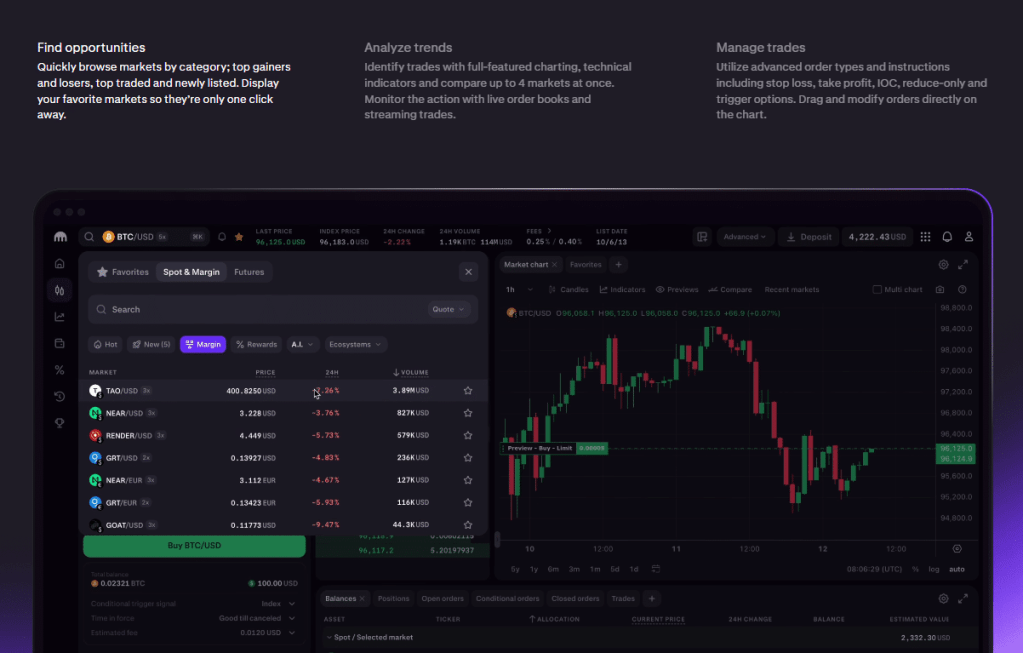

Fees: Kraken offers a very competitive fee schedule, especially on its Kraken Pro trading interface. For spot trades, the base tier fees are around 0.16% maker / 0.26% taker for 30-day volumes under $50,000.

Kraken Pro overview (Source: Kraken)

As your trading volume increases, those fees drop further (for example, to 0.14%/0.24% under $100k, and so on). This is on par with or slightly better than many peers – for instance, Kraken’s fees are lower than Coinbase’s and similar to Binance’s in higher tiers.

If you use Kraken’s straightforward buy widget (the Instant Buy feature on the main site or app), a higher fee (around 1.5%) applies, so it’s recommended to use Kraken Pro for the best rates.

Kraken does not have an exchange token for discounts, but the fees are already low.

Deposit fees: most crypto deposits are free, and Kraken was known for free ACH and free SEPA deposits/withdrawals in certain regions. Bank wire withdrawals in USD have a fee (e.g. $4–$5 domestically, $35 for SWIFT) and crypto withdrawals incur a fixed fee per coin (reasonable).

Kraken’s fee approach is straightforward and trader-friendly, without hidden spreads. Overall, it scores high on fees, especially for the Pro users.

Supported Coins: Kraken has expanded its coin listings dramatically in recent years, and currently supports over 530 cryptocurrencies and 1,271 trading pairs, which is a huge number. (This figure might surprise people who remember Kraken having a limited selection – the exchange has actively added many new assets, including DeFi tokens, meme coins, and more, particularly to cater to a global audience.)

In fact, Kraken’s coin count now rivals or even exceeds some of the traditionally “altcoin-heavy” exchanges. Of course, Kraken lists all major coins (BTC, ETH, LTC, XRP, etc.) and a wide array of mid to small-cap tokens.

It also supports 7 major fiat currencies (USD, EUR, GBP, JPY, CAD, AUD, CHF) for trading and account funding, which makes it versatile for users around the world. If your goal is to trade a diverse set of assets, Kraken will likely have what you need – from top ten coins to emerging altcoins – though it still doesn’t list absolutely every obscure token that exists.

User Experience: Kraken offers a blend of user-friendliness and advanced capability. The main Kraken platform (and mobile app “Kraken”) is geared toward ease of use: you can quickly buy/sell crypto using simple forms and view your portfolio.

For those who want more, Kraken Pro (accessible via web or a separate app) provides a professional trading interface with advanced charting (powered by TradingView), multiple order types, order books, etc.

The Kraken Pro interface is highly customizable, which serious traders appreciate – you can arrange charts, depth windows, and trade panels to your liking.

At the same time, it’s not too intimidating if you’re stepping up from basic trading, thanks to a clean design. In terms of performance, Kraken is known for stability (it generally stays up even during volatile spikes, whereas some exchanges have had downtime issues in past bull runs).

Another aspect Kraken is praised for is its customer support – they offer 24/7 live chat support with quick response, which many users find helpful when issues arise. For beginners, Kraken’s website has a wealth of learn materials and a detailed Help Center, plus Kraken’s interface for buying crypto with cash is straightforward.

Overall, Kraken’s user experience is solid: perhaps not as “hand-holding” as Coinbase for absolute newbies, but very approachable, and with plenty of depth for those who need advanced features.

Additional Features: Kraken is often touted for its security-first approach. The exchange has never been hacked in its 12+ year history – a remarkable feat. They keep around 95% of deposits in offline cold storage, do regular penetration testing, and have security audits. Kraken also was one of the first to implement Proof of Reserves audits after 2022 (and continues to do so, showing it holds more than 100% of customer assets in reserve).

Another strength is Kraken’s adherence to regulations: it’s one of the few major exchanges with a U.S. license (FinCEN-registered) and has expanded to get a full license under the EU’s MiCA regulation for operation across Europe.

For users, that means more assurance of compliance and longevity. Feature-wise, Kraken supports margin trading on many pairs (up to 5x leverage for spot trades), and it offers futures trading for non-U.S. customers (Kraken Futures, acquired from Crypto Facilities, with up to 50x leverage on BTC, ETH and other contracts).

