Missed Altcoin Season? Arthur Hayes Says It’s Been Playing Out All Along

While many cryptocurrency traders continue to wait for a clear signal that “altcoin season” has begun, Arthur Hayes argues that the market has already delivered one — just not in the way many expected.

Speaking during a podcast interview published to YouTube on Thursday, the BitMEX co-founder dismissed the idea that altcoin season is a single, synchronized event that sweeps across the market. Instead, Hayes suggested that traders who believe it has yet to arrive are simply positioned in the wrong assets.

“There is always an altcoin season happening,” Hayes said. “And if you’re always saying altcoin season isn’t there, it’s because you didn’t own what went up.”

Traders Stuck in Old Playbooks

Hayes said many market participants are still expecting altcoin season to unfold the same way it did in previous cycles, with familiar tokens and narratives repeating once Bitcoin rallies. That assumption, he argued, can leave traders blind to where capital is actually flowing.

“You wanted it to be like last altcoin season, because then you felt like you knew what you had to do,” Hayes said. “Oh, I gotta buy these things because that is what pumped in the last season.”

According to Hayes, the crypto market has matured and diversified to the point where relying on historical patterns is increasingly risky. New infrastructure, new applications, and shifting liquidity dynamics mean that each cycle rewards different assets.

“This is a new season,” he said. “New things pump.”

Hyperliquid and Solana as Proof Points

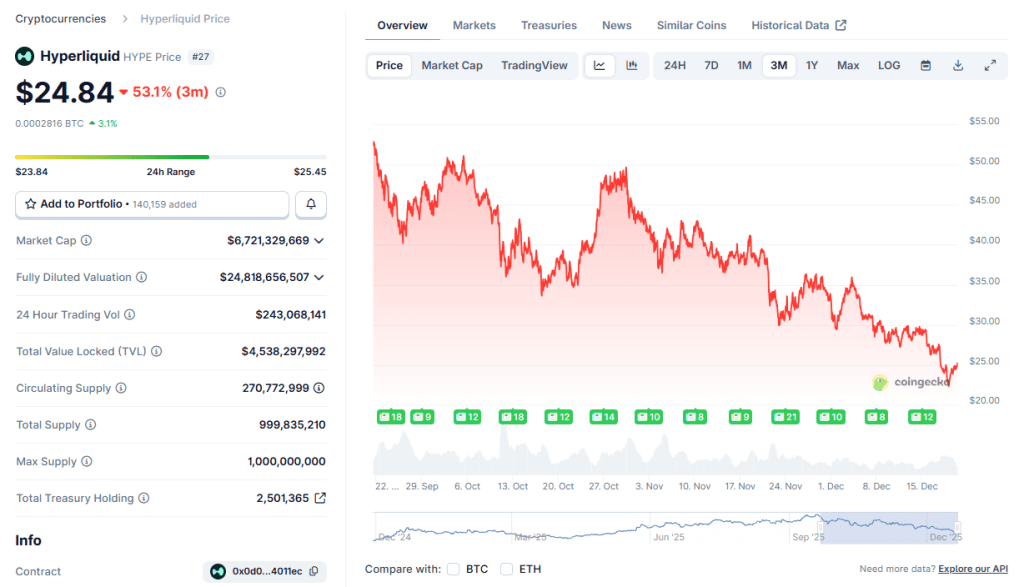

To illustrate his point, Hayes pointed to Hyperliquid, which he described as the strongest narrative of the current cycle. He noted that the platform’s HYPE token launched at roughly two to three dollars before surging as high as $60 during its rally.

HYPE price performance over the past 3 months (Source: CoinGecko)

Hayes also highlighted Solana, which suffered a dramatic collapse during the 2022 bear market, falling to near $7 before rebounding sharply. Solana went on to rally to nearly $300 earlier this year before retracing, underscoring how selective altcoin gains have been.

Also read: How to Research Altcoins Like a Pro (Even if You’re Just Getting Started)

Despite Solana’s recent pullback, Hayes said its recovery exemplifies his broader argument that altcoin season has already played out — just unevenly.

“Again, there’s been altcoin season,” he said. “You just didn’t participate in it.”

Competing Views on the Next Rotation

Some traders continue to anticipate a traditional rotation, with Bitcoin reaching new highs first, followed by Ethereum, before capital eventually flows into smaller-cap altcoins.

Others argue that the rise of ETFs has fundamentally altered market structure. Analysts at Bitfinex said in August that altcoins are unlikely to see a broad, outsized rally until ETFs expand beyond the largest cryptocurrencies, allowing institutional capital to access a wider range of digital assets.

For Hayes, however, the fixation on timing a single “altcoin season” may be misplaced. Rather than waiting for a market-wide surge, he believes traders should focus on emerging use cases, new platforms, and where real adoption is taking hold.