BTC Holds the Line: Why the Daily Chart Hints at a Possible Upside Shift

Bitcoin (BTC) continues to trade in a narrow range on the daily chart, reflecting a market that is attempting to stabilize after recent downside pressure.

The latest sequence of daily closes shows the crypto market leader holding above nearby support, but still struggling to reclaim higher resistance zones. This type of price action often signals indecision, with buyers and sellers reaching a temporary balance as the market searches for direction.

Daily Trend Remains Weak but Shows Early Signs of Stabilization

From a broader trend perspective, Bitcoin remains technically heavy on the daily timeframe. The price is still positioned below key short-term and medium-term moving averages, which keeps the overall structure bearish to neutral.

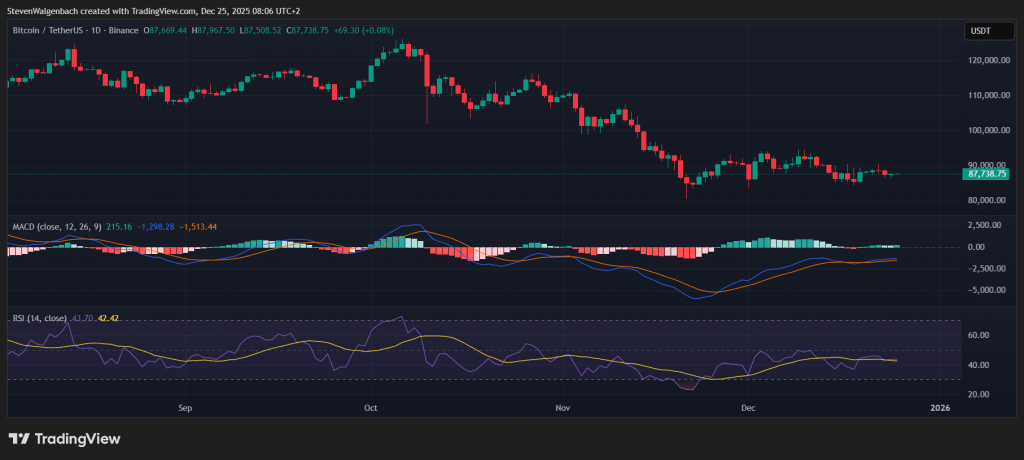

Daily chart for BTC/USDT (Source: TradingView)

However, the short-term average has started to flatten, suggesting that selling pressure is no longer accelerating. This often precedes a period of consolidation and, in some cases, a gradual trend transition rather than an immediate reversal.

Until Bitcoin can reclaim those moving averages and hold above them, upside moves are likely to face resistance, keeping the broader trend cautious.

BTC’s Momentum Indicators Point to Weakening Bearish Control

Momentum indicators suggest that bearish dominance may be losing strength. The MACD structure shows improving momentum, indicating that downside pressure is easing rather than expanding. While this does not yet confirm a bullish reversal, it often appears during early base-building phases or range-bound conditions.

The RSI remains below neutral territory, highlighting that sellers still have the upper hand. However, its recent stabilization implies that downside momentum is no longer intensifying, reducing the likelihood of an immediate sharp breakdown.

Resistance Levels That Could Define Any Recovery Attempt

Overhead resistance remains well defined and will play a critical role in determining whether BTC can regain bullish traction. The first key resistance sits near $91,333, where sellers are likely to become active. A daily close above this level would be an important technical signal and could open the door to further upside toward $92,678 and $93,429.

Failure to clear those zones would likely keep Bitcoin locked in a broader consolidation range, with repeated rejections reinforcing the current structure.

Support Levels Continue to Anchor the Downside

On the downside, support around $86,286 remains a critical level for maintaining the current range. Holding above this zone helps preserve the stabilization phase currently forming on the chart. A decisive break below it would increase the risk of further declines toward $85,516 and potentially $84,739.

Those lower support areas may attract stronger dip-buying interest, but a breakdown would signal renewed bearish control.

Order Book Data Highlights Short-Term Balance

Order book analysis supports the idea of near-term equilibrium.

Several bid walls clustered just below the current price suggest that buyers are actively defending the mid-$87,000 region, helping to limit immediate downside. However, the relatively small percentage impact of these bids means that if they are absorbed, the price could slide quickly toward lower support.

On the upside, visible ask walls between $87,745 and $87,900 show where sellers are positioned to cap short-term rallies. Clearing these sell orders could allow BTC to push higher, but the limited projected upside suggests any move would likely be gradual.

Potential Trade Considerations for Both Longs and Shorts

From a trading perspective, patience remains key. Long setups may be more attractive after a confirmed daily close above key resistance and a reclaim of short-term trend levels. More aggressive longs could look for reactions near established support, but should be prepared for volatility if those levels fail.

For short setups, rejection at resistance combined with weak follow-through could offer opportunities, especially if the price remains below key moving averages. Shorts targeting a breakdown would likely wait for a clear loss of support as confirmation.

Outlook: Bitcoin Approaches a Decision Point

Bitcoin’s daily chart reflects a market at a crossroads. Bearish momentum is fading, but bullish strength has yet to take control. Until the price either breaks convincingly above resistance or loses key support, BTC is likely to remain range-bound, with traders closely watching for confirmation of the next directional move.

Disclaimer: The information presented in this article is for informational and educational purposes only. It does not constitute financial advice. Ecoinimist is not responsible for any losses incurred. Readers should exercise caution before acting on this content.