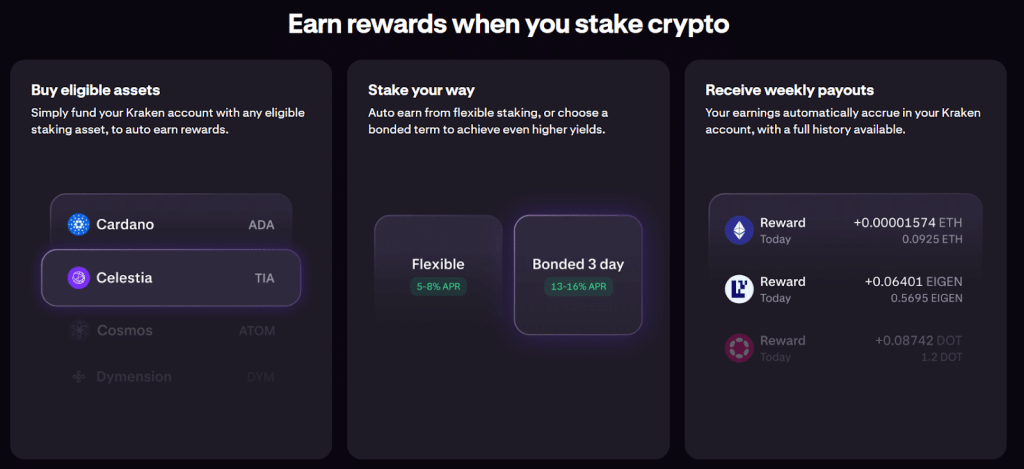

It also has staking (including on-chain staking for coins like ETH, DOT, ADA, etc., allowing users to earn staking rewards – although U.S. users had staking rewards halted in early 2023 due to SEC pressure).

Kraken staking (Source: Kraken)

Additionally, Kraken has recently introduced things like an NFT marketplace (beta) and even stock trading (in some regions, fractional stocks called “xStocks”).

Those latter features are not yet core to Kraken’s identity but show Kraken moving toward a multi-asset platform.

Security is worth emphasizing: Kraken employs measures such as mandatory 2FA, MasterKey and PGP encryption for communications, a global settings lock (to prevent account changes), and was one of the first to pass a SOC 2 security audit. Users generally feel that Kraken is one of the safest places to trade.

Kraken’s motto “Not your keys, not your crypto” even encourages users to self-custody if they prefer – a unique stance for an exchange (they provide an integrated Kraken crypto wallet but also recommend personal cold wallets for long-term holding).

Pros:

- Excellent security track record – no major breaches, rigorous security standards, and regular proof-of-reserves audits for transparency.

- Competitive fees on Kraken Pro (0.16%/0.26% base), making it cost-effective for active traders (plus no large spreads on trades).

- Wide range of assets and fiat – 500+ cryptos supported along with multiple fiat currencies for deposit/trade.

- Advanced trading features – margin trading, futures, OTC desk for large orders, and a customizable pro interface for sophisticated trading strategies.

- Good customer support and reliability – 24/7 live support and generally stable uptime, giving users confidence during volatile market periods.

Cons:

- Not available in some regions – Kraken is unavailable in a few U.S. states (like New York, due to BitLicense issues) and some countries due to regulatory restrictions. Always check if you can use Kraken in your location.

- Slower listing of certain coins – while Kraken has many coins now, it still evaluates coins carefully. You might not find some extremely new or fringe tokens as quickly as on Binance or KuCoin.

- Interface, while improved, might feel a bit dated to some – Kraken Pro is powerful but the design is utilitarian. Beginners might still prefer the simplicity of Coinbase until they learn the ropes.

- Limited direct payment options – Kraken supports bank transfers well, but it doesn’t support credit card buys in many cases (they prefer bank and wire for fiat). This could be a minor inconvenience if you’re used to card purchases.

- Staking limitations for U.S. users – due to regulatory issues, U.S. clients can’t currently earn staking rewards on Kraken (after a settlement with the SEC in 2023), whereas international users can.

Bybit – Derivatives Powerhouse with Expanding Spot Market (Best for Active Traders)

Bybit is a leading cryptocurrency exchange known primarily for its derivatives trading.

Launched in 2018, Bybit initially focused on perpetual futures contracts (similar to BitMEX’s model), and it quickly became one of the top futures platforms globally.

In recent years, Bybit has expanded into spot trading and a host of other features, making it a well-rounded exchange – but it still shines brightest for active traders and those interested in margin or leveraged products.

Bybit is incorporated in Dubai and serves a global user base (excluding a few countries like the U.S. and UK).

Fees: Bybit offers very low fees, especially for derivatives. For spot trading, Bybit’s standard fee is 0.10% for both makers and takers (before any discounts), which is straightforward and on par with Binance and others.

Bybit also has a VIP program and its own token incentives: holding or using Bybit’s native token (which transitioned from BIT to MNT (Mantle) in 2023) can give you a 25% fee discount on spot trades, bringing the fee down to 0.075%. For derivatives, Bybit’s fees are among the best: base tier is about 0.02% maker / 0.055% taker for perpetual futures. Makers actually get a small rebate or very close to zero in some cases. These low taker fees are great for high-volume futures traders – slightly cheaper than Bitget or OKX’s base taker fee.

Bybit often runs promotions (like fee-free trading on certain spot pairs or reduced fees for new listings). Outside of trading fees, Bybit charges no fees on crypto deposits, and withdrawals are subject only to network fees. It supports free fiat deposits via third-party in some regions or P2P marketplace.

Overall, Bybit’s fee structure is extremely competitive, tailored to attract professional traders.

Supported Coins: Bybit’s initial claim to fame was offering perpetual swaps on a handful of major coins (BTC, ETH, etc.). Bybit has greatly broadened its offerings. It now lists hundreds of cryptocurrencies on its spot exchange – approximately 700+ coins can be traded on Bybit’s spot markets, and it offers derivatives for many of those as well.

That puts Bybit in a similar league to Binance for asset selection. They list many DeFi tokens, meme coins, and newly emerging tokens (Bybit even has a Launchpad for new token offerings).

So, despite its roots in just a few assets, Bybit is now a place where you can trade a wide array of cryptos. The one catch: Bybit is not allowed to serve certain countries, chiefly the United States.

Traders in restricted regions technically shouldn’t use Bybit (though some do via VPNs, it’s against the terms). For everyone else, access to various coins is excellent. If you’re looking for that small-cap gem, there’s a good chance Bybit might have it, or will list it early – they’ve been aggressive in expanding listings to compete with other altcoin exchanges.

