$10 Million Bitcoin Is Possible, Saylor Says — If Corporations Keep Buying

Michael Saylor used the stage at the Bitcoin MENA conference to mount one of his most sweeping defenses yet of corporate Bitcoin accumulation, arguing that public companies are no longer peripheral participants but structural engines powering Bitcoin’s transition into a multi-trillion-dollar monetary network.

His remarks came just days after Strategy shocked the market with another massive Bitcoin acquisition, purchasing 10,624 BTC for approximately $962.7 million at an average price of $90,615 per coin.

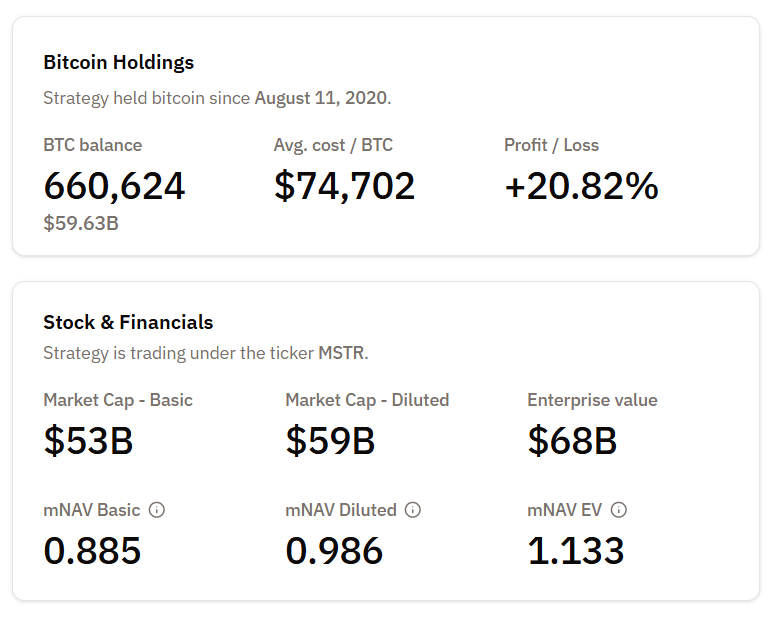

The buy lifted the company’s total holdings to 660,624 BTC, acquired for roughly $49.35 billion at an average price of $74,696 — placing Strategy’s Bitcoin exposure just shy of $50 billion in total investment.

Strategy BTC holdings (Source: Bitcoin Treasuries)

Saylor Rejects Concentration Fears

Addressing long-standing criticism that corporate treasuries threaten Bitcoin’s decentralization, Saylor argued that public companies function as distribution systems, not centralizing forces.

“We have somewhere in the range of 15 million beneficiaries,†Saylor said, referring to shareholders and institutional backers that include pension funds, insurance firms, and sovereign wealth vehicles.

He added that roughly 15% of Strategy’s securities are held inside retail accounts at Charles Schwab, reinforcing his argument that Bitcoin exposure is flowing outward to everyday investors rather than remaining locked inside corporate vaults.

Also read: Strategy’s Michael Saylor Sees Trillions Flowing Into Bitcoin-Backed Digital Banks

Saylor said Strategy has already “delivered Bitcoin interest to 50 million people,†a figure he expects to double to 100 million beneficiaries over the next several years as institutional adoption accelerates.

He also emphasized that visible corporate holdings represent only a fraction of Bitcoin’s real ownership structure.

According to Saylor, roughly 85% of all Bitcoin is held in opaque wallets or “dark pools,†where the identities of holders are unknown.

Since Strategy entered the market in 2020, Saylor claimed the company’s capital flows have helped drive approximately $1.8 trillion in additional value into the Bitcoin network, with the vast majority of that wealth transferred to holders outside the corporate economy.

“Without Us, Bitcoin Would Still Be $10,000â€

Saylor framed corporate Bitcoin accumulation as a necessary precondition for large-scale financialization.

