“Thinking About Buying More Bitcoin”: Saylor’s Hint Sends Speculation Surging

Bitcoin’s slide below $90,000 this week has introduced a moment of consolidation in the market, but it has done little to dampen enthusiasm from the asset’s most prolific corporate accumulator.

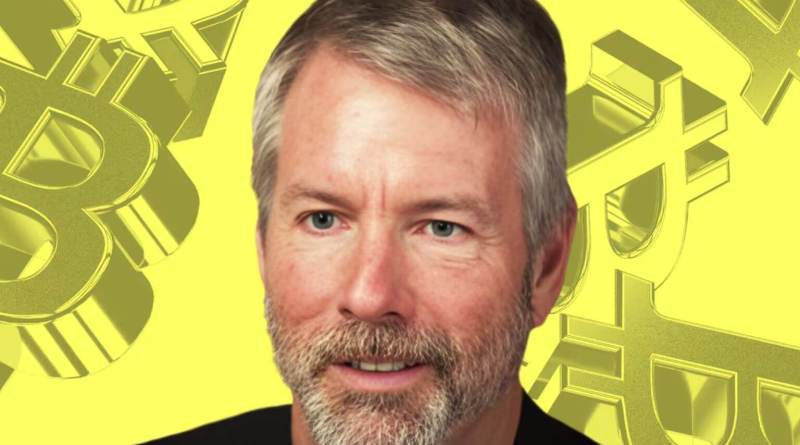

Trading just above $89,000 on Thursday, BTC is still recovering from its recent plunge, yet Strategy (MSTR) Executive Chairman Michael Saylor used the moment to reinforce his long-standing conviction.

In a brief but charged post on X, Saylor wrote: “Thinking about buying more bitcoin.”

The message, though simple, landed at an interesting moment.

Saylor’s posts have long been used as signals for imminent acquisitions, often with his trademark orange-dot emojis appearing over weekends before Monday announcements.

A mid-week hint is less common and has sparked discussion about whether Strategy may be preparing another near-term purchase, or simply reminding markets of its unbroken accumulation thesis.

Strategy Continues Its Aggressive Accumulation

Even without the tease, Strategy’s recent behavior makes the direction of travel clear.

The company has added Bitcoin at an unprecedented pace, often announcing purchases on a near-weekly cycle.

Over the past two weeks alone, Strategy has spent roughly $3.4 billion acquiring additional BTC, funded through a blend of common stock issuances and preferred share offerings.

Those financing moves, once seen as unconventional for a software company, have become strategic pillars for Saylor’s transformation of Strategy into a Bitcoin-focused treasury and technology hybrid.

The firm’s total holdings reached 709,715 BTC as of Monday — a stash now valued at more than $60 billion at current market prices.

Strategy’s BTC holdings (Source: Bitcoin Treasuries)

With that figure, Strategy controls over 3.3% of Bitcoin’s eventual fixed supply, maintaining its dominance as the world’s largest corporate BTC holder.

Saylor has repeatedly framed BTC as the superior long-term treasury reserve asset, arguing that its finite supply, decentralization, and resistance to monetary dilution make it preferable to traditional holdings like cash or government bonds.

Market Reaction Remains More Measured

While Saylor’s conviction appears unwavering, the market’s response was more muted.

MSTR shares slipped 1.4% during Thursday’s trading session, tracking Bitcoin’s broader softness. BTC itself has been unable to reclaim the $90,000 threshold since the mid-week correction, which followed months of strong momentum fueled by institutional inflows, broader macro confidence, and post-halving supply dynamics.

Despite these short-term fluctuations, Strategy’s underlying strategy has remained consistent across market cycles. Whether BTC dips, rises, or consolidates, Saylor has treated nearly every phase of the market as a buying opportunity — a philosophy that has defined the company’s financial evolution since it first added BTC to its treasury in 2020.

What Comes Next for Strategy and Bitcoin

Saylor’s latest post may be only a few words, but it signals that Strategy’s accumulation phase is far from over. The timing, tone, and market backdrop suggest the possibility of another purchase announcement in the coming days, though no official filing has yet been released.

With Bitcoin hovering near $89,000, attention now turns to whether Strategy will seize the moment and tighten its grip on the asset’s limited supply once again. For now, the message is unmistakable: volatility has never slowed Strategy’s buying — and this week’s consolidation appears unlikely to break that pattern.