User Experience: Bybit’s interface is often praised by experienced traders. It’s slick, modern, and highly responsive. The trading screen (both web and mobile) has a clean dark theme by default, with easy toggles between isolated and cross margin, leverage adjustments, etc.

Bybit futures interface (Source: Bybit)

Order execution is fast – Bybit boasts about its matching engine’s speed and reliability (up to 100k TPS per contract). Even during volatile periods, Bybit generally performs well without major outages. The charting is powered by TradingView and is nicely integrated. For new users, Bybit might seem complicated initially because the homepage leans into trading directly. However, they have a “Buy Crypto” portal for simple credit card or fiat purchases if that’s all a beginner wants.

Bybit has separate sections for spot, derivatives, options, and also features like copy trading. Copy Trading is a popular feature on Bybit: newbies can automatically follow the trades of experienced “master traders” – Bybit provides stats for these traders, and one can allocate a portion of funds to mirror their moves.

It’s quite user-friendly to set up and has attracted many users who want to try passive trading (though of course, results vary and there are risks in blindly copying). The Bybit mobile app is full-featured, letting you trade, manage positions, do P2P trades, etc., and it’s generally well-rated.

Another aspect: Bybit provides a lot of educational content and alerts via its app and blog, plus an active community on Telegram and other social media for support. They also have 24/7 live chat support which, according to user feedback, is reasonably responsive.

Additional Features: Being trader-focused, Bybit continually adds new features. Beyond the core of perpetual futures (on dozens of coins) and spot trading, Bybit has introduced USDC options trading (they offer options settled in USDC, expanding into that derivatives market).

They have a Launchpad for new token sales which has hosted several successful IEOs – users can commit funds to get allocations of new tokens.

Bybit Earn is another feature: they offer interest-earning products, dual asset mining, and flexible savings for users who want passive income on idle assets. One unique offering is Bybit’s NFT marketplace, where users can trade NFTs (though it’s not as big as dedicated NFT platforms).

Bybit also supports P2P fiat trading, allowing users to buy/sell crypto directly with other users in local currencies (useful in regions where direct banking is tricky). A major event in Bybit’s recent history is worth noting: in February 2025, Bybit suffered a serious hack on one of its cold wallets, where attackers managed to steal around $1.4 billion worth of ETH (about 430,000 ETH). This was one of the largest crypto exchange hacks ever. Bybit responded by halting withdrawals temporarily, working with blockchain analytics firms, and ultimately covered the losses (exact details of compensation weren’t fully public, but Bybit’s insurance fund and emergency reserves were used to ensure user balances were not affected).

The hack was a blow to Bybit’s security reputation, although it’s believed North Korean state-sponsored hackers were behind it (a very sophisticated attack). Since then, Bybit has enhanced security further – but this incident underscores that even big exchanges are not invulnerable. Bybit has since published proof-of-reserves and stressed its commitment to reimbursing users.

Users considering Bybit should keep this in mind but also note that the exchange survived the incident and continued operations normally after a short pause.

Pros:

- Industry-leading derivatives platform – high liquidity and volume (often #2 after Binance), with a wide range of futures and options, suitable for serious traders.

- Low fees for both spot and futures – 0.1% spot, and discounted further with token; only ~0.055% taker on futures, which is cheaper than many peers.

- Broad and growing selection of cryptocurrencies – hundreds of coins listed, aggressive in adding new tokens, giving traders many options (almost like a one-stop shop for spot and futures on even smaller coins).

- Advanced yet user-friendly interface – the trading experience is smooth, with great charts and tools, plus features like copy trading for those who want a simpler way to engage.

- Rich features and promos – Bybit offers earn products, launchpads, and frequent bonuses (they often have sign-up rewards or trading competitions, appealing to the active trading community).

Cons:

- Not available in certain jurisdictions – U.S. users (and some others like Canadians, UK residents) cannot legally use Bybit, which limits its accessibility (using a VPN is against ToS and can risk account closure).

- Trust hit by 2025 security breach – the February 2025 hack was one of the largest ever, which may concern users despite Bybit making customers whole. It highlights some potential security lapses that needed addressing.

- KYC now required – Bybit initially allowed trading without verification, but as of 2023 it mandates KYC for most functionalities. This is a con for those who preferred anonymity (though it aligns with industry compliance trends).

- Less fiat integration – Bybit does not support direct bank deposits/withdrawals in as many currencies; it relies on third parties or P2P for fiat, which is not as seamless as an exchange like Coinbase.

- Highly trading-focused – Bybit is fantastic for trading, but it’s not really an “investment app” or beginner-learning platform. If someone just wants to buy and hold crypto with a simple interface, Bybit might feel too geared toward active trading and could be overkill.

Bitstamp – Longest-Running Exchange with Reliability and Simplicity

Bitstamp is one of the world’s oldest cryptocurrency exchanges, founded in 2011.

Originating in Europe (Luxembourg), it has built a reputation over a decade as a secure and reliable platform for buying and selling top cryptocurrencies. In 2025, Bitstamp underwent a notable change: it was acquired by Robinhood for $200 million, and is now branded as “Bitstamp by Robinhood” in some places.

This partnership aims to leverage Bitstamp’s solid exchange infrastructure with Robinhood’s user base and fintech experience. Despite the new ownership, Bitstamp continues to operate as its own exchange and remains a favorite for users who value trust and straightforward service over flashy features.

Fees: Bitstamp has a tiered fee schedule based on 30-day USD trading volume. For low-volume traders (under $1,000 monthly), the fee is 0.25% per trade. The tiers then drop to 0.24% under $10k, 0.22% under $20k, etc., reaching as low as 0.1% for very high volumes. Effectively, most retail traders will pay between 0.10% and 0.25% per trade. These fees used to be higher (Bitstamp historically was ~0.5%), but they have become more competitive – now roughly matching Kraken’s fee levels for small traders.

Notably, Bitstamp does not charge different maker/taker rates for most tiers; it’s a flat fee which simplifies things (except at the very highest volumes where maker may drop slightly lower). There are no fees to deposit crypto or most fiat methods: SEPA euro deposits are free, ACH deposits free, etc., while an international wire deposit has a small percentage fee.

Withdrawal fees: SEPA withdrawals €3, international wire 0.1% (min $25), and crypto withdrawals have fixed fees depending on coin (for example, 0.0005 BTC to withdraw Bitcoin, etc.).

