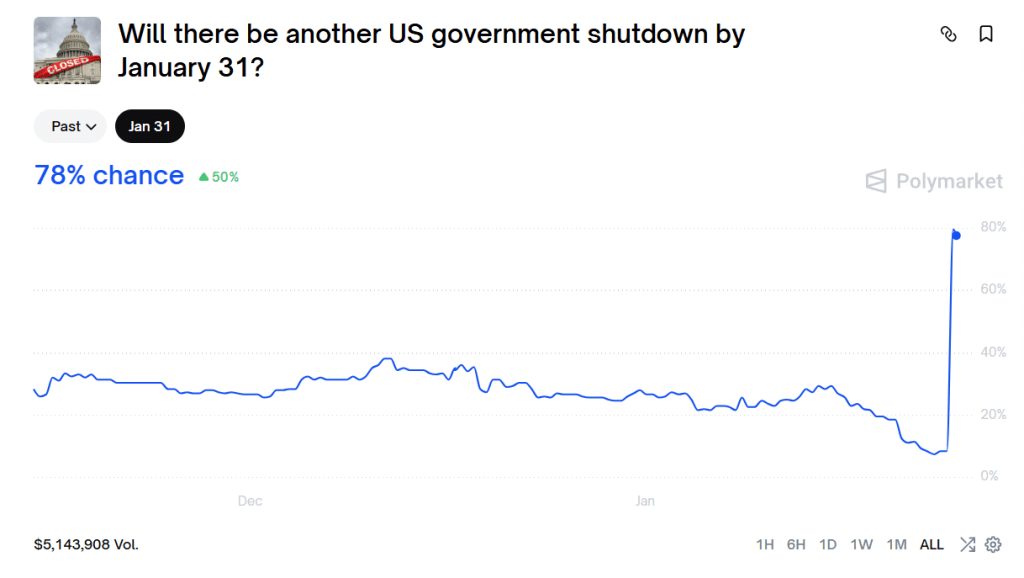

Polymarket Now Predicts 78% Chance of U.S. Shutdown — Crypto Bill Timeline at Risk

Polymarket bettors are rapidly pricing in the risk of fresh political turbulence in Washington, pushing the probability of another U.S. government shutdown to 78% before the end of January—a dramatic 50% surge in just 24 hours.

Contract asking if there will be another U.S. government shutdown (Source: Polymarket)

The spike comes amid mounting tensions on Capitol Hill as lawmakers clash over budget priorities, reigniting fears of legislative paralysis that could once again derail key policy debates, including the high-stakes CLARITY Act crypto bill.

The market shift was first highlighted on Saturday by political commentator Collin Rugg, who shared the soaring odds shortly after a new standoff emerged in the Senate.

In a statement, Senate Majority Leader Chuck Schumer warned that Senate Democrats would not “provide the votes to proceed” on the upcoming appropriations package if it includes funding for the Department of Homeland Security (DHS)—a line in the sand that immediately rattled markets.

“What’s happening in Minnesota is appalling—and unacceptable in any American city,” Schumer said, referencing national outrage after federal agents reportedly shot a 37-year-old man in Minneapolis on Saturday morning. He later added that the DHS funding bill is “woefully inadequate to rein in the abuses of ICE. I will vote no.”

The renewed shutdown fears arrive just two months after the record 43-day government shutdown in October and November, which stalled legislative work across the board. This included the CLARITY Act, a landmark crypto regulatory package that aims to clarify federal oversight of digital assets.

Lawmakers and industry participants have blamed the earlier shutdown for pushing the bill’s schedule into 2026, and a second disruption could deepen the uncertainty.

Trump Suggests Another Shutdown Is Possible

President Donald Trump added fuel to the fire this week, refusing to rule out a future shutdown during a Fox Business interview on Thursday.

“I think we’re probably going to end up in another Democrat shutdown,” he said, arguing that negotiations over border security and DHS are headed toward a stalemate.

The comment, combined with Schumer’s refusal to back the current appropriations bill, aligns with Polymarket’s sudden repricing—suggesting traders anticipate a rapid deterioration in bipartisan cooperation.

CLARITY Act Timeline Now Even Harder to Predict

The rising risk of a shutdown complicates an already delicate phase for the CLARITY Act, which has faced growing pushback from the crypto sector in recent weeks. The latest draft of the bill—once heralded as a major step toward regulatory clarity—has triggered concerns among industry leaders who argue the current language could worsen the status quo.

“This version would be materially worse than the current status quo. We’d rather have no bill than a bad bill,” Coinbase CEO Brian Armstrong wrote in a Jan. 15 post announcing the withdrawal of support. “Hopefully we can all get to a better draft.”

His comments reflect a broader shift within the crypto industry, which had initially hoped the CLARITY Act would provide much-needed certainty on stablecoins, asset classifications, and federal licensing.

Adding to the concerns, Galaxy Digital head of research Alex Thorn issued a report Thursday warning that core disagreements—particularly over stablecoin yields and bank sector competition—remain unresolved.

The U.S. banking lobby has argued that allowing stablecoin issuers to offer interest-bearing products would place traditional banks at a structural disadvantage, creating a political impasse that lawmakers have so far been unable to bridge.

“There aren’t yet any significant indications that the two sides have identified a compromise that can rejuvenate the bill’s prospects,” Thorn wrote. He added that the anticipated 4–6 week delay before another markup attempt may give negotiators time to rework key sections, but emphasized that progress hinges on resolving disputes around stablecoin rewards.

One of the “big questions,” Thorn noted, is whether the gridlocked negotiations over stablecoin rewards can advance far enough in the coming weeks to boost the odds of a bipartisan breakthrough.

With Washington once again flirting with a shutdown—and Polymarket signaling traders are preparing for the worst—the CLARITY Act’s roadmap has rarely looked more uncertain. The next several weeks will determine whether Congress can stabilize negotiations or whether the crypto industry must brace for another round of delays and policy drift.