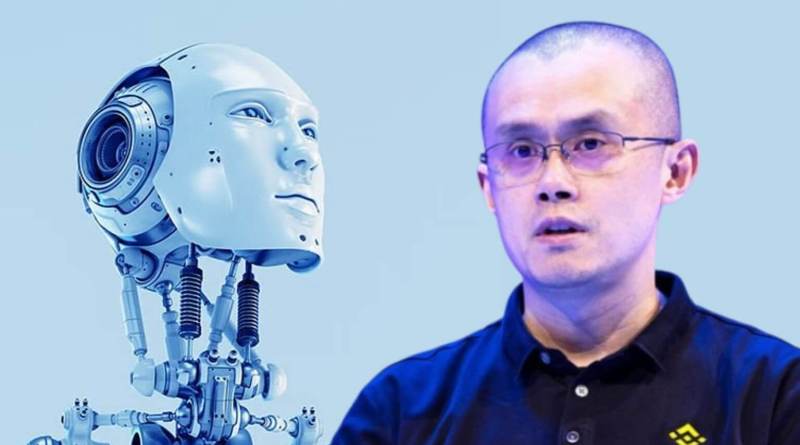

CZ Says AI Will “Make You Jobless” — But Crypto Could Help You Retire Sooner

Binance co-founder Changpeng “CZ” Zhao sparked intense debate after declaring that artificial intelligence will eliminate traditional employment, while crypto will give people a path to financial freedom.

The comments, posted on X, arrive as world leaders gather in Davos to discuss the accelerating, and unavoidable, restructuring of the global workforce driven by AI.

“AI will make you jobless. Crypto will make you not need a job,” CZ wrote. He added a familiar refrain to crypto believers—“Buy and hold now, retire in a few years”—before qualifying the post with a standard disclaimer: “Not financial advice.”

CZ’s message landed at a moment when the World Economic Forum (WEF) is warning that AI’s impact on work has moved far beyond incremental productivity gains. Instead, global companies are rebuilding workflows, reshaping management structures, and redefining what a “career” even looks like.

AI Is Reshaping Work Faster Than Expected

Three years after generative AI went mainstream, it is no longer viewed as a tool layered onto existing processes. According to the WEF’s new report, companies are now redesigning entire systems around AI.

In sectors ranging from finance to healthcare, AI-driven processes are cutting costs, compressing timelines, and displacing or reshaping traditional roles. One example cited in the report described AI systems compressing weeks of tax and regulatory analysis into days, delivering $120 million in savings.

In healthcare, automated ordering systems have reduced tasks that once took half an hour to mere seconds, freeing up tens of thousands of work hours annually.

The takeaway, according to WEF researchers, is that these early operational wins only hint at a deeper structural shift: organisations are beginning to function with AI embedded at their core, with human roles reorganised around it.

Careers Are Flattening—and Pressure Is Rising

Contrary to fears that AI will primarily erase entry-level jobs, the WEF suggests mid-level employees could face sharper disruption.

AI copilots allow junior workers to handle complex tasks far earlier in their careers, accelerating progression and flattening hierarchies.

Some companies are already preparing for a future where AI agents sit alongside humans on organisational charts, with defined responsibilities and performance expectations. This emerging hybrid model is blurring the lines between human expertise and machine capability—and challenging employers to rethink how they develop leadership and experience.

CZ’s claim that AI will “make you jobless” echoes this trend, but he frames it through a crypto-native lens: if traditional employment becomes less secure, digital assets may form a parallel path to long-term wealth.

Crypto as a Path to Independence?

CZ’s suggestion that crypto could make traditional jobs unnecessary reflects a long-running narrative within the digital-asset community—that decentralised finance enables individuals to build wealth outside conventional economic structures.

The timing of his comments is notable. Crypto markets have surged in recent years as institutional adoption, tokenization, and real-world asset integration accelerate.

For early adopters who held through market cycles, long-term gains have indeed reshaped personal financial trajectories. CZ’s post even invited those who had already “retired” from crypto profits to raise a hand.

Still, his message stands in stark contrast to the more cautious tone in Davos, where leaders emphasise responsible AI adoption, digital-skills investment, and inclusive access to new AI-native roles—not speculative asset accumulation—as the foundation for economic resilience.

Skills, Trust and Inclusion Remain Central

At WEF 2026, 25 global companies—including Cisco, Wipro and ServiceNow—committed to expanding AI access and equipping workers with digital and human skills. The coalition aims to reach 120 million people by 2030 through affordable AI tools, skills-based hiring pathways and community-driven training.

Alongside the economic promise of AI, the Forum stressed that trust and transparency remain essential—particularly as companies adopt AI in regulated sectors like banking and healthcare. Systems must be explainable, auditable and accountable if they are to scale safely.

A Converging Future for AI and Crypto

CZ’s comment captures a sentiment shared by many in the crypto industry: AI will disrupt traditional employment, while blockchain technologies—through ownership, automation and decentralised finance—may redefine how individuals earn, save and accumulate wealth.

But the WEF offers a more nuanced view of this transition: AI’s influence on work is permanent, and the challenge now is shaping a human-machine ecosystem that broadens opportunity rather than leaving workers behind.

Whether crypto becomes the safety net CZ suggests—or simply one component of a rapidly evolving economic landscape—remains a defining question for the years ahead.