Bitcoin-Gold Ratio Slips to 2024 Lows as Investors Favor Bullion

The long-running comparison between Bitcoin and gold has tilted further in favor of the precious metal, with the ratio between the two assets sliding to its lowest level in more than a year. According to TradingView data, the Bitcoin-to-gold ratio fell to 20.18, marking its weakest point since Jan. 1, 2024. It has since recovered slightly to stand at 20.41 at press time.

While BTC continues to trade sideways in dollar terms—oscillating between roughly $86,000 and $90,000—the decline in the ratio places the spotlight on gold’s renewed appeal as a safe-haven asset. Bitcoin was modestly lower on the day, down about 1.5% against the U.S. dollar.

BTC price (Source: CoinMarketCap)

Safe-Haven Demand Boosts Gold’s Appeal

Gold’s strength has been fueled by mounting concerns over fiscal discipline in advanced economies and expectations that the Federal Reserve may begin cutting interest rates.

Against that backdrop, investors appear to be leaning toward assets with a long-established track record of preserving value during periods of macroeconomic and geopolitical uncertainty.

The sustained drop in Bitcoin’s performance relative to gold suggests that, despite its reputation as “digital gold,” the crypto is still being treated by many investors as a risk-on asset in the short term. Gold, by contrast, has benefited from its role as a hedge against inflation, currency debasement, and geopolitical shocks.

Tokenized Gold Gains Traction on Base

The shift toward gold has not gone unnoticed within the crypto sector. As investor interest in bullion grows, projects focused on tokenized real-world assets are increasingly positioning themselves to capture that demand.

This week, Gold Token S.A. (GTSA), the tokenization arm of precious metals group MKS PAMP, launched its physically backed gold token, DGLD®, on the Coinbase-backed layer-2 blockchain network Base and the decentralized exchange Aerodrome.

The token provides holders with legally enforceable ownership of PAMP® gold stored in Swiss vaults, with the option to redeem holdings for physical metal in denominations as small as one gram.

“Launching DGLD® on Aerodrome allows us to bring Swiss-vaulted physical gold directly into the centre of the Base ecosystem,” said Kurt Hemecker, CEO of Gold Token S.A. “Base and Aerodrome have become a gravitational hub for RWAs and DeFi innovations.”

Real-World Assets Meet DeFi Infrastructure

The launch comes amid rapid growth in tokenized real-world assets, particularly gold. The tokenized gold market surpassed $2.57 billion in capitalization by the third quarter of 2025, as investors seek assets that combine transparency, stability, and efficient settlement.

Liquidity for DGLD® on Aerodrome is being managed by Arrakis Finance, which aims to keep on-chain pricing closely aligned with real-world gold markets. The approach is designed to reduce slippage and maintain predictable execution, even during periods of heightened volatility.

By deploying DGLD® on Base via Ethereum’s native bridge, GTSA is tapping into an ecosystem with more than eight million monthly active users, positioning tokenized gold as a practical on-chain alternative for both retail and institutional participants.

Is Gold Rising—or Is the Dollar Falling?

As gold outperforms BTC and tokenized bullion gains momentum on-chain, a broader question is resurfacing across markets: are hard assets strengthening, or is the U.S. dollar simply losing purchasing power?

Some industry observers argue that recent crypto market weakness reflects geopolitical developments rather than a fundamental shift in long-term value. In commentary shared with Ecoinimist, Alexis Sirkia, Captain of Yellow Network, linked recent market dips to geopolitical tensions and their impact on the dollar.