“If we ever get to 5% of the network, Bitcoin’s going to be at least a million-dollar coin,†he said. “If we ever get to 7.5% of the network, Bitcoin will be $10 million.â€

At those levels, he projected that $18–$20 trillion — and eventually as much as $150 trillion — would be transferred to non-corporate holders, even as Strategy and other firms act as on-ramps for large capital pools.

Without public equity structures and credit instruments providing compliant access for pensions, insurers, and family offices, Saylor argued Bitcoin would still be priced near $10,000 and the entire network would remain capped around $200 billion in total value rather than competing at the scale of global sovereign money markets.

Current BTC price (Source: CoinGecko)

“If you want the network to become $20 trillion or $200 trillion,†Saylor said, “you have to allow corporations, money managers like BlackRock, and banks to enter the network.â€

Also read: CryptoQuant Says Strategy’s BTC Buying Collapse Signals Deep Bear Cycle Ahead

Accumulation Continues Despite Market Weakness

Despite Bitcoin’s recent struggles to reclaim its highs, Strategy has shown no hesitation in continuing to add to its position. The firm reported a 24.7% BTC yield year-to-date for 2025, a key internal metric measuring Bitcoin growth relative to share dilution.

Chaitanya Jain, the company’s head of Bitcoin, summarized the latest milestone on X: “Closing in on $50 billion of total investment in $BTC.â€

For supporters, the relentless accumulation reinforces Strategy’s conviction-based approach. For critics, it magnifies concerns about leverage and cyclicality just as technical warning signs intensify.

Japan’s “Digital Credit†Question Put to Saylor

Saylor’s appearance at Bitcoin MENA also intersected with the next frontier of corporate Bitcoin finance: Asia’s dormant perpetual preferred market.

The question of whether Strategy would list a perpetual preferred equity, or “digital credit,†in Japan was raised directly by Simon Gerovich, CEO of Metaplanet, the Tokyo-listed firm rapidly building its own Bitcoin treasury strategy.

Saylor’s answer was unequivocal. “Not in the next twelve months,†he said, adding that Gerovich now had a “twelve-month head start.â€

Metaplanet is preparing to issue two Bitcoin-linked perpetual instruments into Japan’s historically quiet preferred equity market. The country currently has only five listed perpetual preferreds, with All Nippon Airways recently becoming the fifth.

The first instrument, Mercury, is designed as Japan’s counterpart to Strategy’s convertible STRK preferred. It is expected to pay 4.9% in yen with conversion optionality, a yield Gerovich noted is nearly ten times higher than domestic bank deposits or yen money-market funds, which hover near zero. Mercury is in its pre-IPO phase, with a planned listing in early 2026.

The second instrument, Mars, is structured to mirror Strategy’s short-duration, high-yield STRC credit product.

Structural Differences Between Japan and the U.S.

Unlike Strategy, which relies heavily on at-the-market (ATM) offerings to raise capital for both common stock and perpetual preferred issuance, Japanese regulations prohibit ATM-style share sales. Instead, Metaplanet plans to use a Moving Strike Warrant (MSW) structure to facilitate capital formation for its preferred products.

The two executives also split on how broadly digital credit should be deployed.

Saylor encouraged widespread issuance and predicted a future with “a dozen†Bitcoin treasury companies offering institutional-grade crypto credit products.

Gerovich countered that balance-sheet strength should matter more than issuer count, stressing that Metaplanet intends to focus primarily on Japan and Asia before expanding elsewhere.

Corporate Bitcoin at a Market Crossroads

Together, Saylor’s bold projections, Strategy’s accelerating accumulation, Japan’s emerging digital credit push, and mounting technical warnings reveal a market at a critical junction.

Also read: Larry Fink Reveals State Investors Were Accumulating Bitcoin During the Crash

On one side stands Saylor’s thesis: that corporate balance sheets are now the ignition system for Bitcoin’s transformation into a $20-trillion-plus monetary network. On the other side, analysts see technical structures flashing caution just as corporate exposure reaches historic extremes.

Whether Strategy’s growing financial architecture ultimately stabilizes Bitcoin’s climb into the global reserve class — or amplifies the depth of the next downturn — is now one of the defining questions shaping crypto’s institutional era.