Meme Coins May Be Near a Contrarian Bottom as Traders Lose Faith, Santiment Says

A rebound in the struggling meme coin sector could arrive earlier than expected, even as the broader cryptocurrency market continues to face uncertain conditions.

According to a new report from crypto sentiment analytics firm Santiment, the current wave of pessimism surrounding meme coins may actually be a classic signal that a bottom is forming.

The platform noted that social chatter and trader commentary increasingly frame meme coins as a dead trend, a shift in tone that historically aligns with market capitulation. Santiment argues that when an entire sector is dismissed by the crowd, it often becomes a point of interest for contrarian investors.

The firm described the prevailing narrative as one of “nostalgia,” with traders looking back on past meme coin rallies as if they were part of a bygone era. However, such sentiment, according to Santiment, tends to emerge near market bottoms rather than at the start of prolonged declines.

Meme Coin Market Shrinks Amid Broader Downturn

The data shows the meme coin sector has taken a heavy hit over the past month. The total market capitalization across meme-themed tokens has dropped more than 34% to about $31 billion, reflecting a broader downturn across digital assets.

Bitcoin’s recent weakness has contributed to the negative sentiment. The largest cryptocurrency briefly slipped toward $60,000 in early February, marking its lowest level since October 2024.

That decline reduced risk appetite across the market, particularly for speculative sectors like meme coins.

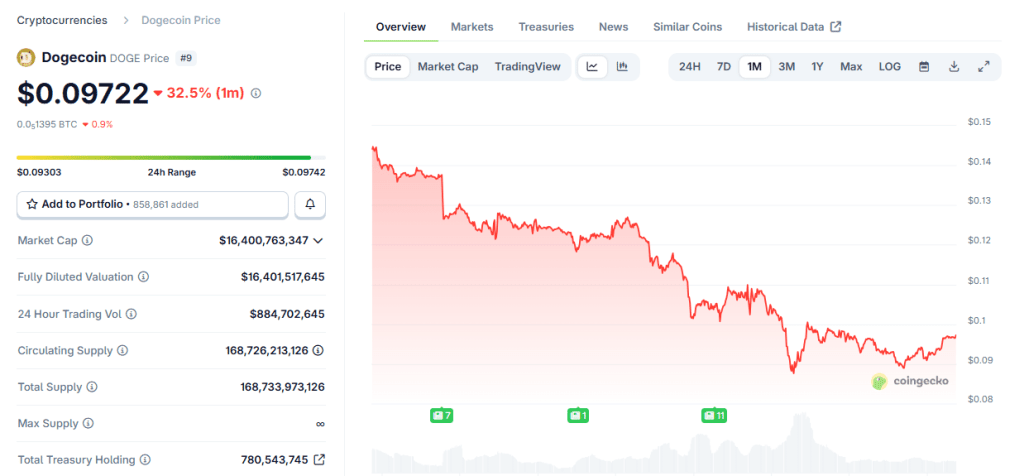

Dogecoin, the most established asset in the category, has followed the trend. Its price has fallen roughly 32% over the past 30 days, highlighting how sharply the segment has cooled after previous surges.

DOGE’s price over the past month (Source: CoinGecko)

Short-term performance data also points to muted momentum.

Among the top 100 cryptocurrencies, most meme coins recorded only modest gains over the past week. One notable outlier was the token Pippin, which surged more than 240% during the period. By comparison, Official Trump rose just over 1%, while Shiba Inu posted a similarly small increase.

Changing Dynamics in Crypto Market Cycles

In previous bull runs, the crypto market often followed a predictable rotation pattern.

Bitcoin would lead the rally and set new highs, after which capital would flow into Ethereum. As confidence grew, investors typically moved further down the risk curve into smaller altcoins and eventually meme coins.

Some analysts now question whether that sequence will unfold the same way in the current cycle. As Bitcoin matures and attracts more institutional participation, its market behavior may differ from earlier years. The presence of large financial players and spot exchange-traded funds could reshape how capital moves across the ecosystem.

This shift has led to growing speculation that the next altcoin season may be far more selective than previous ones. Instead of widespread gains across nearly every token, analysts suggest that only certain projects may benefit from renewed capital inflows.

Craig Cobb, founder of trading education platform The Grow Me, previously said that the next altcoin cycle may not resemble the broad rallies of the past. Rather than a scenario where a “rising tide raises all ships,” he expects more targeted gains.

Bearish Sentiment Could Signal a Turning Point

Santiment’s report also highlighted the tone of online discussions, which currently lean heavily bearish. According to the firm, negative commentary significantly outweighs bullish sentiment across social media platforms.

While that might appear discouraging on the surface, the platform views it as a potentially constructive sign. Markets have historically moved in the opposite direction of prevailing expectations, particularly when pessimism becomes widespread.

Santiment suggested that this lingering disbelief—even during short-term price recoveries—could indicate the early stages of a broader rebound.

For now, meme coins remain under pressure as the wider crypto market searches for direction. But if past sentiment-driven cycles repeat, the current environment of skepticism could eventually give way to another unexpected surge in the sector.