BlackRock Fund Buys More of Its Own Bitcoin ETF as Institutional Demand Explodes

BlackRock is quietly deepening its exposure to Bitcoin.

According to a new regulatory filing with the U.S. Securities and Exchange Commission (SEC), the firm’s Strategic Income Opportunities Portfolio has increased its holdings of the iShares Bitcoin Trust (IBIT), marking another vote of confidence in the flagship cryptocurrency from the world’s largest asset manager.

The filing shows that the fund held 2,397,423 IBIT shares worth approximately $155.8 million as of Sept. 30, a 14% increase from the 2,096,447 shares reported at the end of the second quarter.

The move signals that the firm’s internal portfolios are not only launching Bitcoin products—but are actively allocating to them.

Also read: Ex-BlackRock Executive Says Ethereum Will Power Wall Street’s Future

A Flexible Bond Fund Leaning Into Bitcoin

The Strategic Income Opportunities Portfolio is not a crypto-themed fund.

It’s an unconstrained bond portfolio—a strategy designed to move across a wide range of traditional fixed-income instruments including Treasuries, corporate bonds, mortgage-backed securities, emerging-market debt, and cash-like holdings.

What sets it apart, however, is its flexible mandate. The fund is structured to allocate to nontraditional instruments such as ETFs when doing so improves its risk-return profile or strengthens diversification.

BlackRock appears increasingly comfortable blending Bitcoin exposure with fixed-income strategies, a trend reflecting broader institutional shifts. For many managers, Bitcoin’s low correlation to bonds—combined with its asymmetric upside—makes small allocations attractive within multi-asset portfolios.

Also read: BlackRock Becomes the New Home for Bitcoin Billionaires: Bloomberg

IBIT in the Spotlight as Options Limits Rise

The timing of BlackRock’s increased allocation aligns with growing institutional interest in IBIT itself.

Earlier this week, Nasdaq ISE filed to raise the position limit for IBIT options to one million contracts, a move that would significantly expand trading capacity for one of the world’s most liquid Bitcoin ETFs.

Option limits are typically raised only when market demand becomes too large for existing parameters, suggesting trading firms and institutional investors are eager to scale up activity around IBIT’s derivatives market.

At the same time, data from Fintel shows that institutional ownership of IBIT has reached its highest level since launch, with more than 400 million shares held by institutions.

Market Moves Back Bitcoin’s Momentum

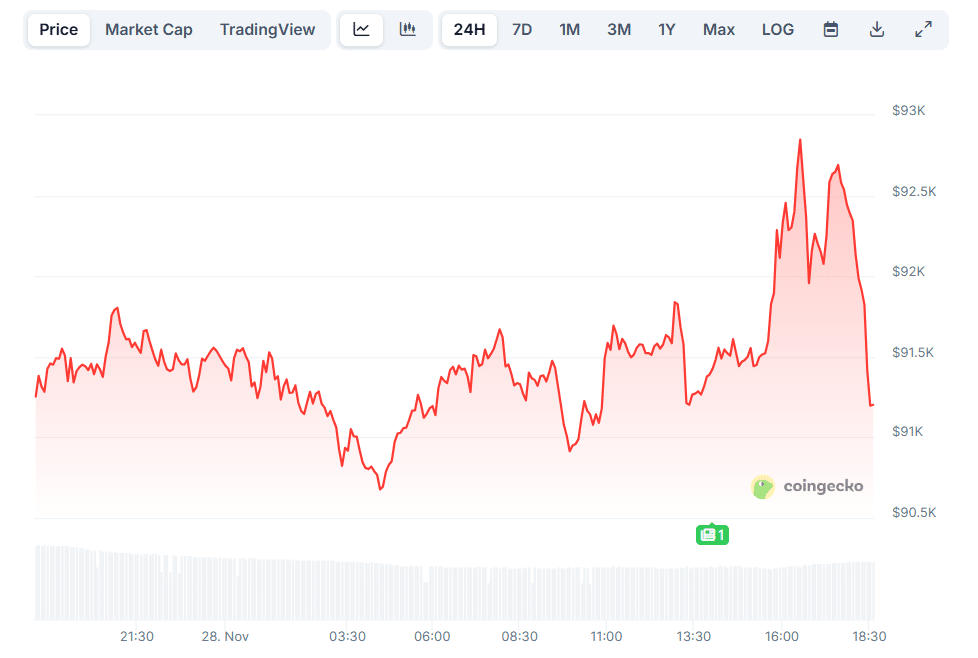

Bitcoin’s price action appears to support the surge in interest.

On Friday, BTC surpassed $91,000, continuing its upward trajectory and adding to this year’s institutional-led rally. IBIT itself is trading up about 2% in premarket hours, hovering around $52 per share.

BTC price (Source: CoinGecko)

A Signal of How Wall Street Is Integrating Bitcoin

The Strategic Income Opportunities Portfolio’s growing allocation to IBIT shows how Bitcoin is becoming increasingly normalized inside traditional finance. What was once viewed as a speculative instrument is now being incorporated into the asset mix of one of the world’s most conservative investment categories: bond funds.

Also read: BlackRock CEO Larry Fink Says We’re Entering the Tokenized Age of Finance

Although Bitcoin remains more volatile than traditional assets, its evolving role as a macro hedge and potential store of value is reshaping allocation strategies across major firms. As managers look for ways to diversify returns in an environment of rate uncertainty and shifting global liquidity, small but meaningful Bitcoin allocations are becoming more common.

BlackRock’s latest filing doesn’t just show increased exposure—it signals growing institutional comfort, advancing demand, and the continued mainstreaming of Bitcoin-based financial products.

With IBIT hitting record institutional ownership, derivatives limits expanding, and Bitcoin trading above $91,000, Wall Street’s integration of digital assets appears to be entering a new phase—one defined not by experimentation, but by strategic allocation.