ARK Invest Predicts a $22 Trillion Crypto and Tokenization Boom by 2030

ARK Invest’s newly released Big Ideas 2026 report outlines one of its most expansive visions yet for the future of digital assets, forecasting a financial system that increasingly migrates onto public blockchains by the end of the decade.

The research firm projects that the combined market value of tokenized assets and crypto networks could exceed $22 trillion by 2030, driven by rapid institutional adoption, regulatory clarity, and the maturation of blockchain infrastructure.

While ARK has long been optimistic about the role of crypto in global markets, this year’s outlook frames tokenization not as a niche innovation but as a foundational shift in how financial instruments are issued, owned, settled, and exchanged.

The breadth of the report reflects a macro view that digital assets are transitioning from speculative instruments to core components of global financial plumbing.

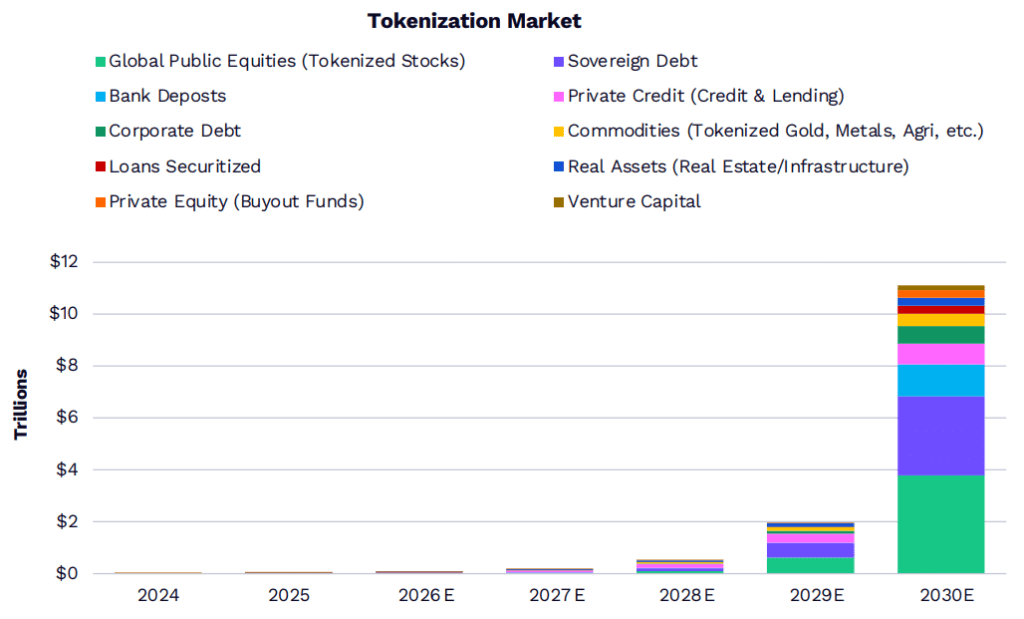

Tokenization Could Surpass $10–12 Trillion by 2030

The most striking section of the report is its forecast for global tokenized assets, a category that includes tokenized U.S. Treasuries, corporate debt, public equities, commodities, real estate, private credit, private equity, and venture capital.

A bar-stacked forecast chart in the report shows the total tokenized market reaching into the low-teen trillions by 2030, with multiple asset categories contributing to growth.

Predicted tokenization market growth (Source: ARK Invest)

That marks a dramatic leap from today’s totals. At the end of 2025, the market value of tokenized real-world assets stood at just under $19 billion, having tripled over the year thanks to U.S. Treasury tokens, tokenized gold products, and institutional pilot programs.

Although early growth has been concentrated in a handful of categories, such as BlackRock’s $1.7 billion BUIDL fund and gold-backed tokens like XAUT and PAXG, ARK believes the addressable market runs far deeper.

The firm highlighted the enormous off-chain value in traditional finance, estimating that most global asset classes remain “untapped” from an on-chain perspective and represent the largest growth opportunity for blockchain adoption.

Regulatory Clarity Spurs Institutional Participation

ARK Invest attributed a significant portion of expected growth to the increasing clarity surrounding tokenization and stablecoin regulations. The report specifically cites the GENIUS Act, which is a pivotal piece of legislation that has accelerated institutional activity and opened the gates for banks, fintechs, and asset managers to build their own blockchain infrastructure.

