Bitcoin Never Really Hit $100K? Inflation Math Rewrites BTC’s Biggest Milestone

Bitcoin’s latest price cycle has reignited a familiar debate in financial markets: has the world’s largest cryptocurrency truly broken into six-figure territory, or has inflation quietly moved the goalposts?

According to Alex Thorn, head of research at Galaxy Research, Bitcoin has never actually crossed $100,000 when adjusted for inflation, despite reaching a nominal all-time high above $126,000 in October.

“If you adjust the price of Bitcoin for inflation using 2020 dollars, BTC never crossed $100,000,” Thorn said Tuesday. “It actually topped at $99,848 in 2020 dollar terms, if you can believe it.”

Inflation Changes the Milestone Narrative

Thorn’s analysis adjusts Bitcoin’s historical price using cumulative changes in the Consumer Price Index (CPI) since 2020, accounting for the steady erosion of purchasing power in the U.S. dollar.

CPI is calculated by the US Bureau of Labor Statistics and tracks changes in the cost of a representative basket of goods and services.

In November, the agency reported that CPI rose 2.7% year over year, shedding light on the persistent inflation that has followed the COVID-era stimulus period. Thorn estimates that the dollar has lost roughly 20% of its purchasing power since 2020, meaning that today’s prices are about 1.25 times higher than they were five years ago.

In practical terms, a dollar today buys only about 80% of what it could in 2020—an adjustment that pulls Bitcoin’s apparent six-figure breakout just below the psychological threshold.

US Inflation Remains a Structural Force

Although inflation has cooled from its mid-2022 peak above 9%, it remains stubbornly above the Federal Reserve’s 2% target. The persistence of higher prices has become a defining macroeconomic backdrop for digital assets, shaping both investor expectations and narratives around Bitcoin as an inflation hedge.

At the same time, the U.S. dollar itself has weakened. The Dollar Currency Index (DXY), which tracks the greenback against a basket of major currencies, has fallen roughly 11% year to date, sliding to around 97.8, according to TradingView.

US dollar index chart (Source: TradingView)

The index hit a three-year low in September and has been trending lower since late 2022.

This environment has fueled what many traders describe as the “debasement trade”—allocating capital into assets perceived as scarce or inflation-resistant as fiat currencies lose purchasing power.

Schiff Doubles Down on Bitcoin Skepticism

Not everyone sees Bitcoin benefiting from those macro trends.

Longtime crypto critic Peter Schiff has renewed his warnings, arguing that Bitcoin is entering what he calls a “slow death” phase as it underperforms traditional safe havens.

“If Bitcoin won’t go up when tech stocks rise, and it won’t go up when gold and silver rise, when will it go up?” Schiff wrote on X. “The answer is: it won’t.”

Schiff also noted that Bitcoin is down roughly 46% when priced in gold from its November 2021 peak, suggesting that its long-term performance looks far weaker when measured against hard assets rather than fiat currencies.

Bitcoin Slides as Metals Surge

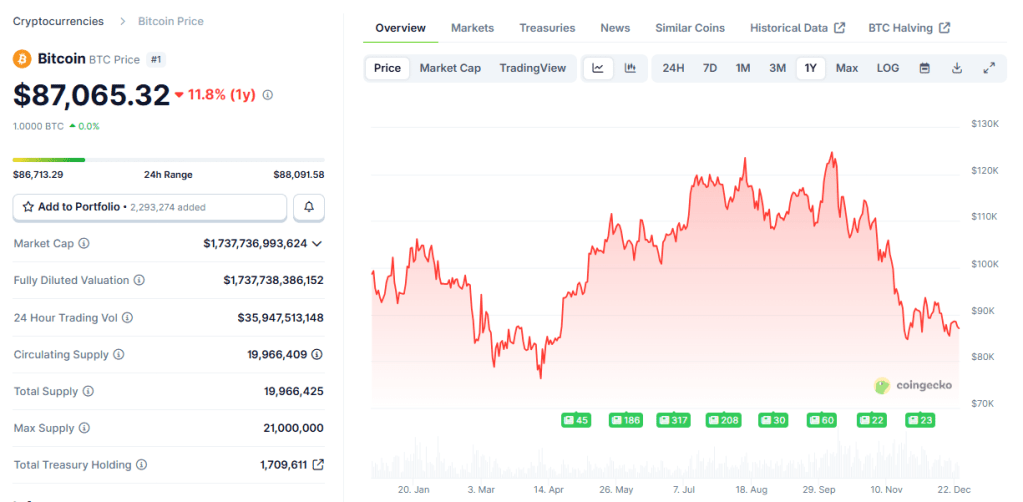

Bitcoin’s price action has done little to silence critics in recent weeks. As of early Tuesday, BTC was hovering near $87,000, according to CoinGecko, marking a modest dip over 24 hours and extending a roughly 7% decline over the past year.

BTC price (Source: CoinGecko)

The cryptocurrency is also on track for its first negative fourth quarter since 2022. Data from CoinGlass shows Bitcoin would need to rally more than 23% before year-end to close Q4 in positive territory.

Meanwhile, traditional precious metals have surged. Gold has climbed to record highs above $4,500 per ounce, while silver briefly touched $72.70 before easing slightly. Platinum and palladium have also posted strong gains.

A Milestone Reframed, Not Erased

While Thorn’s inflation-adjusted analysis reframes Bitcoin’s six-figure narrative, it does not negate the asset’s long-term rise or its role in global markets. Instead, it shows how macroeconomic forces—particularly inflation—can subtly reshape even the most celebrated milestones.

As investors weigh Bitcoin’s performance against weakening fiat currencies, surging metals, and evolving macro conditions, the debate over what truly constitutes “new highs” is likely to remain as volatile as the asset itself.