‘Takaichi Effect’ Sends Stocks, Crypto, and Gold Higher Worldwide

Monday’s global trading session opened with a historic roar as Japan’s Nikkei 225 shattered records, soaring past the 57,000 mark in a powerful rally dubbed the “Takaichi Trade.”

Following Prime Minister Sanae Takaichi’s landslide general election victory and her promise of a massive $135 billion stimulus package, investor euphoria has spilled over into global markets.

From gold hitting unprecedented heights to the Dow Jones eyeing its next major milestone, the “Takaichi effect” is redefining risk appetite and setting a high-octane tone for the global economy in 2026.

Nikkei 225 price (Source: Google Finance)

Since achieving the milestone, the Nikkei 225 price has retraced to trade below 57,000 at the time of writing.

Stimulus Plan Fuels Investor Optimism

The Nikkei 225 jumped 3.4% to a record 57,000, driven by expectations surrounding Takaichi’s expansionary fiscal agenda.

The plan includes a $135 billion stimulus package focused on infrastructure spending and tax cuts. Investors view the proposal as a potential catalyst for long-awaited growth in Japan’s sluggish economy, helping to explain the strong rally in domestic equities.

Safe-Haven Assets Also Surge

Market reactions extended beyond equities.

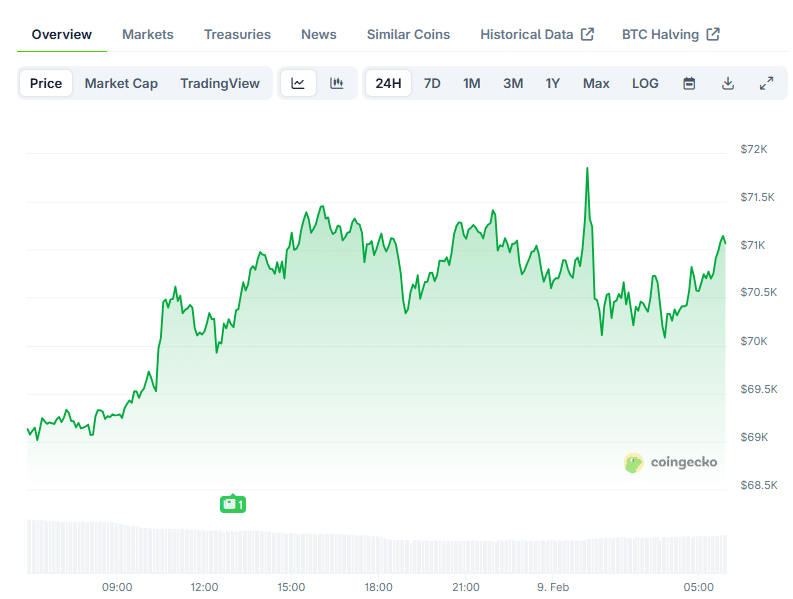

Gold climbed past the $5,000 per ounce mark, while Bitcoin briefly reached $72,000 before settling back above $70,000 during Asia’s morning trading session.

BTC price (Source: CoinGecko)

Both assets are often treated as safe havens during periods of heightened market uncertainty, and their gains reflected the broader shift in global sentiment.

U.S. Markets Join the Takaichi Rally

In the United States, stock futures opened higher, signaling a positive start to the trading day.

The Dow Jones Industrial Average has already crossed the 50,000 level for the first time and is now being discussed in the context of a possible run toward 100,000 before the end of President Donald Trump’s term.

Trump congratulated Prime Minister Takaichi on her victory, suggesting it could support global markets. U.S. Treasury Secretary Scott Bessent echoed the sentiment, praising Japan’s commitment to fiscal stimulus.

Their endorsements added to investor confidence and helped sustain the global rally.

Risk Appetite Returns to Global Markets

The “Takaichi Trade” has shown a renewed willingness among investors to take on risk in pursuit of higher returns.

The shift in sentiment could have wide-ranging implications as capital flows into equities and alternative assets in response to changing economic conditions.

As markets digest the election results and policy outlook, attention is turning to the sustainability of the rally.

Takaichi’s victory has clearly triggered a powerful global reaction, but investors are now asking whether the momentum can continue or if a correction lies ahead. For the moment, markets appear to be riding high on the wave of Japan’s new political mandate.