SUI Shows Early Recovery Signals as Bear Trend Starts to Stall

SUI is showing early signs of stabilization on the daily chart following an extended corrective phase.

Recent daily closes indicate that sellers are losing control, with the price gradually pushing higher after defending key support zones. While the altcoin has not yet confirmed a trend reversal, the market structure is beginning to shift away from aggressive downside continuation and toward a more balanced phase.

Despite the short-term improvement, SUI remains below its key moving averages, which keeps the broader outlook cautious. This positioning suggests the asset is still trading within a corrective environment rather than a confirmed uptrend. However, the reduced distance between the price and short-term averages points to weakening bearish pressure and increasing buyer participation.

SUI Momentum Signals Hint At Bearish Exhaustion

Momentum indicators are beginning to tell a more constructive story.

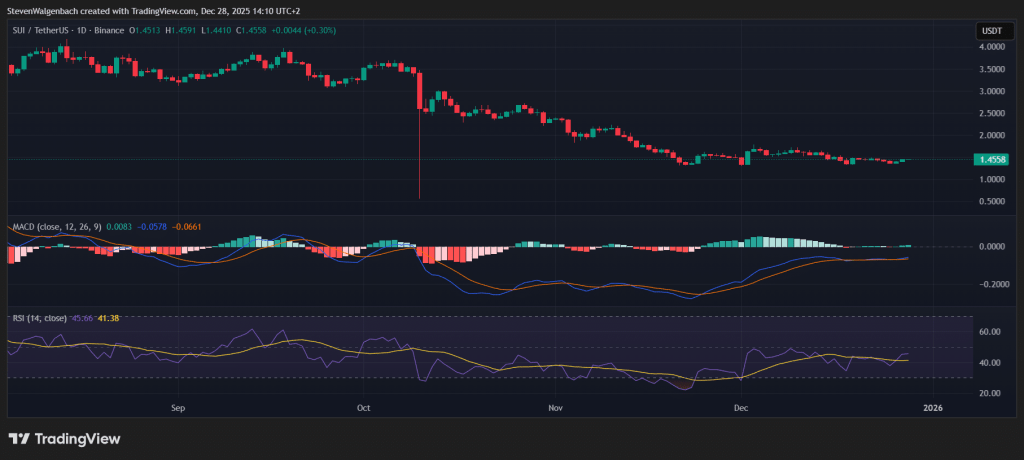

Daily chart for SUI/USDT (Source: TradingView)

Although the MACD remains below its neutral baseline, its improving trajectory signals that bearish momentum is fading rather than strengthening. This type of MACD behavior often appears during transition periods, where markets move from strong selling into consolidation or early recovery phases.

The RSI supports that interpretation. After spending time in weaker momentum territory, the RSI has steadily recovered toward neutral levels. This suggests that selling has become less aggressive and that buyers are stepping in more consistently.

However, the RSI has not yet reached levels associated with strong bullish conviction, indicating that any upside move may still face hesitation without increased volume or broader market support.

Resistance Levels Continue To Cap Upside

Overhead resistance remains a critical hurdle for SUI. The first major barrier sits near the $1.56 area, where selling pressure previously intensified. A sustained move above this level would be an important technical development, as it could open the path toward the higher resistance band between $1.65 and $1.69.

Until those levels are reclaimed, rallies are likely to be met with profit-taking and short-term selling. This keeps the market in a cautious recovery mode rather than a confirmed bullish breakout, particularly for swing traders watching daily closes.

Support Zone Remains A Key Line In The Sand

On the downside, SUI continues to find strong demand in the mid-$1.34 region. This tightly clustered support zone has repeatedly attracted buyers and now represents a critical area for maintaining the current recovery narrative. As long as the price holds above this zone, downside risks appear more contained.

A decisive breakdown below this support band would undermine the improving momentum structure and could reintroduce accelerated selling. Such a move would likely shift sentiment back toward a continuation of the broader downtrend.

Order Book Data Highlights Near-Term Battle Zones

Order book analysis adds valuable context to SUI’s current technical setup. Large bid walls positioned between $1.40 and $1.35 suggest that buyers are actively defending these levels. These liquidity clusters act as buffers against sudden downside moves, but a clean break below them could result in a swift decline as buy-side support thins.

On the upside, multiple ask walls just above the current price highlight why upward progress has been gradual. Sellers are concentrated in the mid-$1.46 area, and clearing these levels would be necessary to unlock further upside toward higher resistance. If these sell walls are absorbed, short-term momentum could accelerate quickly.

Potential Trade Scenarios To Watch

From a trading perspective, the current setup offers different opportunities depending on risk appetite. For bullish traders, pullbacks toward defended support zones may present favorable long entries, particularly if momentum indicators continue to improve. In these scenarios, resistance levels remain logical areas for partial profit-taking.

For bearish traders, resistance zones still provide potential short opportunities if the price shows rejection signals, as the broader trend has not yet fully flipped bullish. However, improving momentum increases the risk of short squeezes, making disciplined risk management essential.

Outlook Remains Cautiously Constructive

Overall, SUI appears to be at a technical crossroads on the daily chart. Bearish momentum is fading, buyer interest is strengthening near support, and momentum indicators are stabilizing. While the broader trend remains cautious, downside risks appear more limited in the near term. A confirmed breakout above resistance would be needed to shift the outlook decisively bullish.

Disclaimer: The information presented in this article is for informational and educational purposes only. It does not constitute financial advice. Ecoinimist is not responsible for any losses incurred. Readers should exercise caution before acting on this content.