Vanguard Opens the Door to Crypto Funds, Allowing Trading of Bitcoin and Ether ETFs: Report

Vanguard, the $11 trillion asset-management giant long known as one of Wall Street’s most conservative institutions, is preparing to allow customers to trade cryptocurrency exchange-traded funds (ETFs) and mutual funds on its brokerage platform beginning Tuesday, according to reporting from Bloomberg.

The move marks a major shift for a firm that, until now, has kept digital assets at arm’s length even as competitors leaned into the fast-growing sector.

Andrew Kadjeski, Vanguard’s head of brokerage and investments, told Bloomberg that crypto-linked funds have proven their resilience and operational readiness during multiple bouts of volatility over the past several years.

“Cryptocurrency ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity,” he said.

“The administrative processes to service these types of funds have matured; and investor preferences continue to evolve.”

The change will allow Vanguard’s roughly 50 million clients—historically steered toward long-term index investing—to trade most regulated crypto ETFs and mutual funds that meet U.S. compliance standards.

The firm emphasized that its approach to digital-asset funds will mirror how it treats gold and other niche asset classes, offering access while maintaining strict internal criteria. Products tied to memecoins or funds lacking clear SEC support will remain prohibited, a stance consistent with Vanguard’s reputation for caution.

A Notable Shift for a Traditionally Crypto-Skeptical Titan

Vanguard’s decision represents one of the most significant endorsements yet of crypto’s growing foothold in mainstream financial markets.

For years, the company stood in stark contrast to firms such as BlackRock, Fidelity, and Invesco, who aggressively pursued crypto ETF approvals and trading infrastructure. Vanguard, by comparison, repeatedly stressed that digital assets had no place in traditional long-term portfolios.

Even now, the firm says it has no plans to launch its own crypto products. Instead, it will provide access to third-party vehicles that have already been vetted and regulated. Still, the pivot is substantial: it signals that demand among retail investors has reached a point where denying access may be riskier than enabling it in a controlled environment.

The timing also aligns with a broader wave of institutional acceptance.

Spot bitcoin ETFs—approved in January 2024 after more than a decade of regulatory deadlock—have grown at one of the fastest clips in ETF history.

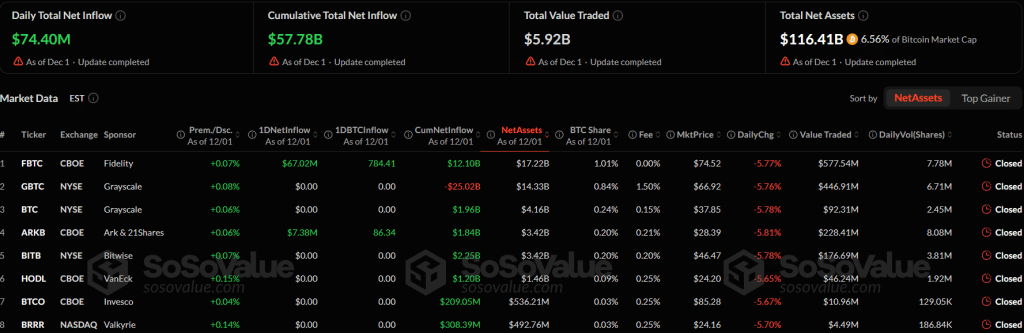

According to data from SoSoValue, spot bitcoin ETFs have ballooned to nearly $116 billion in assets under management (AUM), driven primarily by BlackRock’s IBIT and Fidelity’s FBTC products. Ether ETFs, launched just months later, have accumulated close to $20 billion.

US spot BTC ETF metrics (Source: SoSoValue)

Expanding Access to a Growing Market

By opening its platform to crypto funds, Vanguard effectively widens the reach of these products to a massive new audience.

The firm counts tens of millions of U.S. retail investors across its brokerage, retirement, and index-fund businesses. Even a modest adoption rate among Vanguard clients could meaningfully increase inflows into the digital-asset ETF ecosystem.

The move also shows how ETF wrappers have become the dominant gateway for U.S. investors seeking crypto exposure. After years of market distrust following high-profile exchange collapses and regulatory uncertainty, ETFs backed by large asset managers have emerged as a comparatively safe alternative—offering regulated custody, audited financials, and low-fee trading.

Vanguard’s new policy may amplify that trend. While the firm will not cater to speculative or unregulated crypto products, its decision to support mainstream ETFs indicates growing confidence that bitcoin and ether have staying power as portfolio assets.