Overall, Bitstamp’s fees are fairly low, especially after its adjustments post-Robinhood deal – casual users paying 0.25% is decent, and if you trade more, the percentage drops quickly. There are no token-based discounts (Bitstamp has no native token), but the simplicity and fairness of fees are appreciated.

Also, Bitstamp has no hidden spreads; the order book trading ensures you get market rates. Supported Coins: Unlike some exchanges that try to list every coin under the sun, Bitstamp maintains a more conservative selection. It currently offers around 100+ cryptocurrencies for trading. These include virtually all of the large-cap and mid-cap coins (BTC, ETH, XRP, LTC, BCH, LINK, SOL, etc.) and a selection of other reputable altcoins.

They have added more assets in recent years (especially DeFi-related tokens, metaverse tokens, etc.), but the total count is modest compared to Binance or Coinbase. Bitstamp tends to ensure any listed asset has sufficient liquidity and a solid project – you likely won’t find meme coins like SHIB, nor many micro-caps on Bitstamp.

For many users, especially those mainly interested in major cryptos, this “quality over quantity” approach is fine. However, if you’re looking for very new or niche altcoins, Bitstamp will not have those.

One advantage of Bitstamp’s asset support is that it often provides fiat trading pairs (USD, EUR, GBP) for its listed coins, reflecting its European roots where people trade in euros. This makes it easy to go from cash to crypto directly for those coins.

User Experience: Bitstamp is often described as a simple and no-nonsense platform. The interface is clean and not overloaded. The website has a straightforward trading view and a basic UI for buying/selling.

For those who want advanced trading, Bitstamp offers Tradeview (an interface with TradingView charts and order books), but it’s not as advanced as something like Binance Pro – it’s more comparable to Coinbase Pro interface in simplicity.

The mobile app is well-designed, giving an easy way to buy or sell with a few taps, view prices, and set price alerts. Bitstamp does not offer complex products (no derivatives, no lending), so the UI stays uncluttered. This makes it a good choice for those who just want to reliably swap between fiat and crypto or trade mainstream coins without distraction.

The exchange is also known for its customer support and compliance. Being a regulated entity in Luxembourg and with offices in the UK and US, Bitstamp has proper KYC procedures and a support team that historically has been quite responsive (they even have phone support lines in some regions).

The reliability of Bitstamp’s platform is excellent – it’s rarely down, and has navigated even high-volatility days with less downtime than some competitors. It’s worth noting that Bitstamp’s interface and approach can feel “boring” to thrill-seeking traders – there’s no gamified rewards, no flashy banners of new coin lotteries, etc. It’s a “what you see is what you get” exchange, which many traditional investors actually prefer. Additional Features: Bitstamp’s feature set is relatively limited compared to multi-service exchanges, but it has a few notable aspects:

- Fiat on/off ramps: Bitstamp supports USD, EUR, and GBP deposits and withdrawals (including credit card buys, bank transfers, and newer methods like Apple Pay). It’s very useful as a fiat bridge, especially for Europeans using SEPA – Bitstamp has long been one of the easiest ways in Europe to move euros into crypto.

- Staking/Earn: Bitstamp introduced staking for a couple of coins (ETH2 staking, etc.) and Bitstamp Earn which offered yield on assets via partnerships. However, after U.S. regulatory pressures, Bitstamp in mid-2023 suspended staking for U.S. customers. Internationally, some staking features may still be available (e.g. Bitstamp Earn via third parties like Celsius was offered but then discontinued after Celsius issues). In late 2025, with Robinhood’s involvement, Bitstamp might integrate more earning features, but currently it’s not a major platform for yield.

- Security: Bitstamp has a strong security track record overall (though it did suffer a hack in January 2015 where ~19k BTC were stolen – but since then, no major incidents). They keep the majority of assets in cold storage, have insurance for custodial assets, and have implemented modern security features (2FA, address whitelisting, etc.). Bitstamp also undergoes audits and was one of the first to get a full regulatory license in Luxembourg in 2016. The acquisition by Robinhood (a US-regulated broker) further underscores its compliance focus.

- Robinhood integration: While still early, the Robinhood acquisition could lead to new features. For example, Robinhood could channel some of its crypto order flow through Bitstamp’s exchange for better liquidity, or Bitstamp could potentially list stocks or other assets through Robinhood’s infrastructure in the future. As of late 2025, nothing major has changed for users except co-branding, but users might notice improved resources and possibly tighter integration with Robinhood’s app coming.

Pros:

- Extensive longevity and trust – over 12 years of operation, making it one of the most reputable exchanges (often praised for transparency and surviving multiple market cycles).

- Simple, user-friendly platform – great for those who want a reliable place to buy/sell major cryptos without the complexity of newer exchanges.

- Competitive fee structure, especially after recent reductions (0.25% or less for most, and as low as 0.1% for higher volumes). No hidden spreads – straightforward pricing.

- Strong fiat support – easy deposits and withdrawals in USD, EUR, GBP, etc., with low fees (ideal for converting between crypto and fiat). This makes Bitstamp a good fiat on-ramp/off-ramp.

- High security and regulatory compliance – fully licensed in the EU, now backed by Robinhood, with a good security record post-2015 and implementation of industry best practices.

Cons:

- Limited selection of coins – only ~100 cryptocurrencies, so many smaller altcoins or trendy new tokens won’t be found here. It’s focused on the most established assets.

- No derivatives or advanced products – no futures, no leverage trading, no lending/borrowing markets on Bitstamp. It’s strictly spot trading. This may not suit advanced traders who want those tools.

- Moderate user interface – while easy to use, it might lack some advanced charting or order types that seasoned traders get elsewhere. (For example, Bitstamp has basic order types but not the variety of conditional orders some competitors offer.)

- Lesser emphasis on innovation – Bitstamp doesn’t have features like an NFT marketplace, DeFi integrations, or a robust API ecosystem beyond standard trading API. Those who want cutting-edge features might find Bitstamp behind the times.

- Past hack (2015) – long ago, but worth noting historically. Bitstamp improved a lot since then; however, it reminds that even older exchanges had issues and thus continuous security vigilance is necessary.

OKX – Global Exchange for Altcoins and Derivatives with DeFi Integration

OKX (formerly known as OKEx) is a major international crypto exchange that offers a full suite of trading products.

Founded in 2017 as an offshoot of the original OKCoin exchange, OKX has grown to become one of the top exchanges by volume, particularly strong in Asia and emerging markets. It’s known for competitive fees, a wide range of supported coins, and advanced trading features. In addition to centralized exchange services, OKX has also invested in decentralized tools (its own Web3 wallet and DEX), blurring the line between CEX and DeFi.

