Big Investors Shift From Arbitrage to Bullish Bitcoin Bets

In the cryptocurrency market, a shift is underway as large institutional investors increasingly pile into bullish bets while reducing their positions in arbitrage strategies, according to recent data from SoSoValue.

That trend is signified by a net inflow of $1.2 billion into U.S.-listed Bitcoin Exchange-Traded Funds (ETFs) so far this month, marking a reversal from the December redemptions.

A Bullish Signal Emerges

While the overall inflow number is positive, a closer examination of the data reveals a more significant shift—large investors are ditching their traditional arbitrage plays and are increasingly betting on a long-term price upswing.

The usual strategy employed by these large investors, commonly known as “Cash-and-Carry” arbitrage, aimed to profit from the pricing mismatch between spot and futures markets. However, recent ETF inflows suggest that traders are now seeking increasingly directional bullish bets. This shift is indicative of a changing market landscape, with potential bullish implications for Bitcoin.

Traditionally, investors used that strategy by purchasing spot Bitcoin ETFs while shorting Bitcoin futures. The goal was not to predict an increase in the price of BTC; it was simply about pocketing the small price difference between the two contracts.

With the pricing gap between the present and future now shrinking, and costs of funding such trades escalating, this strategy has lost its appeal.

Shift Toward Long-Term Investments

Despite diminishing returns on traditional Bitcoin arbitrage strategies, investors’ interest in exposure to BTC still remains strong. Consequently, they have opted to ditch sophisticated trades and invest directly in the cryptocurrency for its potential long-term price rally.

While U.S.-listed spot ETFs have seen a net inflow of $1.2 billion, the total number of open or active standard and micro Bitcoin futures contracts on the Chicago Mercantile Exchange (CME) has surged by 33% to 55,947 contracts.

However, the recent ETF inflows seem unlikely to be associated with carry trades, as the “basis”—the price gap between CME futures and spot ETFs—has narrowed to levels that barely cover transaction costs and funding expenses.

Bitcoin’s Low Volatility

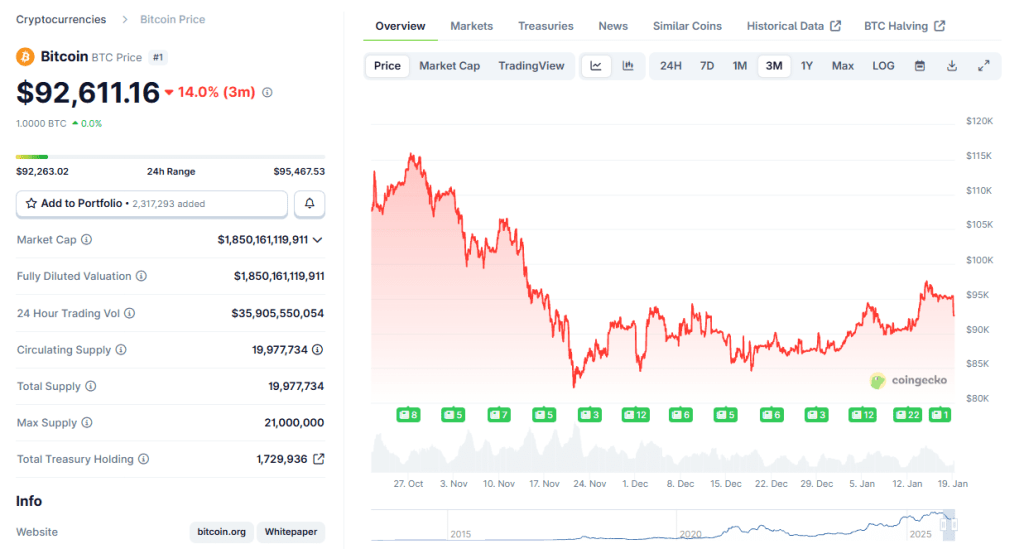

One factor contributing to reduced arbitrage opportunities is the low volatility experienced by Bitcoin since its sharp decline from its all-time high in October 2021. The price of BTC has shown relative stability, trading within a narrow range around $90,000.

BTC price performance over the past 3 months (Source: CoinGecko)

Consequently, that low volatility environment reduces the likelihood of price mismatch between spot and futures markets, and it makes the “Cash-and-Carry” trade less profitable.

Bitcoin’s annualized 30-day implied volatility, as represented by Volmex’s BVIV index, has fallen to 40%. This signifies a three-month low in market expectations for price swings, according to analysts at cryptocurrency exchange Bitfinex.

‘Sticky’ Investors and Increased Speculation

The shift in market behavior marks a significant change in Bitcoin’s investment landscape, with large institutional investors gradually increasing their long-term bullish exposure to the digital asset.

Analysts at Bitfinex have referred to these new investors as “sticky” because they are not focused on short-term profits based on price gaps but instead view Bitcoin as a long-term investment due to reduced volatility.

Exploring Arising Opportunities

The question then turns to who exactly are these “sticky” investors betting on upside, rather than engaging in arbitrage strategies?

The answer lies in the data relating to short positions in CME-listed Bitcoin futures. As open interest increases, it is evident that it has grown due to speculators betting on a bullish outcome rather than hedging with shorts—implying an overall escalation of bullish exposure.