Bank of America Joins Crypto Wave, Allowing 1%–4% Bitcoin Exposure for Clients

Bank of America, one of the largest financial institutions in the United States, has taken a decisive step into digital assets by allowing its wealth management advisors to recommend bitcoin exposure to clients for the first time.

Beginning in January, advisors across Merrill Lynch and the broader Bank of America Private Bank will be permitted to suggest a 1%–4% allocation to crypto assets, according to reporting from Yahoo Finance — a remarkable pivot for a bank that had previously kept its advisory units at arm’s length from crypto.

The internal greenlight marks a dramatic shift in sentiment inside one of Wall Street’s most conservative institutions.

For years, Bank of America allowed clients to invest in crypto products through brokerage channels if they insisted, but its advisors were strictly prohibited from recommending or initiating crypto exposure.

The new policy upends that long-standing posture and signals the bank’s growing acceptance that digital assets — and bitcoin in particular — are becoming a core component of modern portfolio construction.

Also read: Nasdaq Pushes to Supercharge IBIT Options as Bitcoin Goes Mainstream

A Focus on Four Spot Bitcoin ETFs

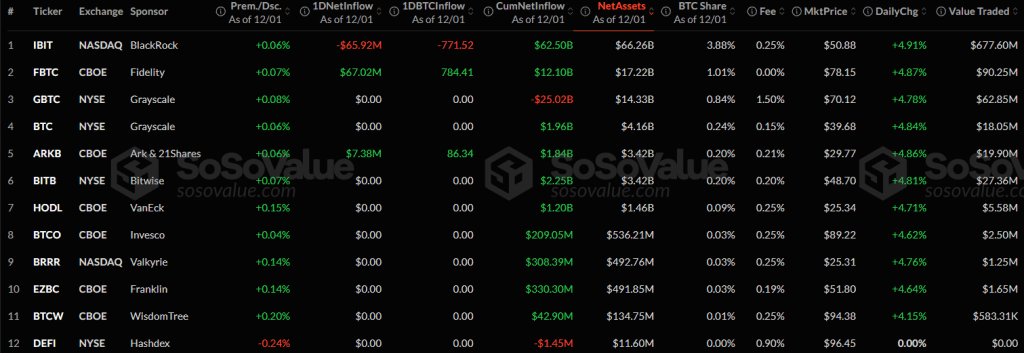

Under the new framework, Bank of America advisors will direct approved clients toward four U.S.-listed spot bitcoin ETFs: BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Bitwise’s Bitcoin ETF (BITB), and Grayscale’s Bitcoin Trust (BTC).

US spot BTC ETF metrics (Source: SoSoValue)

Those products have gained massive traction since their approval in January 2024, collectively capturing tens of billions in inflows and establishing themselves as the primary gateway for institutional bitcoin exposure in public markets.

By steering clients toward spot ETFs instead of direct bitcoin purchases, Bank of America is aligning itself with the dominant path taken by other major asset managers — offering the upside of BTC exposure while avoiding the complexities of self-custody, security risks, or on-chain transaction handling.

For a bank with deep regulatory sensitivities and a reputation for caution, ETFs provide a controlled bridge into digital assets that satisfies both compliance requirements and customer demand.

A Rapidly Shifting Landscape Across Wall Street

Bank of America’s move comes just hours after another industry heavyweight — Vanguard — reversed its long-standing resistance and announced it will now allow clients to buy and sell cryptocurrency ETFs on its brokerage platform. The back-to-back policy shifts represent a profound turning point for institutional engagement, reshaping how mainstream wealth managers handle digital assets.

The change brings Bank of America in line with the advisory practices of firms like BlackRock and Morgan Stanley, both of which have allowed wealth advisors to recommend bitcoin ETFs to suitable clients with varying levels of oversight.

The shift also intensifies pressure on a shrinking group of holdouts — including Wells Fargo, Goldman Sachs, and UBS — which have so far chosen not to formally embrace crypto advisory permissions.

Whether those institutions can maintain their distance is now increasingly unclear. With both Vanguard and Bank of America joining the ETF-access camp in the same 24-hour news cycle, Wall Street’s center of gravity appears to be moving decisively in bitcoin’s direction.

A Significant Philosophical Pivot

The recommendation allowance also underscores a philosophical shift at Bank of America. Once one of the most skeptical large banks regarding crypto’s place in wealth management, the firm has now adopted a framework that acknowledges both bitcoin’s durability and its role as a legitimate alternative asset.

“For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,” said Chris Hyzy, chief investment officer at Bank of America Private Bank. He noted that a 1% position may better suit conservative investors, while more risk-tolerant clients may consider exposure up to 4% of their portfolios.

Hyzy’s comments reflect a growing institutional consensus: bitcoin and other digital assets are no longer viewed merely as speculative tools, but as innovative components of diversified investment strategies — particularly within portfolios oriented toward long-term growth themes like decentralized finance, tokenization, and digital scarcity.

From Reluctance to Recognition

For Bank of America, integrating digital assets into wealth advisory channels marks the culmination of a multi-year transition from skepticism to pragmatic adoption.

In previous years, internal reports from the bank’s research divisions often framed crypto as volatile, unproven, or structurally incompatible with traditional banking models. Yet the explosive adoption of spot bitcoin ETFs, combined with mounting client demand across multiple demographics, created growing pressure inside the institution to modernize its position.

The arrival of spot ETFs appears to have been the turning point. Since their launch, these products have displayed deep liquidity, tight spreads, strong custody partnerships, and reliable market infrastructure — removing many of the operational risks that previously made institutions uneasy.

With the industry now shifting rapidly and bitcoin trading consistently above $80,000, the bank’s timing places it squarely within the wave of traditional finance players racing to meet investor appetite for crypto exposure.

As of early December, the market awaits responses from Wells Fargo, UBS, and Goldman Sachs — the remaining major U.S. wealth platforms still reluctant to formally permit bitcoin ETF recommendations. With Bank of America and Vanguard breaking decades-long barriers within a single day, analysts expect additional institutions to capitulate in the coming months.

If that happens, the U.S. wealth management landscape could reach a tipping point where bitcoin exposure is no longer niche or experimental — but standard.