OKX is headquartered in Seychelles for regulatory purposes, but has a presence in many countries (and is working on US compliance, though not serving US customers yet).

Fees: OKX offers very low fees, especially if you’re an active trader. The standard spot trading fees for new users are 0.08% maker / 0.10% taker, which is slightly better than Binance’s base 0.1%. With higher trading volume or if you hold their native token OKB, your fees can drop further – OKX has VIP tiers and loyalty tiers that can reduce maker fees to near zero and taker fees a few basis points for big traders. For derivatives (futures, swaps), the base fees are similarly low: around 0.02% maker / 0.05% taker for most contracts (and lower for VIPs).

Additionally, OKX often runs zero-fee campaigns on particular trading pairs or discounted trading for new listings to incentivize usage.

Deposit/withdrawal: Crypto deposits are free; crypto withdrawal fees vary by asset (they are usually a fixed fee, roughly aligning with network costs – not excessive). OKX supports many fiat channels via third-party providers and P2P – those may involve some fees set by providers but OKX itself doesn’t charge a deposit fee.

In summary, trading on OKX is very cost-effective, appealing to both retail and high-volume traders who can save with its tiered structure.

Supported Coins: OKX lists an extensive range of cryptocurrencies – over 350 coins and hundreds of trading pairs on the spot market. It’s among the top exchanges for altcoin variety, though not as many as some like KuCoin or MEXC.

You will find all major coins on OKX and a huge selection of DeFi tokens, gaming tokens, etc. OKX is often quick to list new trending coins (with appropriate warnings if they are very new).

The exchange categorizes assets and even offers an “Innovation Zone” for newer, riskier tokens. For derivatives, OKX provides futures and perpetual swaps on dozens of assets (BTC, ETH, XRP, DOT, DOGE, and many more, including some DeFi tokens), and even options trading (BTC and ETH options primarily).

It also has a robust earn section that supports many coins for staking or saving. If you’re looking to trade or invest in a broad crypto portfolio, OKX likely has most of what you need.

That said, it might not have the absolute fringe tokens that only appear on decentralized exchanges, but it covers more than enough for most traders. User Experience: OKX has put a lot of effort into its platform experience.

The exchange interface is highly customizable and professional – similar in complexity to Binance or Kraken Pro. It offers advanced charting, various order types (including stop-limit, iceberg, TWAP, etc.), and an aggregated view of spot, margin, and derivatives if you use the unified account mode.

Despite all the features, the interface is reasonably clean and the learning curve is moderate. For beginners, OKX has a simple buy/sell interface (and a separate mobile app section for just swapping or buying with a card). The mobile app of OKX is particularly praised for its smooth design and the fact that it contains both the trading functions and a built-in Web3 wallet. This means you can easily switch to the DeFi side within the app if you want to explore DApps or the OKX NFT marketplace.

The Web3 wallet integration is a unique selling point: you can manage a decentralized wallet for accessing DEXs, decentralized loans, NFTs, etc., all from within OKX’s ecosystem. This indicates OKX’s strategy of offering a “one-stop” crypto experience (centralized + decentralized).

In terms of reliability, OKX is known to be quite stable; it hasn’t had major downtime scandals in recent years. The trading engine is robust (capable of high TPS), and risk systems (for margin and futures) are well-established, which helps prevent auto-deleveraging in volatile times.

Customer support is available via chat and ticket, and OKX has communities on Telegram/Discord for help. For most users, the experience on OKX is very positive once they get accustomed to the features – it’s frequently recommended by expert traders as an alternative to Binance due to similar offerings but sometimes better rates and perhaps fewer regulatory hassles (for non-US users).

Additional Features: OKX is feature-rich:

- It supports margin trading on the spot market, allowing up to 5x leverage on many trading pairs.

- Futures and Perpetual Swaps: It offers a wide array of perpetual swaps and quarterly futures with high leverage (up to 125x on major pairs, though using such high leverage is risky).

- Options trading: OKX is one of the few major CEXs aside from Deribit to offer a crypto options market (BTC, ETH options).

- Savings and Staking: The OKX Earn section provides ways to stake coins (both simple staking and DeFi staking where OKX does on-chain operations for you), yield farming opportunities, fixed-term deposits, dual investment products, etc.

- NFT and Web3: OKX’s built-in Web3 wallet (OKX Wallet) is a non-custodial wallet that connects to various blockchains. Through it, OKX launched an NFT marketplace and supports decentralized app access – for instance, you could trade on Uniswap through the OKX app, or store your NFTs in the OKX Wallet. This is somewhat unique among big exchanges (Binance has a separate Trust Wallet; OKX integrated theirs into the platform experience).

- OKB Loyalty Token: OKX has a utility token, OKB, which users can hold to get trading fee discounts and other perks (like early access to token sales on OKX Jumpstart platform). OKB doesn’t have as central a role as Binance’s BNB, but it’s there for ecosystem benefits.

- Proof of Reserves: Post-FTX, OKX started publishing monthly Proof of Reserves audits, allowing users to verify that OKX holds sufficient assets (they even provide a tool for users to verify their account’s inclusion via Merkle tree). These reports have shown OKX holding reserves exceeding customer balances, aiming to build trust with the community.

- Developer & API: OKX provides robust API support for algorithmic traders and even offers a cloud service (OKX Cloud) for partners to launch their own exchanges using OKX tech.

One more thing: OKX has made news by securing high-profile sponsorships (e.g., partnerships with English Premier League champions Manchester City and Formula 1 teams) which increases its global brand presence.

Pros:

- Low fees and VIP benefits – base trading fees 0.1% or below, plus additional discounts for high volume or using OKB, making it cheaper than many for active trading.

- Large selection of cryptocurrencies and markets – 350+ coins, plus extensive derivatives offerings (perpetuals, futures, options) catering to all trading needs.

- Sophisticated trading platform – advanced tools for pros, including customizable interface, variety of order types, and margin/leverage trading features on par with the top exchanges.

- Integrated DeFi and Web3 features – the OKX Wallet allows users to explore decentralized exchanges, NFTs, and other Web3 services without leaving the platform, blending CeFi and DeFi in one app.

- Strong security and transparency efforts – regular proof-of-reserves audits, robust identity verification, and no major security breaches reported. It’s considered one of the more reliable offshore exchanges.

