ZEC Price Action Tightens as Bulls and Bears Battle Key Levels

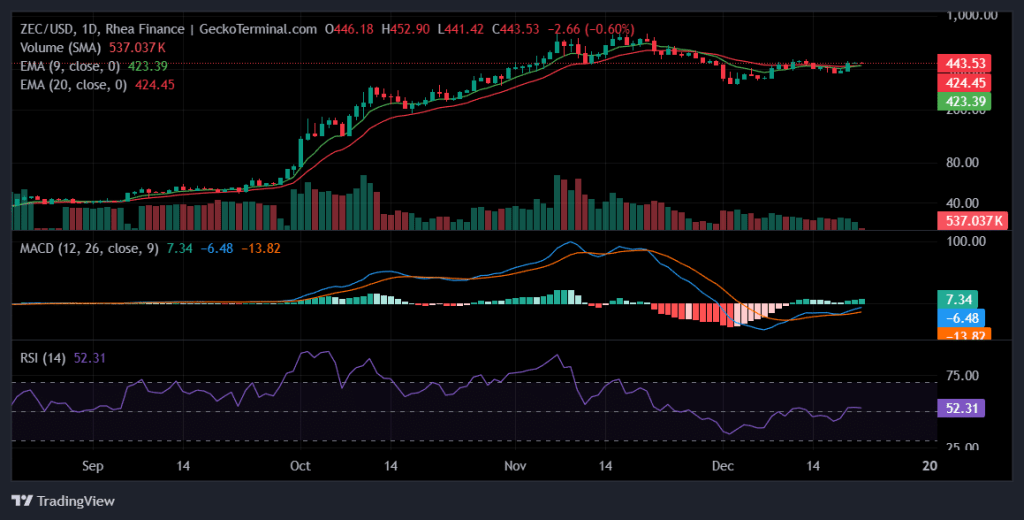

Zcash (ZEC) is showing signs of stabilization on the daily chart after emerging from a corrective phase that saw price action grind lower before finding firm demand.

Recent daily closes reflect a gradual recovery, with buyers stepping in more confidently and preventing further downside continuation. While the crypto has not yet confirmed a full trend reversal, the structure now suggests that bearish pressure has meaningfully weakened and the market is entering a more balanced, decision-making phase.

That shift in behavior is important. Rather than sharp rebounds followed by immediate sell-offs, the crypto has begun to post sustained higher closes, indicating that dip buyers are gaining influence. The market appears to be transitioning from distribution into accumulation, at least in the short to medium term.

ZEC Trend Structure And Momentum Shift

From a trend perspective, ZEC’s reclaim of its short-term moving average signals improving short-term sentiment.

Daily chart for ZEC/USD (Source: GeckoTerminal)

The price is now interacting with the medium-term trend zone, an area that often determines whether a recovery evolves into a sustained upside move or stalls into consolidation.

When the price begins to hold above short-term trend levels while pressing into longer-term averages, it typically reflects growing confidence among buyers rather than panic-driven short covering.

Momentum indicators reinforce that narrative. Negative momentum has been steadily fading, while bullish momentum has been building incrementally. This transition does not suggest an overheated rally, but rather a healthy reset where selling exhaustion is being replaced by cautious optimism.

Such conditions often precede either a breakout attempt or a tight range as the market builds energy for its next directional move.

RSI And Market Strength Context

Relative strength readings further support the idea that ZEC is shifting into a more constructive phase.

The RSI has moved out of weaker territory and into a neutral-to-positive range, indicating that the market is no longer dominated by sellers. Importantly, RSI levels suggest room for continuation without signaling exhaustion, meaning upside attempts are less likely to be immediately rejected purely on momentum grounds.

This environment tends to favor trend development rather than abrupt reversals, especially if volume confirms follow-through buying on higher daily closes.

Key Resistance Zones To Watch

Overhead resistance remains the primary challenge for bulls.

The first major barrier sits near $454.99, an area reinforced by recent price reactions and visible sell-side interest. A clean daily close above this level would be a notable technical signal, suggesting that sellers at this zone have been absorbed.

Beyond that, higher resistance levels around $645.44 and $699.00 define the broader upside potential. While these targets are further out, they remain technically relevant if momentum accelerates and broader market conditions turn supportive.

Reaching those zones would likely require sustained strength rather than a single impulsive move.

Support Levels And Downside Risk

On the downside, support near $443.43 has become increasingly important. This level now represents the line between continued recovery and renewed weakness. Holding above it would reinforce the bullish recovery thesis and suggest that former resistance is being successfully flipped into support.

If that level fails, deeper support zones at $312.81 and $205.07 come back into focus. A move toward these areas would signal that the recovery attempt has failed and that sellers have regained control, likely shifting sentiment back toward risk-off positioning.

Order Book Signals And Liquidity Dynamics

Order book data adds valuable insight into near-term price behavior.

Significant bid walls clustered around the low $440s and low $430s suggest strong buyer interest defending these levels. This liquidity concentration implies that the price may find support quickly on pullbacks, unless aggressive selling pressure overwhelms these bids.

On the upside, large ask walls between $455 and $465 explain why progress higher may be slow and contested. These sell-side clusters represent areas where profit-taking and short positioning are likely to increase.

Clearing those zones would be a strong signal of bullish conviction and could accelerate the price toward the next resistance area.

Trade Scenarios And Strategic Outlook

For long setups, traders may look for continued holding above the $443 support zone, with added confirmation coming from a decisive break above the $455 resistance area. Such a move would indicate that buyers are in control and could justify targeting higher resistance zones while managing risk below reclaimed support.

Short setups become more compelling if ZEC is rejected strongly at resistance and loses the $443 level on a daily closing basis. This scenario would suggest a failed breakout attempt and increase the probability of a deeper retracement toward lower support zones.

Overall Technical Bias

Overall, the ZEC daily chart presents a cautiously bullish technical outlook.

Bearish momentum has faded, buyers are actively defending key levels, and the price is pressing into resistance rather than collapsing back into its prior range.

While confirmation is still required, the current structure suggests that the altcoin is approaching an inflection point where a sustained breakout or a renewed consolidation phase will soon define the next major move.

Disclaimer: The information presented in this article is for informational and educational purposes only. It does not constitute financial advice. Ecoinimist is not responsible for any losses incurred. Readers should exercise caution before acting on this content.