Saylor Snaps: “Ignorant and Offensive” — His Fiercest Defense of Bitcoin Yet

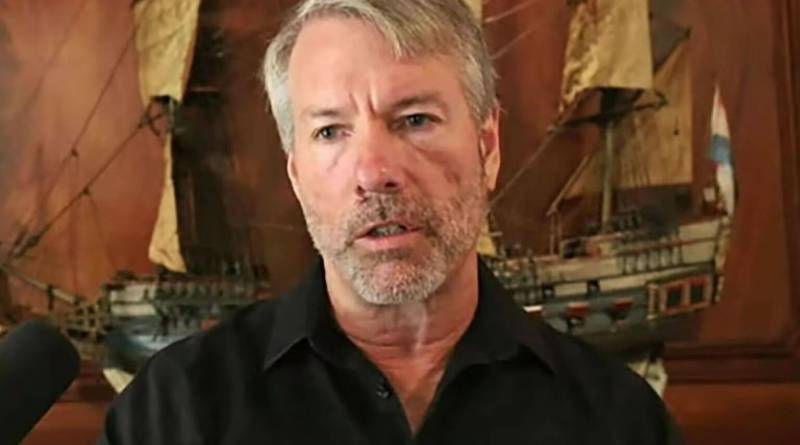

Michael Saylor is not in the mood for skepticism about the corporate Bitcoin treasury trade he helped popularize.

During a Jan. 12 episode of the What Bitcoin Did podcast, the Strategy founder lashed out at host Danny Knowles after being asked whether the market can absorb the more than 200 companies now branding themselves as Bitcoin treasuries, and whether the model of issuing debt to buy Bitcoin is sustainable in the long run.

“Who are you to say that they are just issuing debt to buy Bitcoin?” Saylor snapped. “That’s just an ignorant and offensive statement on your part.”

The outburst landed at a time of growing pressure on the Bitcoin treasury sector, which has ballooned into a $100 billion corporate bet since Strategy kicked off the trade in 2020. But despite the rapid expansion, the market’s recent slide has exposed severe structural fragilities. and renewed questions about whether the playbook Saylor evangelizes can survive a prolonged downturn.

A Sector Under Strain

Nearly 40% of the top 100 Bitcoin treasuries are now trading at a discount to the value of their underlying Bitcoin, the key metric that allows them to raise fresh capital for additional BTC purchases. More than 60% of these firms purchased Bitcoin at higher prices than today’s levels.

Some treasury-wrapped equities have collapsed almost entirely, with stock prices crashing by as much as 99%.

For interviewers and investors alike, the cracks are becoming difficult to ignore.

Strategy’s Model: Financial Engineering in Plain Sight

Saylor’s defense of the treasury model stands in sharp contrast to his company’s own disclosures.

Strategy generated about $125 million in operating cash flow over the first nine months of 2025. This was almost entirely from its long-standing business intelligence software division.

But during that same period, it raised over $50 billion through equity and convertible offerings, deploying nearly all of it into Bitcoin. More than 99% of the capital now fueling Strategy’s massive Bitcoin position did not come from actual business operations, but from issuing securities.

The firm’s own earnings presentation showed the shift. Roughly 90% of its slides are now devoted to the Bitcoin treasury. The software business, which was once its entire identity, is relegated to two or three slides, none of which present it as a meaningful driver of growth or capital allocation.

The result is striking: Strategy is the single largest corporate Bitcoin holder in the world, with more than 687,000 BTC—more than twelve times that of any other firm.

Top 20 largest corporate BTC holders (Source: Bitcoin Treasuries)

The Trade That Sparked a Stampede

When Saylor began buying Bitcoin through aggressive equity issuance in 2020, Strategy’s stock exploded. Shares surged more than tenfold, creating a model other companies found too tempting to resist.

By 2024 and 2025, firms across Japan, Brazil, Europe, and the U.S. began replicating the strategy—sometimes abandoning their existing business lines entirely.

Japan’s Metaplanet, formerly a budget hotel operator, now owns zero properties. Its sole business is issuing debt and stock to purchase more Bitcoin.

Nakamoto, a company created specifically as a treasury vehicle for other Bitcoin treasury companies, joined the ranks as well. So did outfits like the Bitcoin Standard Treasury, Brazil’s OranjeBTC, and dozens more—many effectively functioning as publicly traded wrappers for Bitcoin exposure rather than traditional operating businesses.

More than 200 such companies now hold approximately 1.1 million BTC, according to Bitcoin Treasuries.

Saylor’s Rebuttal: Bitcoin as the New Electricity

Pressed on the sustainability of this corporate stampede into leveraged Bitcoin positions, Saylor compared buying Bitcoin to the adoption of electricity.

“How is it irrational for a company to adopt a new technology which is better than the previous technology?” he asked.

Critics, however, note that the analogy falls short. Unlike electricity adoption, Bitcoin treasuries rely on perpetual capital raises and increasingly complex financial structures—not operational revenue—to function.

Saylor, for his part, argues that any company, even an unprofitable one, should buy Bitcoin. “If a company loses $10 million a year but makes $30 million on Bitcoin appreciation,” he said, “it’s now making $20 million a year.”

No Competition, Just “Ignorance”

When Knowles suggested that Bitcoin treasury firms might be competing with one another for investor capital, Saylor bristled again.

“We’re not competing with each other,” he insisted. “That’s the ignorant part of the question. There’s room for 400 million companies to buy Bitcoin.”

But that framing sidesteps the concern raised by analysts and shareholders alike: not whether companies should buy Bitcoin, but whether companies whose entire business models revolve around buying Bitcoin can remain viable if the market turns against them.