Cons:

- Not accessible to U.S. users – like many global exchanges, OKX does not serve the United States (and some other restricted countries), due to regulatory unclarity. This limits who can directly use the platform (though they are eyeing compliance to possibly enter the U.S. in the future).

- Complexity for beginners – while there is a simple buy interface, the sheer number of features on OKX can be daunting to new users. It’s a platform slightly more tailored to intermediate and expert users (though their Academy materials can help newcomers learn).

- OKB token not as widely used – some ecosystem features (like fee discounts or Jumpstart allocations) require OKB, which is an extra step for users and not as ubiquitous as BNB or similar exchange tokens.

- Past reputational blips – in its OKEx days, there was an incident in 2020 where withdrawals were paused for a few weeks due to a keyholder issue (when an executive was in custody in China). Although no users lost funds, it caused temporary worry. This kind of event hasn’t recurred, but it’s a reminder of some operational risks in the past.

- Fiat support could be better – OKX supports buying crypto with fiat via third parties and P2P, but direct bank deposit support is limited compared to, say, Coinbase or Kraken. This might inconvenience users in some regions who prefer direct fiat on/off ramps.

KuCoin – Altcoin Supermarket with Advanced Features (No KYC for Small Traders)

KuCoin launched in 2017 and has branded itself as “The People’s Exchange.”

It’s one of the most popular crypto exchanges globally for trading a vast array of altcoins. KuCoin is often the place where you find smaller and early-stage tokens that bigger exchanges haven’t listed yet – giving it the feel of an altcoin supermarket.

In addition to spot trading, KuCoin has expanded into margin trading, futures, lending, staking, and even its own metaverse and NFT platform. It’s based out of Seychelles (though initially had roots in China/Hong Kong) and is not licensed in the US or EU, which means it operates in a grey area but has attracted users worldwide.

Notably, KuCoin still allows trading without full KYC (up to certain withdrawal limits), which appeals to users who prioritize privacy.

Fees: KuCoin’s fees are very low and straightforward: 0.1% trading fee for both makers and takers on spot trades (this is the base rate for normal users). If you pay fees using KuCoin’s native token KCS, you get a 20% discount, bringing the effective rate to 0.08%. This structure is similar to Binance’s (which also gives 25% off with BNB), and it positions KuCoin among the cheapest exchanges for spot trading. For futures trading on KuCoin, fees start around 0.02% maker / 0.06% taker (again, pretty standard or slightly better for base tier).

KuCoin has a tiered fee system for higher volumes which can drop spot fees even further (down to 0.005% or so for huge volumes). Additionally, holding more KCS can slightly upgrade your VIP level.

Outside trading fees, KuCoin doesn’t charge for crypto deposits, and withdrawal fees are set per asset (comparable to other exchanges’ withdrawal fees).

One draw: KuCoin often has lots of trading contests, bonus campaigns, and rewards which can effectively reduce costs or give cash back to active traders.

Overall, KuCoin’s fees are among the lowest for a non-regulated exchange, enticing many cost-conscious traders.

Supported Coins: This is KuCoin’s strongest selling point. KuCoin lists over 1,000 cryptocurrencies and more than 1,700 trading pairs. It’s frequently among the top exchanges in terms of number of coins supported.

If there’s a coin that’s not on Coinbase or Binance yet, chances are it might be on KuCoin. They’ve listed many community-driven projects, DeFi tokens, meme coins, etc., quite early. KuCoin also has a feature called “Gem” or Spotlight for new token launches (similar to an IEO launch platform), which introduces new projects to the exchange.

The vast selection makes KuCoin a favorite for “altcoin gem hunters” who want to invest in lower-cap projects before they potentially get big. However, with quantity comes risk – not every coin on KuCoin is vetted to the same degree as on say, Kraken or Gemini. Users must do their own research on these lesser-known tokens, as some could be very volatile or end up failing. Still, for experienced traders who want maximum choice, KuCoin is hard to beat.

Another note: KuCoin offers many trading pairs against not just USDT, but also BTC, ETH, KCS, and even some fiat tokens (like EURT) and others, giving flexibility in how you trade.

User Experience: The KuCoin platform is fairly user-friendly despite its wealth of features. The interface is somewhat similar to Binance’s in layout: an exchange dashboard with tradingview charts, order books, etc., and a simple mode for quick buys. KuCoin’s mobile app is also robust, allowing everything from spot and futures trading to staking and loaning on the go.

One thing to mention: because KuCoin offers so much (spot, margin, futures, P2P fiat trade, earn, NFT marketplace, etc.), the interface can present many options, which might be overwhelming for brand-new users. They have improved the UI over the years, and provided tutorials for newcomers.

Setting up an account on KuCoin is very easy – you just need an email and password (no KYC required to start trading small amounts). This low barrier has attracted many users who dislike lengthy verification. However, KuCoin has optional KYC: if you complete it, you get higher daily withdrawal limits and potentially access to certain features or events. Without KYC, there’s a withdrawal limit (around 1 BTC per day for unverified accounts, subject to change). Some see the no-mandatory-KYC as a plus for privacy; others see it as a potential risk (since bad actors could use KuCoin, drawing regulatory attention eventually).

In terms of performance, KuCoin generally performs well, though in extremely volatile times some users have reported occasional lags (not uncommon across exchanges). Customer support is offered via tickets, email, and an online help center – it’s decent, but not as hands-on as, say, Coinbase’s support. The community around KuCoin (on Reddit, Telegram) is active and often can help peers.

Additional Features: KuCoin is not just a trading platform; it’s an ecosystem:

- Margin Trading: KuCoin allows margin on dozens of pairs with up to 10x leverage on some. What’s interesting is it operates a peer-to-peer lending system for margin: users can lend out their funds to margin traders and earn interest. This KuCoin Lending feature means you, as a user, can deposit, say, USDT into the lending market and set an interest rate; margin traders borrow it and you earn interest daily. It’s a way to earn passive income.

- Futures/Derivatives: KuCoin Futures (formerly KuMEX) offers perpetual contracts on many coins and some quarterly futures. The interface is separate but integrated, and they have their own token (USDⓈ-Margined futures use USDT/USDC, and Coin-margined futures use the coin itself). Leverage up to 100x on top coins, lower on smaller.