A timeline chart in the tokenization section shows a wave of announcements during 2025, including:

- Circle launching its own Layer-1 network, Arc

- Stripe unveiling Tempo, a stablecoin-focused Layer-1

- SWIFT integrating a blockchain-based ledger

- Tether-backed Plasma chain going live

- Multiple stablecoin issuers receiving conditional banking charters

Timeline of events (Source: ARK Invest)

The momentum, ARK argued, reduces uncertainty, lowers operational risk, and gives institutional players the confidence to scale tokenized offerings.

“Thanks to the regulatory clarity associated with the GENIUS Act, stablecoin activity surged to record highs,” the report notes — a tailwind that also benefits tokenization platforms, settlement layers, and asset-issuance frameworks.

A $22 Trillion Crypto Market by 2030

In parallel to the tokenized asset outlook, ARK Invest lays out updated projections for the crypto market itself, which it expects to grow at an unprecedented rate over the next five years.

Bitcoin: ~$16 trillion by 2030

ARK predicts that Bitcoin will remain the dominant digital asset and could reach a market capitalization of roughly $16 trillion by 2030, up from just under $2 trillion today.

That implies a compound annual growth rate of about 63%, driven by demand from:

- Institutional portfolios

- Nation-state reserves

- Corporate treasuries

- Emerging-market store-of-value use cases

- On-chain financial applications that utilize BTC as collateral

Smart Contract Platforms: ~$6 trillion by 2030

Ethereum, Solana, and other smart contract networks are projected to reach a combined valuation of roughly $6 trillion by the end of the decade.

Despite high revenue growth across decentralized applications, ARK believes that the majority of value accrual for those networks will come from monetary premium — their role as reserve assets and settlement layers — rather than simple fee-based cash flows. The report argued that two or three Layer-1 ecosystems will ultimately dominate.

When combined, ARK’s projections for Bitcoin and smart contract platforms imply a $22 trillion crypto market. This is more than 10× today’s size.

Tokenization and Crypto: Two Sides of the Same Transformation

One of ARK’s core arguments is that tokenization and crypto market growth reinforce each other. As more traditional assets migrate on-chain, demand for blockchain infrastructure increases. This boosts the monetary premium, liquidity, and global recognition of major networks like Bitcoin, Ethereum, and Solana.

The firm noted that Ethereum already hosts more than $400 billion in on-chain assets, a figure likely to multiply as tokenized stocks, bonds, and real-estate instruments expand.

Meanwhile, stablecoin activity — which hit a trailing 30-day average of $3.5 trillion in monthly adjusted volume in December 2025 — is now surpassing traditional payment networks and acting as the primary medium for transmitting value between tokenized assets.

The growth of both stablecoins and tokenized assets strengthens the broader argument for a unified, blockchain-native financial system.

What Drives Tokenization Toward the Trillions?

ARK’s framework suggests five structural drivers:

1. Institutional Migration to On-Chain Markets

Banks, brokers, and asset managers are launching their own L1 and L2 networks — an unprecedented development that signals a shift from experimentation to production-grade deployment.

2. Real-world Demand for Faster Settlement and Greater Transparency

Tokenized assets can settle instantly, reduce counterparty risk, and offer 24/7 transferability — advantages that traditional systems cannot match.

3. Regulatory Green Lights Enable Scaling

Legislation like the GENIUS Act establishes a clear operating framework for stablecoins and tokenized financial instruments, enabling institutions to scale with confidence.

4. On-Chain Liquidity Deepens with Stablecoins

Stablecoins have become the largest source of liquidity and settlement volume across major blockchains — supporting not only crypto trading but tokenized treasury markets and on-chain lending.

5. Network Effects of Public Blockchains

Each additional tokenized asset or application increases the utility of blockchain settlement, accelerating adoption across adjacent asset classes.

Toward a Blockchain-Native Global Capital Market

ARK Invest’s thesis points to an overarching transformation: the convergence of traditional finance and decentralized financial infrastructure. By 2030, the firm envisions a world where:

- Tokenized public and private markets operate at multi-trillion-dollar scale

- Stablecoins rival major payment networks

- Institutions run their own blockchain networks

- Bitcoin becomes a global macro asset

- Smart contract platforms serve as the base layer for tokenized financial instruments

The report underscored that forecasts are uncertain and past performance is no guarantee of future results — but it frames the crypto and tokenization trajectory as a structural, not cyclical, shift.

If ARK’s outlook materializes, the financial system of 2030 will not simply integrate blockchain technology — it will depend on it.