Schiff Warns of ‘Huge Sucker’s Rally’ as Bitcoin Hits $97K Before Retracing

The cryptocurrency market faced a sharp reality check on Thursday after prominent gold bug and perennial Bitcoin skeptic Peter Schiff took to social media to blast the latest price action.

Schiff labeled the recent surge to $97,000 a “huge sucker’s rally,” warning investors that the rotation out of traditional safe havens and into digital assets is a strategic blunder.

The “Sucker’s Rally” Narrative

In a post on X that quickly went viral across trading circles, the Chief Economist and Global Strategist at Euro Pacific Asset Management suggested that the momentum driving Bitcoin is being fueled by a misguided exodus from precious metals.

“My guess is that some traders are taking profits in gold and silver mining stocks and buying Bitcoin ETFs and $MSTR,” Schiff wrote.

“That’s a big mistake, and savvy traders should take advantage by buying mining stocks and selling Bitcoin and MSTR.”

Schiff’s comments come at a time of heightened volatility for the “digital gold” narrative. While Bitcoin has historically been viewed as a hedge against inflation, Schiff remains a staunch proponent of physical bullion, arguing that the current inflow into crypto is a temporary mania rather than a structural shift in global finance.

Bitcoin’s Volatile 24 Hours

The market backdrop for Schiff’s critique was a rollercoaster session for the world’s largest cryptocurrency. Over the last 24 hours, Bitcoin staged an aggressive rally that saw it pierce through the $97,000 resistance level, fueled by a wave of institutional optimism.

However, the euphoria was short-lived as the asset faced a sharp correction, retracing to trade at approximately $96,200 at the time of writing.

BTC price (Source: CoinGecko)

Despite the intraday pullback, the underlying demand remains significant. Farside Investor data for the last three trading days shows that Spot Bitcoin ETFs in the United States have seen a staggering $1 billion in net inflows.

That massive liquidity injection suggests that while Schiff may be bearish, Wall Street’s appetite for regulated crypto exposure shows no signs of waning.

Strategy: A High-Beta Proxy

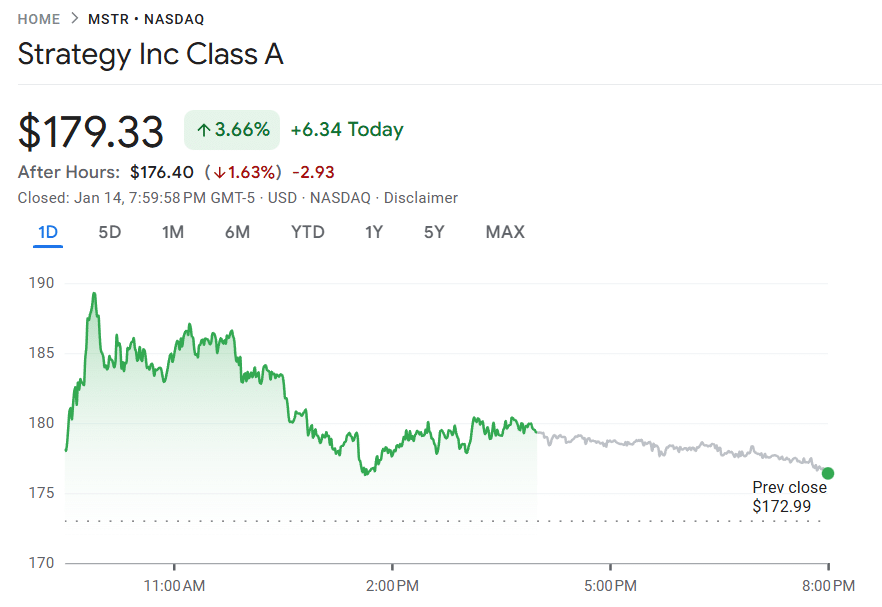

The volatility extended to Strategy (MSTR), the software firm turned Bitcoin treasury giant.

Often traded as a high-beta proxy for the coin itself, MSTR saw its stock price jump over 3% during the latest regular trading session as Bitcoin broke the $97,000 mark.

MSTR price (Source: Google Finance)

The gains, however, proved fragile. In the after-hours session, MSTR corrected by more than 1%, mirroring the cooling sentiment in the spot Bitcoin market.

A Clash of Ideologies

The current market structure presents a fascinating divide between traditionalists and the new guard of digital asset proponents.

| Asset Class | 24-Hour Trend | Institutional Signal |

| Bitcoin | Hit $97K; Retraced to $96.2K | $1B+ ETF Inflows (3-day) |

| Gold/Silver | Profit-taking (per Schiff) | Outflows to ETFs/MSTR |

| MSTR | Up 3% (Reg); Down 1% (AH) | High-beta volatility |

While Schiff urges “savvy traders” to return to mining stocks, the data indicates a massive migration of capital.

The recent billion-dollar inflow into ETFs suggests that institutional investors are viewing the $96,000–$97,000 range not as a ceiling, but as a consolidation zone.

As the market digests the recent retracement, the question remains: is this the “sucker’s rally” Schiff predicts, or is it merely a pitstop on the road to $100,000?

For now, the “digital gold” vs. “physical gold” debate is as heated as the price action itself.