- Staking & KuCoin Earn: KuCoin’s Earn hub includes Pool-X (where you stake coins to earn rewards, sometimes with liquidity so you can trade staked positions), fixed-term staking, flexible savings (a bit like interest accounts), and occasional promotions for new coin deposits. They often offer very high APYs for new or promotional events (which can be attractive but usually temporary).

- KuCoin Community Chain (KCC): KuCoin has its own blockchain (KCC), and while it’s not as prominent as BSC or others, it’s part of their push into DeFi. They encourage projects to build on KCC and list those tokens.

- NFT marketplace and Windvane: KuCoin has dipped into NFTs with an initiative called Windvane, aiming to be a decentralized NFT marketplace. It’s not a huge part of KuCoin yet, but it shows they’re following trends.

- KuCoin Token (KCS): KCS is central to KuCoin’s ecosystem. By holding at least 6 KCS, users get a daily bonus which is basically a share of 50% of KuCoin’s trading fee revenue, distributed proportionally. This can result in a decent yield for holders (it fluctuates based on trading volume). KCS also gives trading fee discounts and acts as the utility token for the KuCoin ecosystem (like paying fees, joining token sales, etc.). KCS has performed well historically because as KuCoin usage grows, demand for KCS can increase.

- No Fiat Trading (Direct): Historically, KuCoin did not support direct fiat currency deposits or trading pairs. In recent times, they have added P2P fiat marketplace and integration with third-party payment processors for credit card buys. But there are still no native USD or EUR order books; everything is crypto-to-crypto or stablecoin-based. This is part of them staying somewhat outside of strict financial regulations.

- Security: KuCoin had a significant hack in September 2020 where ~$280 million of crypto was stolen. However, they managed to recover a majority of funds through law enforcement and insurance, and fully reimbursed users. Since then, they stepped up security and required KYC for large withdrawals. They use multilayer encryption, custody with Onchain Custodian, and bug bounty programs. No major incidents since 2020.

Pros:

- Huge variety of coins – a top exchange for altcoin hunters, listing 700+ coins including many small-caps you won’t find on other major exchanges. Great for portfolio diversification into emerging projects.

- Low trading fees – 0.1% base fee and even lower (0.08%) with KCS pay. Also, lending and staking features allow users to earn interest, potentially offsetting trading costs.

- Advanced features – offers margin trading, futures, peer-to-peer lending, and a variety of earn options. It’s a versatile platform for experienced users who want more than basic trading.

- Privacy option (no mandatory KYC) – you can trade reasonably large amounts (up to 1 BTC withdrawal per day) without identity verification. For those who value privacy or come from regions with weaker KYC infrastructure, this is a big plus.

- Active community and token incentives – KCS bonus and other rewards give an extra reason to engage with the platform. The community vibe is strong, and KuCoin often implements user feedback and runs contests/giveaways.

Cons:

- Not licensed in many jurisdictions – KuCoin is essentially unregulated in the traditional sense; this means higher risk if you’re concerned about its legal status. It’s not available to U.S. users (officially) and could face crackdowns (e.g., in 2023 the NY Attorney General took action against KuCoin operating in New York illegally).

- Past security incident – the 2020 hack was a reminder that security is a concern. KuCoin did the right thing by covering losses, but users should still be cautious and possibly not treat KuCoin as a long-term storage solution (withdraw to personal wallets if not actively trading).

- No direct fiat deposits – although there are workarounds (P2P, etc.), you can’t link your bank to KuCoin for instant transfers. This can be less convenient for some users as an on-ramp.

- Customer support can lag – some users report slow response times or bot-like replies from support. During high volume times, support might be less responsive compared to more regulated exchanges with bigger support teams.

- Interface could overwhelm beginners – with so many coins and features, a new user might be confused or might be tempted into very risky altcoins without much guidance. KuCoin does have some learning resources, but it’s a lot to navigate for the uninitiated.

Gemini – Ultra-Secure U.S. Exchange with Emphasis on Compliance

Gemini is a U.S.-based cryptocurrency exchange founded in 2014 by the Winklevoss twins.

It brands itself around the principles of security, compliance, and a regulated approach to crypto. Gemini has often been the choice for institutions or individuals who want a safe, regulated platform even if that means fewer coins or slightly higher fees.

Operating under the oversight of the New York State Department of Financial Services (with a coveted BitLicense), Gemini has a strong compliance pedigree. Its motto is “crypto needs rules,” reflecting their philosophy of cooperating with regulators to build trust in crypto.

Gemini operates in the U.S. (all states) and over 60 countries globally, though it pulled back from certain regions like the UK in 2023 due to licensing issues (aiming to re-enter later).

Fees: Gemini has two fee structures: the simple interface (“Gemini Exchange” via web/app) and the active trader interface. If you use the simple buy/sell on the Gemini app or website, the fees are relatively high – there’s a convenience fee (~0.5% built into price) plus a flat transaction fee (ranging from $0.99 to 1.49% of the order depending on size). This is similar to Coinbase’s main consumer interface and can be steep for large purchases. However, Gemini’s ActiveTrader interface uses a maker-taker model with much lower fees. On ActiveTrader, if your 30-day volume is under $100k, you pay 0.20% maker / 0.40% taker.

Fees get lower as volume increases, going down to 0.0%/0.03% for makers/takers at the highest tier. So, an informed user can trade on Gemini fairly cheaply by sticking to ActiveTrader (which is just a setting you can enable on your account – it’s free to use).

Gemini does not have a native token for discounts; it instead occasionally offers promotions like fee-free trading for certain pairs or for new sign-ups.

Another aspect: Gemini has comparatively higher withdrawal fees for crypto; for example, withdrawing ETH or ERC-20 tokens costs a flat amount (which can be more expensive than the raw network fee at times). They did this to eventually move toward a model of “one free withdrawal a month” for active users.

On the fiat side, Gemini offers free bank transfers (ACH) and charges for wire transfers only when withdrawing ($25).

Overall, Gemini’s fee reputation is that it’s pricey for retail unless using ActiveTrader. Many beginners might not realize ActiveTrader exists, which is a downside. But for those who do, the fees are manageable though not the absolute lowest.

Supported Coins: Gemini takes a “quality over quantity” approach to listings. It supports around 100 cryptocurrencies. This includes all the major ones (Bitcoin, Ethereum, Litecoin, Bitcoin Cash, etc.), many DeFi tokens (like UNI, AAVE), some Metaverse and Layer1 tokens (MATIC, SOL, DOT, etc.), and even some popular meme coins like DOGE. But compared to an exchange like Binance, Gemini’s list is much smaller.

