YouTube Adds Stablecoin Payouts as Big Tech Warms to Crypto

Big Tech’s cautious advance into crypto took another step this week as YouTube rolled out a new option allowing creators to receive payouts in PayPal’s U.S. dollar–pegged stablecoin, PYUSD.

May Zabaneh, PayPal’s head of crypto, confirmed the arrangement to Fortune, saying the feature is live but currently limited to creators in the United States.

A Google spokesperson also confirmed that YouTube has enabled payouts in PayPal’s stablecoin but declined to provide further details about the rollout or whether the option will expand internationally.

The change gives YouTube creators a new way to receive earnings while allowing Google to sidestep the technical and regulatory complexities of directly handling crypto assets.

Also read: IMF Warns Stablecoins Could Erode Monetary Sovereignty Worldwide

Built on PayPal’s Existing Payout Infrastructure

YouTube is already a long-standing customer of PayPal and uses the fintech company’s payouts service to distribute earnings to creators, contractors, and other gig workers.

That existing infrastructure made it easier to add stablecoin payouts without requiring YouTube to directly integrate blockchain technology.

Earlier in the third quarter, PayPal added support for PYUSD as a payout option for recipients using its enterprise payouts service. Following this update, YouTube decided to offer creators the choice of receiving their earnings in PayPal’s stablecoin, Zabaneh said.

“The beauty of what we’ve built is that YouTube doesn’t have to touch crypto and so we can help take away that complexity,” she added.

For creators, the option provides additional flexibility in how earnings are received and managed, particularly for those already active in PayPal’s ecosystem.

Stablecoins Gain Momentum Across Big Tech

YouTube’s interest in stablecoins comes amid growing enthusiasm across Silicon Valley for blockchain-based payment tools that promise faster settlement and lower costs than traditional financial rails.

Stablecoins—cryptocurrencies pegged to assets such as the U.S. dollar—have been central to the crypto industry for years.

Over the past year, however, they have gained broader acceptance, especially after President Donald Trump signed the GENIUS Act into law, establishing a regulatory framework for the assets.

Supporters argue that clear rules reduce uncertainty and make stablecoins more suitable for use by large corporations and financial institutions. This shift has drawn increased attention from major fintech and payments companies.

Stripe, for example, made a major bet on stablecoins in February when it acquired stablecoin startup Bridge for $1.1 billion, signaling confidence in the technology’s role in future global payments.

PayPal’s Expanding Stablecoin Strategy

PayPal has been among the earliest large technology companies to move into crypto. In 2020, the company enabled users to buy and sell Bitcoin, Ethereum, and other digital assets through its platform.

In 2023, PayPal launched PYUSD in partnership with Paxos, marking one of the first stablecoins issued by a major U.S. payments company. Since then, the firm has steadily expanded how the token can be used across its products.

Users can hold PYUSD in PayPal’s digital wallet and in Venmo, the peer-to-peer payments app PayPal owns. The stablecoin can also be used to pay merchants, and earlier this year PayPal said small- and medium-sized businesses will soon be able to use PYUSD to pay vendors.

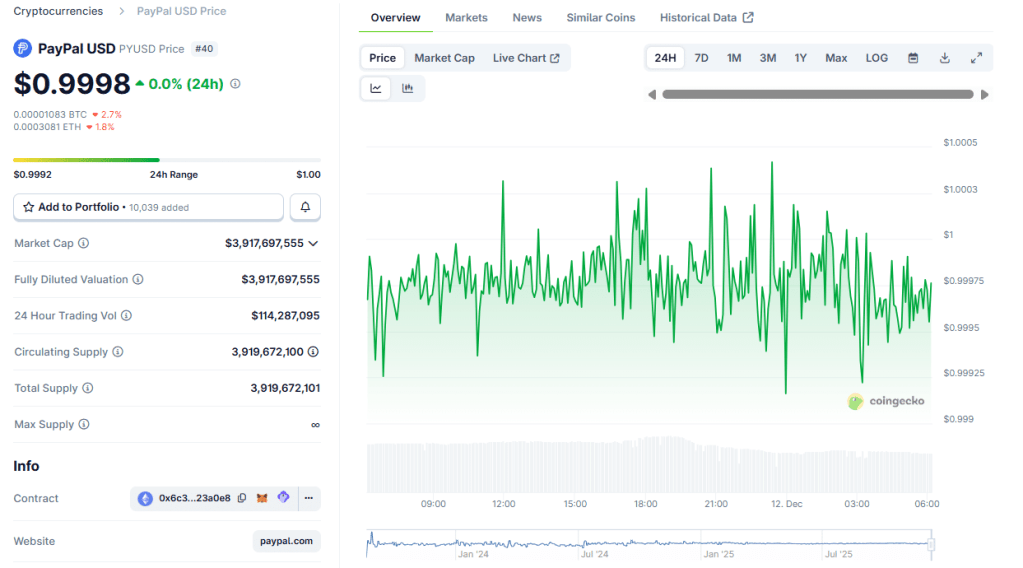

According to CoinGecko, PYUSD now has a market capitalization of nearly $4 billion.

PYUSD overview (Source: CoinGecko)

Google’s Prior Experiments With PYUSD

YouTube’s rollout is not the first time Google has tested PayPal’s stablecoin.

A Google Cloud executive previously said that the cloud computing unit had accepted PYUSD payments from two customers, marking an early experiment with stablecoin transactions inside the company.

While YouTube’s PYUSD payouts remain limited to U.S. creators for now, the move reflects a broader trend among Big Tech firms: integrating stablecoins quietly and selectively rather than launching sweeping crypto initiatives.

For now, YouTube’s approach suggests that stablecoins may gain traction first in back-end payment flows—where they can improve efficiency without forcing platforms or users to fully “touch crypto” themselves.