Strategy Shares Sink 9% as Bitcoin Comes Within $10K of Average Buy Price

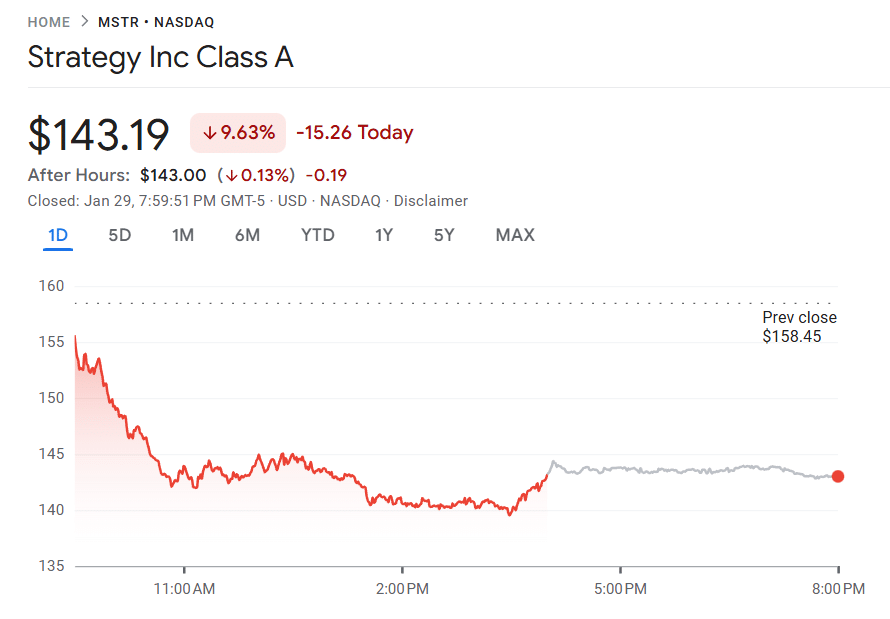

Shares of Strategy dropped more than 9% over the past 24 hours as a sharp decline in Bitcoin’s price rattled investor confidence in the world’s largest corporate holder of the digital asset.

Strategy share price (Source: Google Finance)

The selloff comes as Bitcoin fell roughly 6% over the same period, sliding to around $82,300 and triggering broader weakness across crypto-linked equities.

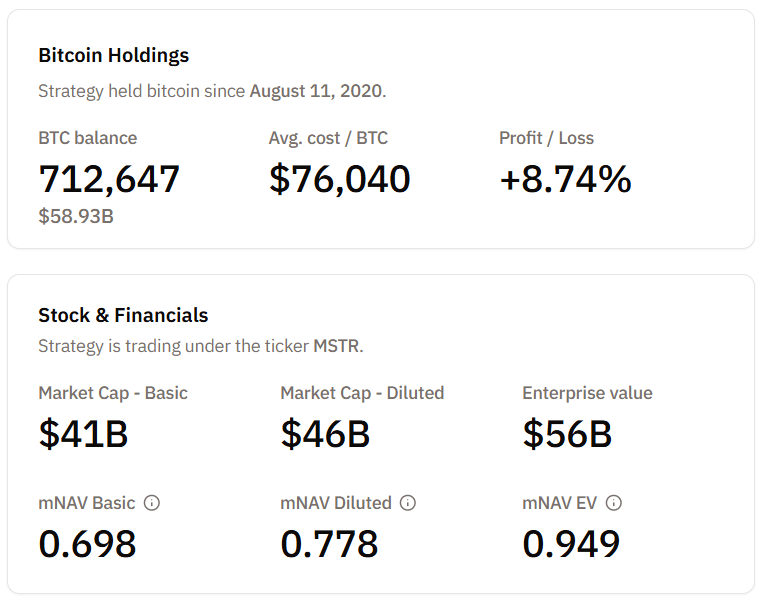

The decline pushed Bitcoin to less than $10K from Strategy’s average purchase price of $76,038 for its massive treasury accumulation program, raising concerns about the company’s valuation premium and risk exposure.

Bitcoin Weakness Drives Equity Pressure

Recent market data shows Bitcoin dipping toward the low-$80,000 range amid heavy liquidations and leveraged position unwinds across crypto markets.

Strategy has historically traded as a high-beta proxy for Bitcoin exposure give its massive holdings, meaning its stock often moves more aggressively than the underlying asset.

The latest drop reflects that relationship, with equity investors reacting quickly to the narrowing gap between market price and corporate acquisition cost.

Massive Bitcoin Holdings Amplify Risk and Reward

Strategy remains by far the largest public corporate Bitcoin holder. The firm currently controls more than 712,000 BTC accumulated since it adopted Bitcoin as its primary treasury reserve asset in 2020.

Strategy’s BTC holdings (Source: Bitcoin Treasuries)

At current Bitcoin levels near $82,000, the company remains in aggregate unrealized profit territory, but the margin has narrowed significantly compared to when Bitcoin traded above $90,000 earlier in the year.

Equity Premium Faces Renewed Scrutiny

Strategy’s business model is heavily dependent on maintaining investor willingness to treat the stock as a leveraged Bitcoin vehicle. The firm has repeatedly used equity and preferred share issuances to fund additional Bitcoin purchases, increasing its exposure to the asset over time.

Historically, the company has traded at a premium to the net asset value of its Bitcoin holdings, reflecting both speculative demand and expectations of long-term Bitcoin appreciation. However, when Bitcoin weakens, that premium often compresses rapidly, accelerating stock declines.

The company has continued accumulating Bitcoin even during market pullbacks, including multi-hundred-million-dollar purchases earlier this year that pushed total holdings past 712,000 BTC.

Market Context Adds to Volatility

The latest move also comes amid broader volatility in crypto markets, with leveraged positions unwinding rapidly and billions in market value erased during short periods of heavy selling pressure.

While Strategy still holds one of the most profitable long-term Bitcoin corporate treasury positions, the shrinking buffer between market price and acquisition cost has become a key short-term sentiment driver.

For now, Strategy’s share performance appears tightly linked to Bitcoin’s ability to stabilize above major psychological price levels. If Bitcoin rebounds, Strategy shares have historically amplified upside moves. Conversely, continued downside pressure in Bitcoin could translate into disproportionate equity volatility.

The latest 9% share drop shows how closely corporate treasury strategies tied to Bitcoin remain linked to real-time crypto market dynamics, reinforcing Strategy’s position as both one of the biggest winners and most sensitive proxies in the digital asset equity landscape.