Metaplanet Grows Bitcoin Treasury to 35,102 BTC in Latest $451M Bet

Metaplanet, a Tokyo-listed investment and operating company focused on Bitcoin treasury management, has expanded its holdings with a $451 million purchase completed in the fourth quarter.

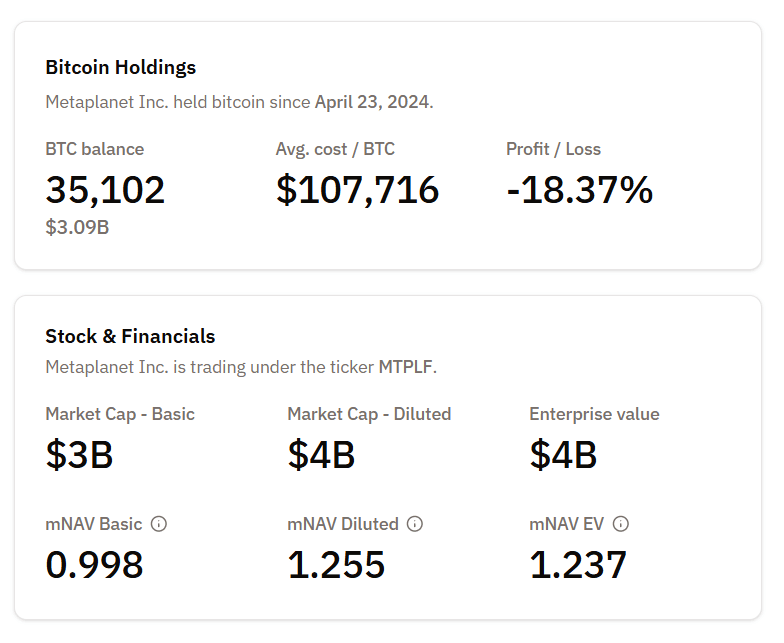

The company said it acquired 4,279 BTC at an average price of $105,412 per coin, lifting its total treasury to 35,102 BTC. The move places Metaplanet as the fourth-largest publicly traded corporate holder of Bitcoin and reinforces its long-term target of accumulating 210,000 BTC by the end of 2027.

Metaplanet’s BTC holdings (Source: Bitcoin Treasuries)

The latest buy brings Metaplanet’s cumulative Bitcoin spend to approximately $3.78 billion at an average acquisition price of $107,607, according to the company’s dashboard.

With BTC trading below $90,000, the position currently carries an unrealized loss of roughly $520 million.

Shares Slide as mNAV Compresses

Metaplanet’s stock closed at 405 yen ($2.60), down nearly 8% on the day of the announcement and about 80% below the all-time high reached in June.

Metplanet share price (Source: Google Finance)

The decline came as Bitcoin failed to hold above $90,000 and slipped toward the mid-$80,000 range, weighing on companies whose equity prices are closely tied to crypto market sentiment.

A key metric watched by investors, Metaplanet’s multiple to net asset value (mNAV), also fell sharply. The ratio—calculated as enterprise value divided by the net value of Bitcoin holdings—dropped from around 1.17 to just above 1.0 following the disclosure.

An mNAV near parity suggests the market is valuing the company only marginally above the net worth of its BTC, a level that often reflects caution during periods of price weakness.

Income Strategy Aims to Offset Volatility

Unlike firms that simply hold Bitcoin, Metaplanet has built a BTC income generation business designed to produce recurring revenue while supporting long-term holdings.

The unit employs derivatives strategies intended to monetize volatility without materially reducing exposure. The company expects the business to generate roughly $55 million in revenue for the full fiscal year.

Metaplanet also confirmed the completion of payments tied to the issuance of 23.61 million MERCURY Class B preferred shares through a third-party allotment, a financing step aimed at supporting further accumulation.

CEO Simon Gerovich said the company’s accelerated strategy delivered a year-to-date BTC yield of 568.2%, a proprietary metric tracking Bitcoin growth relative to shares outstanding.

Strategy Continues Steady Accumulation

Metaplanet’s approach mirrors the playbook pioneered by Strategy, which disclosed another Bitcoin purchase earlier this week.

According to a Form 8-K filing, Strategy added 1,229 BTC between Dec. 22 and Dec. 28 for $108.8 million, funded through at-the-market stock sales. The purchase brings Strategy’s total holdings to 672,497 BTC at an average price of $74,997 per coin.

Led by co-founder and executive chairman Michael Saylor, Strategy disclosed Bitcoin acquisitions in 41 separate weeks in 2025, far exceeding prior years. While the most recent buy ranks among the company’s smaller additions this year, Strategy’s cumulative approach has cemented its position as the largest corporate BTC holder by a wide margin.

Corporate Bitcoin Adoption Broadens

The continued buying by Metaplanet and Strategy reflects a broader expansion of corporate Bitcoin treasuries in 2025.

Publicly traded companies now collectively hold more than 1.08 million BTC across 192 firms, according to Bitcoin Treasuries. Corporate holders account for the largest share of BTC-holding entities by count, outpacing governments, private companies and DeFi protocols.

Beyond Strategy and Metaplanet, other firms have rapidly scaled their exposure. MARA Holdings ranks second among public companies with more than 53,000 BTC, while a growing list of treasury-focused vehicles has emerged across the United States, Canada, the United Kingdom and Japan.

As the BTC price consolidates, Metaplanet’s latest purchase brings attention to a defining theme of the current cycle: an increasing number of public companies are willing to endure near-term volatility in exchange for long-term exposure to Bitcoin as a core balance-sheet asset.

Whether that conviction pays off will depend not only on a price recovery, but also on how effectively firms can pair accumulation with sustainable operating income.