BlackRock’s Spot Bitcoin ETF IBIT Stands Out as Inflows Rise Despite Market Losses

Spot Bitcoin ETF investors may be defying one of the market’s most persistent stereotypes: that crypto capital is driven primarily by short-term price momentum.

New data compiled by Eric Balchunas, a senior ETF analyst at Bloomberg, suggests that investors in the iShares Bitcoin Trust are showing a level of patience and long-term conviction that stands out across the broader ETF landscape.

IBIT Inflows Remain Among The Strongest In The ETF Market

The spot BTC ETF, launched by BlackRock in January 2024, has already established itself as one of the most successful ETF launches on record. But its performance in 2025 is proving notable for a different reason.

So far this year, IBIT ranks sixth among all U.S.-listed ETFs by net inflows, drawing in more than $25 billion in fresh capital.

That places the fund alongside some of the most established products in global markets. At the top of the rankings sits the Vanguard S&P 500 ETF, which has attracted roughly $145 billion in inflows, while the 25th position is held by the iShares S&P 100 ETF, with about $10 billion.

IBIT’s presence in the top tier shows how quickly spot Bitcoin ETFs have moved from novelty products to mainstream portfolio tools competing directly with traditional equity and index funds.

A Negative Return That Didn’t Deter Investors

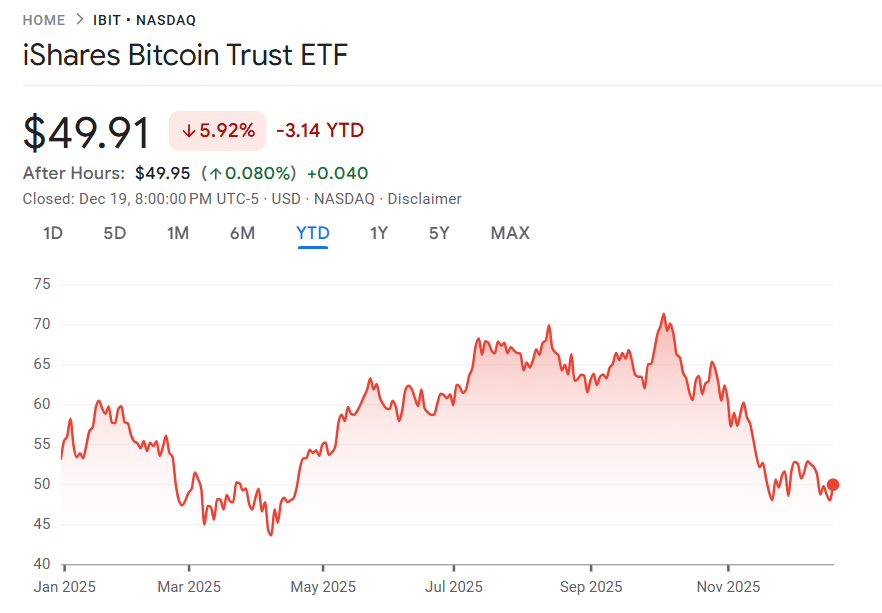

What makes IBIT’s inflow ranking particularly striking is its performance. According to Balchunas, IBIT is the only ETF among the top 25 by inflows that is posting a negative return for the year. As of midday Friday, the fund was down roughly 9.6% in 2025.

IBIT share price (YTD) (Source: Google Finance)

Every other ETF in that group — spanning U.S. equities, global stocks, and commodities — has delivered positive returns.

Under normal market dynamics, that type of underperformance would be expected to slow or even reverse inflows. Instead, IBIT has continued to pull in capital at a pace that rivals some of the largest and most liquid funds in the world.

The data challenges the assumption that BTC ETF investors are primarily momentum-driven traders chasing rallies and exiting positions at the first sign of weakness.

Gold Comparison Highlights Unusual Investor Conviction

Balchunas also highlighted a telling comparison with gold. The SPDR Gold Shares, the world’s largest gold-backed ETF, ranks eighth in inflows this year, with approximately $20.8 billion added.

That figure comes despite GLD posting a dramatic gain of roughly 65% in 2025.

In other words, an asset enjoying one of its strongest years in decades still attracted less new money than a Bitcoin ETF that remains in negative territory.

“Crypto Twitter’s knee-jerk reaction is to whine about the [bitcoin] return,” Balchunas wrote. “But the real takeaway is that it was sixth place despite the negative return.”

From Short-Term Speculation To Long-Term Allocation

Balchunas framed the trend as evidence of a changing investor base.

“Boomers putting on a HODL clinic,” he said, using crypto slang to describe investors willing to hold through drawdowns rather than trade around short-term price movements.

“That’s a really good sign long term,” he added. “If you can do $25 billion in a bad year, imagine the flow potential in a good year.”

The inflow data suggests that spot Bitcoin ETFs are increasingly being used as strategic allocations rather than tactical trades.

Financial advisers, institutions, and longer-term investors appear to be treating Bitcoin exposure more like gold or broad equity indices — volatile assets held for diversification and long-term upside rather than immediate performance.

What Sustained Bitcoin ETF Demand Could Mean For BTC

If the pattern continues, it could have meaningful implications for the crypto market.

Persistent inflows during periods of weak price performance may help stabilize Bitcoin’s ownership base and reduce the intensity of future sell-offs.

Also read: $1.2B Vanishes from Bitcoin ETFs — But Schwab Sees a Bullish Signal

More broadly, IBIT’s experience in 2025 may set expectations for future market cycles. If spot Bitcoin ETFs can attract tens of billions of dollars during a down year, a sustained price recovery could unlock an even larger wave of capital from both institutional and retail investors.

For now, the data suggests Bitcoin ETF holders are proving more patient — and more committed — than many critics anticipated.