Top Bitcoin Treasury Companies Worldwide

Corporate Bitcoin adoption has accelerated in recent years, with dozens of public and private firms now holding sizable amounts of BTC on their balance sheets.

In fact, CoinGecko tracks over 160 institutions (including companies and governments) holding ~1.71 million BTC (roughly 8.1% of Bitcoin’s total supply). Many firms view Bitcoin as a strategic asset – a hedge against inflation, an investment vehicle, or a way to diversify corporate treasuries beyond traditional cash.

In this article we will highlight the top Bitcoin treasury companies as of December 2025, drawing on the latest data to show how much BTC they hold and its USD value. We’ll also discuss why these companies are accumulating Bitcoin, and what this trend means for the future of digital assets.

Bitcoin’s recent price rally and mainstream acceptance have spurred companies to allocate part of their reserves to BTC. High-profile examples like Strategy and Tesla made headlines by placing their Bitcoin holdings front and center.

Other firms – including dedicated mining companies (Riot, Hut 8, CleanSpark) and crypto-focused financial firms (Coinbase, Galaxy Digital, Bullish) – have also built large treasury balances. Several newer entrants have launched specifically as “Bitcoin companies†(for example, Japan’s Metaplanet and Brazil’s OranjeBTC) or merged with SPACs to become pure-play Bitcoin holders.

Below we list and describe the top companies by Bitcoin holdings, including both public and notable private firms.

Why Companies Are Holding Bitcoin

Companies cite various reasons for adding Bitcoin to their treasuries:

- Inflation hedge and store of value: With central banks expanding money supplies, some firms see Bitcoin as “digital gold†– a scarce asset that can preserve value over time. By holding BTC instead of cash, companies hope to hedge against currency devaluation.

- Treasury diversification: Rather than sitting on idle cash, corporate treasurers may diversify into Bitcoin to capture potential upside. In this view, holding BTC is a strategic allocation, akin to investing part of the cash reserves in equities or bonds.

- Investor signaling: Some CEOs (Elon Musk at Tesla, Michael Saylor at Strategy, Jack Dorsey at Block) have publicly embraced crypto. Buying and holding Bitcoin can signal to investors and customers that a company is innovative and aligned with crypto growth.

- Business model alignment: Crypto-focused firms (exchanges, miners, blockchain companies) naturally accumulate Bitcoin as part of their operations. For a Bitcoin mining company like Marathon Digital, every mined BTC is essentially revenue; choosing to hold it on the balance sheet can amplify shareholder value when prices rise.

- Strategic positioning: A few companies were created primarily to hold Bitcoin. For example, the Japanese firm Metaplanet and the Brazilian OranjeBTC structure themselves like proxy funds: their core business is Bitcoin accumulation, hoping to mirror MicroStrategy’s success.

Those motivations reflect broader trends in corporate crypto adoption. Many analysts believe that as Bitcoin matures, more institutional treasuries will consider it alongside cash, bonds, and equities.

By holding BTC, companies effectively allow their shareholders and employees to indirectly invest in crypto through the stock. Of course, adding Bitcoin also brings volatility and accounting implications, so firms typically disclose their strategy in financial reports.

Top Bitcoin Treasury Companies by Holdings

Below we profile several of the largest corporate Bitcoin holders. Data is current as of December 2025, and values are calculated using recent Bitcoin prices (approximately $88,000 per BTC at year-end 2025).

- Strategy (MSTR, USA): The software analytics company far and away leads all public firms in Bitcoin holdings. Strategy owns 671,268 BTC as of Dec 26, 2025 – roughly $59.6 billion worth (at today’s prices). It has been aggressively buying since 2020, spending over $33 billion in total to accumulate its position. Michael Saylor, Strategy’s founder, has framed Bitcoin as a superior store of value to holding cash, and the company treats BTC as its primary reserve asset.

- Marathon Digital (MARA, USA): Marathon is a major Bitcoin mining company. As of Oct 3, 2025, Marathon reported owning 53,250 BTC (about $4.69 billion). Rather than selling all its mined coins for operating expenses, Marathon strategically holds most of them.

- Twenty One Capital (XXI, USA): Twenty One Capital went public on the NYSE in late 2025 as a crypto-native financial firm. It holds 43,514 BTC on its balance sheet (around $3.9 billion). The company began accumulating Bitcoin in mid-2025 and launched with a large treasury.

- Metaplanet Inc. (MTPLF, Japan): This Tokyo-listed company is a pioneer in Japan’s corporate Bitcoin adoption. Metaplanet has publicly stated aggressive targets (e.g. 10,000 BTC by end of 2025) and has rapidly built its treasury. According to BitcoinTreasuries, Metaplanet holds 30,823 BTC (about $2.73 billion).

- Bitcoin Standard Treasury (CEPO/BSTR, USA): Backed by Bitcoin pioneer Adam Back, this SPAC (to be ticker BSTR) is set to list in late 2025. It launched with about 30,021 BTC (worth roughly $2.67 billion) contributed into its SPAC vehicle. Its plan is to become a dedicated Bitcoin treasury company.

- Bullish (BLSH, USA): Bullish is a crypto exchange co-founded by former ICE chairman Jeffrey Sprecher. As a publicly traded company (via a SPAC), it holds 24,300 BTC (~$2.15 billion). The SPAC raised funds and used them to purchase a large Bitcoin stake at launch. Despite being newer to the scene, Bullish’s treasury makes it one of the top holders among exchanges.

- Riot Platforms (RIOT, USA): Riot (formerly Riot Blockchain) is another Bitcoin mining giant. It reports 19,324 BTC (about $1.71 billion) on its books. Riot has been steadily accumulating BTC, reinvesting most mining output into reserves. Its mining focus and commitment to holding has made it one of the most watched corporate treasuries in crypto.

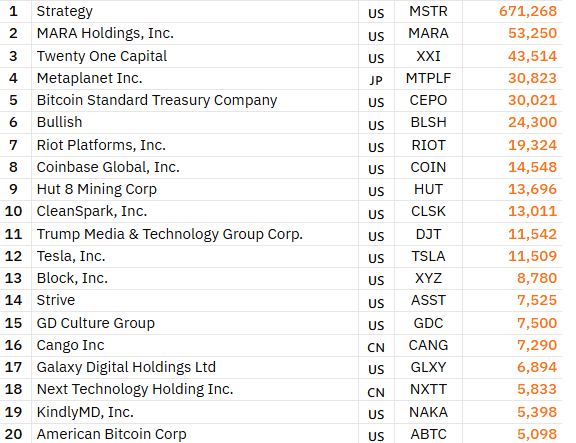

Below is the list of the rest of the biggest Bitcoin treasury companies globally:

Top Bitcoin treasury companies (Source: Bitcoin Treasuries)

Context and Trends

Strategy’s enormous 671k BTC dwarfs other companies’ holdings – it alone accounts for about 3.2% of all Bitcoin supply.

The next-largest public holders are in the tens of thousands of BTC. Notably, many of these firms are miners or crypto businesses, with a few exceptions (Strategy, Tesla) being non-crypto incumbents that made big bets.

The new entrants (Bitcoin Standard Treasury, Twenty One Capital, Bullish) highlight the trend of creating new vehicles solely to hold BTC.

Across those companies, several common themes emerge. Companies often emphasize transparent reporting of their holdings: most announce Bitcoin purchases in press releases or SEC filings, and analysts meticulously track quarterly balances (as we have done here). Many mining firms explicitly state they will hold the vast majority of mined coins, reinvesting only sparingly; this converts them into quasi-investment funds.

Exchanges and crypto financial firms, by virtue of their business, naturally accumulate crypto; for example, Coinbase’s annual 10‑K reports consistently detail its BTC on hand.

The global nature of this list is also noteworthy. While the top spots are U.S. and North American companies, public firms in Japan (Metaplanet) and even Brazil (OranjeBTC) have joined the ranks. OranjeBTC, which debuted on Brazil’s B3 exchange in October 2025, launched with 3,675 BTC as its core asset. The company’s backing by major investors (including Itaú BBA and the Winklevoss twins) reflects growing interest worldwide.

In Europe, Germany’s Bitcoin Group SE (ADE.AU) and others hold Bitcoin too (Bitcoin Group SE has ~3,600 BTC).

Aside from public companies, several private firms are known to hold Bitcoin treasuries, though details may be less transparent. BitcoinTreauries.net notes that Stacking Sats Inc. (a U.S. IT services firm) is among the top 20 private holders.

South Korea’s Dunamu (operator of Upbit exchange) and Japan’s Payward/BitFlyer may also hold corporate balances (though these are often not publicly disclosed). In aggregate, corporate treasuries now contain a sizable chunk of Bitcoin, signaling that businesses of all kinds are positioning for a world where digital assets play a strategic role.

What It Could Mean for the Future

The trend of companies buying Bitcoin has several implications:

- Increased legitimacy: As more recognizable brands add BTC to their balance sheets, Bitcoin’s status as a mainstream asset is reinforced. Institutional investors who own these stocks get indirect exposure to BTC, bridging traditional finance and crypto.

- Market impact: Corporate demand can put upward pressure on price, especially in the event of large announcements. For example, Strategy’s stock price tends to rally on news of big Bitcoin purchases. However, some companies (Tesla, Coinbase) deliberately report conservatively to avoid triggering surges in interest costs or regulatory scrutiny.

- Regulatory and accounting: Firms must navigate how to account for crypto. Currently, most must mark Bitcoin at fair value or cost (depending on accounting rules), leading to volatility in earnings reports. Future regulatory clarity (for example, recognizing crypto as a strategic asset rather than “intangible†on financial statements) could encourage more companies to hold BTC.

- Competition for capital: Some analysts worry that aggressive Bitcoin accumulation could divert funds from core business investment. This tension will be an ongoing debate, as seen in Tesla’s mixed views on further Bitcoin buying.

Ultimately, corporate Bitcoin adoption is still young. The companies in our list tend to be early movers. As the crypto ecosystem evolves, more firms may experiment with holding digital assets. Banks, tech giants, and industrial firms have so far been cautious, but a continued bull market or client pressure could change their calculus.

Ecoinimist Analysis

We have covered Bitcoin treasury companies extensively ever since more companies started jumping on the trend in 2024. There was initial hype around these firms, which offer investors leveraged exposure to BTC. However, what appeared to be a bubble around these entities has seemingly “popped,†as seen with the decline in their respective share prices.

While those stock price drops may have coincided with Bitcoin’s slump in the second half of the year, there is also the upcoming decision by the MSCI that has the market sitting on the sidelines. Earlier this year, MSCI said that it will look to delist companies that hold more than 50% of their assets in crypto. They also shortlisted Strategy, Metaplanet, and several others.

We agree with the overall consensus among analysts that the MSCI removal of Bitcoin and other crypto treasury companies may already be priced in. However, we also think that the potential removal, if confirmed, could serve as a major blow to the crypto industry’s momentum.

Add to that the potential for another US government shutdown at the end of January and the 2026 midterms in the US.