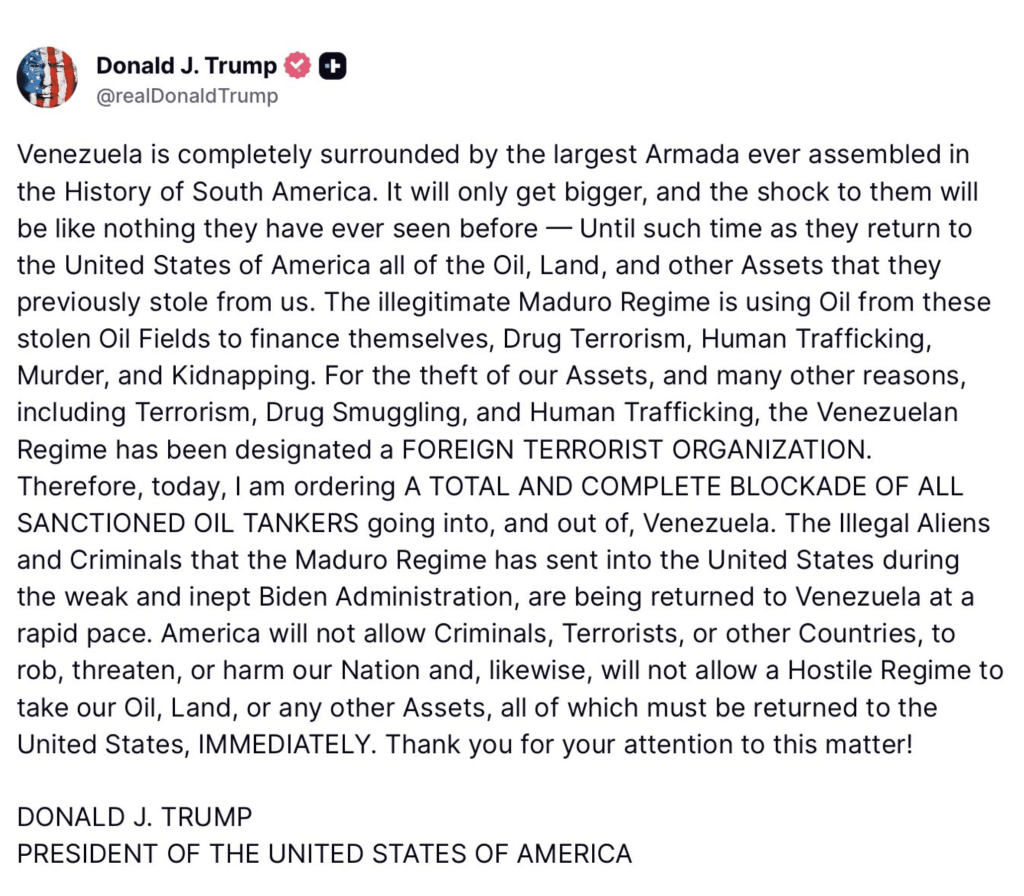

“Recent market dips likely stem from Trump’s comments regarding Venezuela, as potential military intervention would destabilize global markets and trigger short-term declines in Bitcoin and crypto,” Sirkia said.

Trump’s comments on Venezuela (Source: Truth Social

He added that such instability is “unlikely to benefit the USD,” arguing that any medium-term recovery in Bitcoin could be driven by the dollar’s weakening rather than intrinsic crypto growth.

“Like real estate or basic commodities like eggs, Bitcoin will likely appreciate against the USD over time primarily because the dollar continues to lose its fundamental value,” he said.

Geopolitics, Gold, and On-Chain Ownership

Similar themes were echoed in fresh commentary shared with Ecoinimist from Björn Schmidtke, Chief Executive Officer of Aurelion, Nasdaq’s first Tether Gold (XAU₮) treasury, who pointed to rising geopolitical stress as a catalyst for renewed focus on gold and its evolving market infrastructure.

“Escalating geopolitical tensions, most recently around the blockade of Venezuelan oil, are once again exposing how fragile global supply chains and pricing mechanisms remain,” Schmidtke said.

“Oil prices have moved higher, but the more telling signal is in gold, which is once again pushing toward the $4,381 high set in October.”

Schmidtke argued that geopolitical and macro instability is becoming structural rather than cyclical.

“In that environment, gold’s role as a hedge hasn’t changed, but the expectations around how investors access and hold it have,” he said. “What is changing is the infrastructure around how gold is accessed and held… In times like these, investors don’t want exposure, they want ownership.”