Bitcoin’s Year-End ETF Slump Continues, but January Optimism Builds

Bitcoin’s institutional selling pressure showed little sign of easing over the Christmas period, with U.S.-based investors solidifying their position as the market’s largest net sellers.

Even as global trading activity slowed for the holidays, spot Bitcoin exchange-traded funds (ETFs) continued to post sizeable outflows, highlighting persistent caution among institutions heading into year-end.

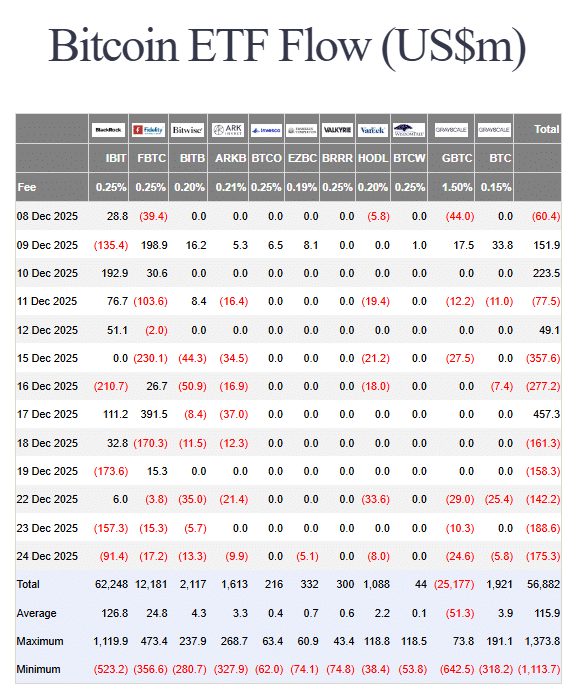

Data from Farside Investors shows that U.S. spot Bitcoin ETFs recorded net outflows of roughly $175 million on Christmas Eve. The selling occurred during the final pre-Christmas trading session on Wall Street, indicating that institutional capital remained active despite the holiday calendar.

US spot Bitcoin ETF flows (Source: Farside Investors)

The Christmas Eve figures are consistent with a broader pattern that has dominated the second half of December.

Over the past five trading days alone, spot Bitcoin ETFs have seen total net outflows of approximately $826 million. Since Dec. 15, every trading day has ended in negative territory except Dec. 17, when ETFs briefly attracted more than $457 million in net inflows.

Seasonal Factors Drive Year-End Selling

Market participants have largely attributed the continued outflows to seasonal dynamics rather than a deterioration in Bitcoin’s longer-term fundamentals.

Tax-loss harvesting has emerged as the most commonly cited explanation, as institutional investors realize losses before the end of the fiscal year to offset taxable gains elsewhere.

Trader Alek said on X that the bulk of ETF selling is likely tied to these tax-related strategies, which typically wind down as the calendar turns. He added that the timing of a major quarterly options expiry may have further weighed on risk appetite across crypto markets.

“This is temporary and institutions will be back to bidding soon,†Alek wrote, suggesting that the current selling pressure should not be mistaken for a structural exit from Bitcoin exposure.

US Selling Pressure Reflected In Market Data

Price behavior throughout December appears to support the idea that U.S.-based selling has played a disproportionate role in Bitcoin’s recent weakness.

Charts shared by market participants show that much of Bitcoin’s downside has occurred during U.S. trading hours, while other regions have provided relative support.

One indicator reinforcing this trend is the Coinbase Premium Index, which measures the price difference between Bitcoin traded on Coinbase and offshore venues such as Binance. Throughout much of December, the premium has remained in negative territory, signaling weaker buying demand from U.S. investors relative to global markets.

Crypto analyst and entrepreneur Ted Pillows summarized the shift by noting that the U.S. has effectively become the largest seller of Bitcoin, while Asian markets have taken on the role of the biggest buyers. Historically, sustained Bitcoin rallies have often coincided with renewed U.S. spot demand, making this divergence a key factor to watch going into the new year.

Bitcoin And Ether ETF Flows Remain Stuck

The slowdown in institutional activity has not been limited to Bitcoin alone. Spot ETFs tracking Ether have also struggled to attract fresh inflows, with capital remaining largely on the sidelines since early November.

Trader BitBull argued that persistently negative ETF netflows, even when viewed through a 30-day moving average, do not necessarily signal a final market top. Instead, he described the current environment as one in which liquidity is inactive rather than permanently withdrawn.

According to BitBull, past cycles suggest that price stabilization typically comes first, followed by neutral ETF flows, and only later by renewed inflows. In his view, a meaningful trend shift is likely to begin once ETF flows turn positive again, setting the stage for a stronger directional move in price.

Hopes For A Post-Holiday Rebound

Despite the uninspiring year-end data, optimism remains that institutional demand could return once seasonal pressures fade. With tax-loss harvesting nearing completion and derivatives-related uncertainty easing after quarterly expiries, many traders expect January to bring a reset in positioning.

Whether that rebound materializes will likely depend on renewed U.S. buying interest and a reversal in ETF flow trends. Until then, Bitcoin appears poised to close the year under the weight of institutional caution, even as longer-term confidence quietly persists beneath the surface.