They are cautious and often late to list assets – for instance, Gemini was one of the last major exchanges to list SHIB (they did eventually). They also place an emphasis on regulatory compliance of assets; they avoid listing securities or tokens that might be deemed such by the SEC.

For users, this means Gemini might not scratch the itch if you’re looking for the newest altcoins or very low-cap gems. However, all coins on Gemini are ones with some established reputation or market standing.

Gemini also uniquely offers trading for Gemini Dollar (GUSD), its own regulated stablecoin, which is fully dollar-backed and audited (though GUSD’s adoption is modest compared to USDT/USDC).

One advantage of Gemini’s limited list: they ensure robust support and liquidity for what they list, and they integrate those assets into their other offerings (like custody, Earn, etc.). If a coin is not on Gemini, one might buy it elsewhere and transfer it to Gemini’s insured custody if they prefer Gemini’s storage security.

User Experience: Gemini’s interface is known for being clean and elegant. On the main app, it’s very straightforward to link your bank, deposit money, and buy crypto. The mobile app has a polished UI with clear portfolio tracking, recurring buy options, price alerts, etc. It’s often compared to Coinbase in terms of simplicity – which makes sense, both target mainstream users.

Gemini’s ActiveTrader interface (on web) provides a more advanced view with candlestick charts, depth charts, and order book, suited for traders. It’s fast and effective, though maybe not as customizable as Binance’s or Kraken’s pro UI.

One thing Gemini prides itself on is security features for users: you can enable hardware security keys for 2FA, whitelisting withdrawal addresses with a cooldown period, and review devices logged in. Gemini has a Security Center in the account settings to walk users through best practices. This focus on account security adds to user peace of mind. In terms of performance, Gemini had issues during the 2017 boom with downtime, but since then it scaled up infrastructure; it’s generally reliable now even in volatile times.

For support, Gemini offers email support and a comprehensive help center. They don’t have live chat support, which is a bit of a drawback, but given their smaller user base, support queries are handled in a reasonable time.

Another factor: Gemini has a strong focus on institutional customers as well – they offer a Gemini Custody service (regulated qualified custodian with insurance) and Gemini Clearing for off-exchange block trades.

While retail users might not use those directly, it means the platform’s backend is designed to high standards which indirectly benefits everyone (in terms of trust and stability). Lastly, Gemini has had some unique products like the Gemini Credit Card (a MasterCard that gives crypto rewards on purchases) which seamlessly ties into the exchange – users can spend dollars and get rewards in Bitcoin or any crypto on Gemini, deposited instantly after each purchase.

That kind of integration and commitment to compliance (the card is available in all 50 states) is a testament to their mainstream, regulated approach.

Additional Features:

- Gemini Earn: Launched in 2021, Gemini Earn allowed users to lend their crypto to approved borrowers through Gemini and receive interest. This was essentially Gemini’s yield product (similar to BlockFi or Celsius offerings, but branded with Gemini’s trust). However, in late 2022, with the collapse of Genesis (Gemini’s lending partner), Gemini Earn was paused and became the center of a high-profile dispute (the Gemini vs. DCG/Genesis case) – unfortunately, Earn users had funds frozen due to Genesis’s failure. As of late 2025, that issue is still resolving in court, and Gemini Earn for U.S. customers remains unavailable. This incident did tarnish Gemini’s image a bit, as many users expected Gemini to ensure their funds’ safety. Gemini has since pivoted to distance from third-party lending risk.

- Gemini Staking: In 2023, Gemini started offering on-chain staking (e.g., for ETH post-merge, allowing users to stake and earn protocol rewards). They had to navigate regulatory concerns (since staking-as-a-service was under SEC scrutiny after Kraken’s settlement), but Gemini aimed to comply by clearly differentiating staking rewards vs lending interest.

- NFT Marketplace (Nifty Gateway): Gemini acquired Nifty Gateway, an NFT platform, in 2019. Nifty Gateway became well-known in the NFT art boom of 2021, hosting drops from famous artists and musicians. It’s somewhat separate from Gemini exchange (different platform, but under Gemini’s umbrella). It allowed buying NFTs with credit cards, etc., bridging fiat and NFTs. The fate of Nifty Gateway by late 2025 saw the original founders leaving and Gemini possibly selling it, but it’s one of Gemini’s ventures beyond standard trading.

- Security/Compliance: Gemini’s core selling point. They undergo SOC 2 Type II security audits annually, store the majority of assets in cold storage with digital asset insurance, and even the hot wallet is insured (Gemini was the first exchange to have insurance on a hot wallet). They also have FDIC insurance on USD deposits up to $250k via partner banks. Gemini is very transparent about being compliant (they do routine bank audits for GUSD reserves, etc.). They also actively engage in policy discussions, trying to shape positive regulation.

- Global Expansion: Gemini has been expanding internationally. They launched Gemini UK in 2021 (with an EMI license and FCA registration), though they temporarily left the UK in 2023 due to new regulations but plan to return. In 2022, they launched in dozens of new countries and in 2023/2024 heavily focused on Asia-Pacific (they announced plans for a new engineering office and possibly an exchange out of India, as well as a license in Singapore). They also set up a separate Gemini Derivatives platform (Gemini Foundation) for non-US users to trade perpetual swaps (since they can’t offer that in the US). This shows Gemini’s attempt to broaden their feature set for international users while staying compliant where possible in the US.

Pros:

- Top-notch security and compliance – Gemini is arguably one of the most secure exchanges, with rigorous regulatory oversight (New York trust company) and a stellar security track record. Funds are held with strong protections and insured where possible. This makes it a trustworthy place to store and trade crypto for risk-averse users or institutions.

- User-friendly and elegant design – The Gemini app and website are simple and clear, suitable for beginners who might be intimidated by complex trading interfaces. It provides a smooth on-ramp for buying crypto with fiat.

- Institutional-grade services – Gemini’s custody, clearing, and OTC services, plus its SOC certifications, have made it a preferred platform for institutional investors dipping into crypto. Retail users indirectly benefit from this robust infrastructure and reputation.

- Innovative products like Gemini Card – Earning crypto rewards on everyday spending seamlessly integrates crypto into daily life. Gemini’s willingness to create such products shows its commitment to mainstreaming crypto.

- Global availability (in many countries) and strong USD support – as a U.S. exchange, it’s one of the best ways for Americans to get into crypto, and its GUSD stablecoin offers a regulated alternative for moving USD value on-chain.

Cons: