Arthur Hayes Says Bitcoin Could Surge to $200K on ‘QE in Disguise’—Then Pull Back Hard

Arthur Hayes, the outspoken co-founder of BitMEX and a longtime Bitcoin bull, says Bitcoin is setting up for a dramatic surge toward $200,000 before retracing to form a durable bottom above $124,000.

The catalyst, according to Hayes, is a little-noticed shift in U.S. monetary operations that he argues markets will soon recognize as a new form of liquidity injection.

In a blog post published Friday, Hayes pointed to the Federal Reserve’s newly described policy of “Reserve Management Purchases,†or RMP, which was referenced during the most recent meeting of the Federal Open Market Committee.

Hayes likened the mechanism to quantitative easing, the controversial policy tool that defined the post-2008 and pandemic-era financial landscape.

“RMP is a new acronym that entered my love language dictionary on December 10th, the day of the most recent Fed meeting,†Hayes wrote. “Immediately, I recognized it, understood its meaning, and treasured it like my long-lost love, quantitative easing (QE).â€

Liquidity, Money Printing, and Bitcoin’s Appeal

Hayes has long argued that expansionary monetary policy ultimately funnels capital into scarce assets, particularly Bitcoin. In his view, any policy that increases reserves or expands the balance sheet functions as indirect money printing, even if it is framed as a technical adjustment rather than full-scale QE.

“I love QE because it means money printing,†Hayes wrote, adding that he owns assets such as gold, mining stocks, and Bitcoin precisely because they tend to outpace fiat currency debasement.

Also read: Missed Altcoin Season? Arthur Hayes Says It’s Been Playing Out All Along

The thesis is consistent with Hayes’ broader critique of the global financial system. He has repeatedly described Bitcoin as a long-term alternative to what he calls the “filthy fiat fractional reserve system,†arguing that continued reliance on liquidity injections will accelerate adoption of decentralized monetary assets.

Earlier this year, Hayes made headlines by predicting Bitcoin could reach $250,000 by year’s end, citing aggressive money printing expectations.

That call has since been walked back. He now expects Bitcoin to trade in a range between $80,000 and $100,000 through the remainder of the year, acknowledging that the anticipated liquidity impulse has taken longer to materialize.

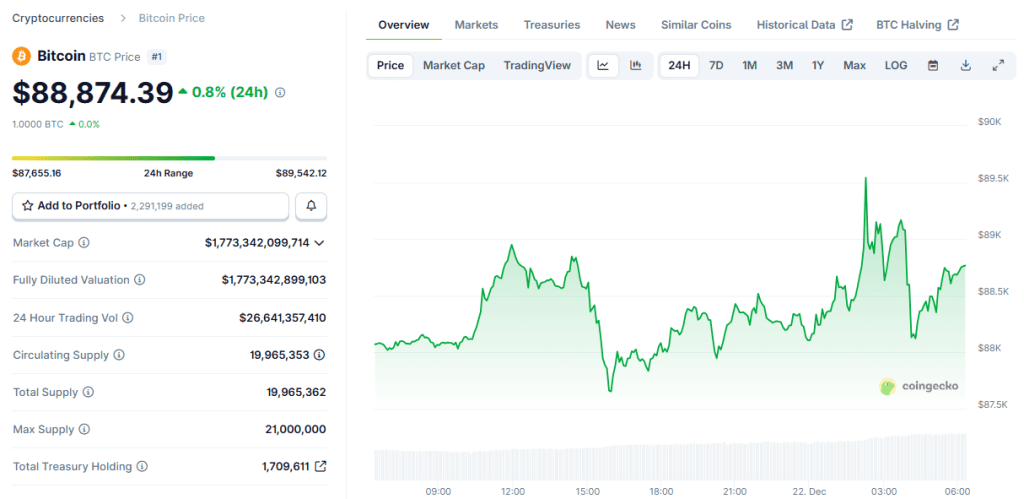

BTC price (Source: CoinGecko)

A 2026 Breakout Scenario

Hayes believes the real move begins once markets fully internalize RMP as QE under a different name. According to his forecast, Bitcoin will first reclaim the $124,000 level before rapidly advancing toward $200,000 in early 2026.

“As the market equates RMP to QE, Bitcoin will quickly retake $124,000 and punch quickly towards $200,000,†he wrote. Hayes expects March to mark peak optimism around the policy’s impact on asset prices, followed by a corrective phase that still leaves Bitcoin well above previous highs.

He specifically pointed to John Williams, president and CEO of the Federal Reserve Bank of New York and vice chair of the FOMC, as a central figure in maintaining accommodative conditions. Hayes suggested that Williams’ influence would keep liquidity flowing even as expectations reset.

Market Reality Pushes Back

At current levels, Bitcoin would need to rally roughly 127% to reach Hayes’ $200,000 target. The asset trades near $88,000 at press time, about 30% below its all-time high of $126,080.

Not all analysts share Hayes’ optimism.

On the same day his blog post was published, blockchain analytics firm CryptoQuant said Bitcoin appears to have entered a bear market.

The firm cited a combination of on-chain metrics and market structure signals indicating sustained weakness since early October, independent of headline price action.

Beyond Bitcoin

Hayes also highlighted opportunities beyond Bitcoin, singling out Ethena’s native token ENA as a beneficiary of shifting rate dynamics.

He described ENA as “a TradFi vs. crypto USD rates play,†suggesting that volatility in interest rate expectations could create asymmetric upside for decentralized alternatives.

Whether RMP ultimately proves to be QE in disguise remains an open question. But if Hayes is right, Bitcoin’s next major move may be less about halving cycles or ETFs and more about the quiet mechanics of central bank balance sheets—once again placing monetary policy at the center of the crypto narrative.