Ethereum Enters Its Tightest Supply Phase Ever as Exchange Balances Collapse

The amount of Ethereum (ETH) held on centralized cryptocurrency exchanges has fallen to an unprecedented low, a development analysts suggest could trigger a significant supply squeeze in the market.

This trend indicates a strong shift of ETH away from trading platforms and into various illiquid or long-term holding mechanisms, creating a notable scarcity that could influence future price dynamics.

Historical Lows for Exchange Balances

According to data compiled by blockchain analytics firm Glassnode, Ether exchange balances dipped to a mere 8.7% last Thursday, marking the lowest percentage since the Ethereum network first launched in mid-2015.

That critically low figure persisted, hovering at 8.8% through Sunday. This represents a dramatic decline in available ETH on exchanges, with a 43% reduction observed since the beginning of July alone. This period notably coincided with a marked increase in purchasing activity by digital asset treasuries (DATs) and other institutional or large-scale holders.

Also read: Ethereum Fusaka Upgrade Live – Why It’s a Major Turning Point for Validators, L2s

For perspective, while Bitcoin (BTC) has also seen outflows from exchanges in recent times, its exchange balance remains considerably higher at 14.7% compared to Ether’s dwindling reserves.

The rapid contraction in ETH’s readily available supply has not gone unnoticed by market observers. Macro investment research feed “Milk Road” commented on the situation, stating that “ETH is quietly entering its tightest supply environment ever,” emphasizing that this represents “a level we’ve never seen before.”

Drivers of ETH Supply Contraction

The sustained outflow of Ether from centralized trading platforms is attributed to a confluence of factors, each pulling ETH into environments where it is less likely to be immediately sold. These significant drivers include:

- Staking and Restaking: A considerable amount of ETH is locked up in staking protocols, particularly since the Merge transitioned Ethereum to a Proof-of-Stake consensus mechanism. The advent of restaking protocols further enhances this trend, as staked ETH is re-hypothecated to secure other networks, effectively doubling down on its illiquidity.

- Layer-2 Activity: As Ethereum’s Layer-2 scaling solutions gain traction and user adoption, more ETH is bridged to these networks for transactions, liquidity provision, and protocol engagement, thereby reducing its presence on Layer-1 exchanges.

- Digital Asset Treasuries (DATs): Corporate and institutional entities are increasingly accumulating ETH as part of their digital asset treasury strategies, holding it for long-term investment rather than active trading.

- Collateral Loops in DeFi: Within the decentralized finance (DeFi) ecosystem, ETH is frequently used as collateral for loans, synthetic assets, and other financial instruments, locking it into smart contracts and removing it from liquid circulation.

- Long-Term Custody: A growing number of investors are opting for long-term self-custody or secure institutional custody solutions, further removing ETH from centralized exchange order books.

Those combined forces paint a clear picture of Ether being systematically removed from liquid markets, suggesting a fundamental shift in its supply dynamics.

Technical Indicators Signal Underlying Strength

Beyond the supply crunch, technical analysis also points to underlying buying strength for Ether.

Analyst “Sykodelic” highlighted a significant development in the On-Balance Volume (OBV) indicator last Friday. OBV, a momentum indicator that uses volume flow to predict price changes, recorded a breakout above a critical resistance level.

While the immediate price action saw a rejection following this breakout, Sykodelic characterized this as a classic divergence. This phenomenon, where the indicator signals strength but the price temporarily falters, often suggests hidden buying strength and can frequently precede significant upside moves.

The analyst underscored the reliability of OBV, noting that they have “found that OBV tends to be one of the most reliable leading indicators” and suggested that “the PA [price action] just looks bullish,” anticipating higher prices before any meaningful pullback.

Also read: Europe’s $2.3T Asset Giant Amundi Rolls Out Tokenized Fund on Ethereum

Current Ethereum Price Action and Market Context

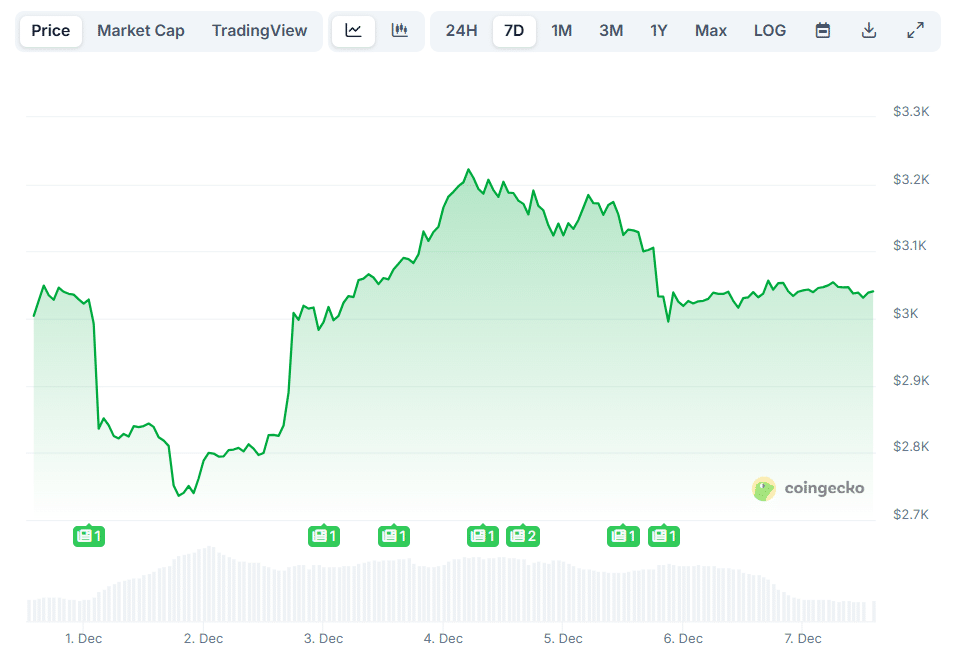

In terms of recent price performance, Ether has largely managed to hold above the $3,000 psychological threshold for the past five days.

However, it encountered notable resistance at the $3,200 level, failing to break through. Over the last 24 hours, the asset has consolidated around the $3,040 area.

ETH price (Source: CoinGecko)

Adding another layer to Ether’s market narrative, the ETH/BTC trading pair also garnered attention last week by successfully breaking above its long-standing downtrend line.

That development is often interpreted by analysts as a signal of potential outperformance for Ether relative to Bitcoin in the near to medium term, reflecting a broader shift in investor focus or capital allocation.

Also read: Tom Lee Says Ethereum Is Entering a “Supercycle” — But Bitcoin Maxis Aren’t Buying It

Market Sentiment Versus Supply Fundamentals

Despite the tightening supply fundamentals, current market sentiment can often feel heavy or indecisive.

However, as “Milk Road” aptly pointed out, “sentiment feels heavy right now, but sentiment doesn’t dictate supply.” The firm reiterated that “ETH supply is tightening in the background while the market decides its next move. When that gap closes, price follows.”