UAE Sovereign Wealth Fund Boosts Bitcoin Holdings as Market Dips

The Abu Dhabi Investment Council (ADIC) has dramatically expanded its exposure to Bitcoin, nearly tripling its holdings in BlackRock’s iShares Bitcoin Trust (IBIT) during the third quarter.

The disclosure, reported by Bloomberg, has been widely interpreted as yet another sign that institutional interest in digital assets across the United Arab Emirates is accelerating.

ADIC, which operates under the Mubadala Investment Company, increased its IBIT stake from 2.4 million shares at the beginning of Q3 to almost 8 million by Sept. 30.

Based on IBIT’s end-of-quarter price of $65 per share, the position was valued at approximately $520 million. The investment came during a period marked by sharp volatility in Bitcoin markets, indicating a strong long-term conviction in the asset.

The council told Bloomberg it views Bitcoin—priced at $92,557 at the time—as the “digital equivalent of gold,” reflecting a broader narrative that has taken hold among regional sovereign funds and global asset managers.

Also read: Bernstein Says Bitcoin’s 25% Crash Isn’t a Peak — ‘This Cycle Is Different’

Volatility Hits Bitcoin and IBIT, but Confidence Remains

The quarter concluded just days before Bitcoin surged to an all-time high of $125,100 on Oct. 5, only to drop back below $90,000 this week.

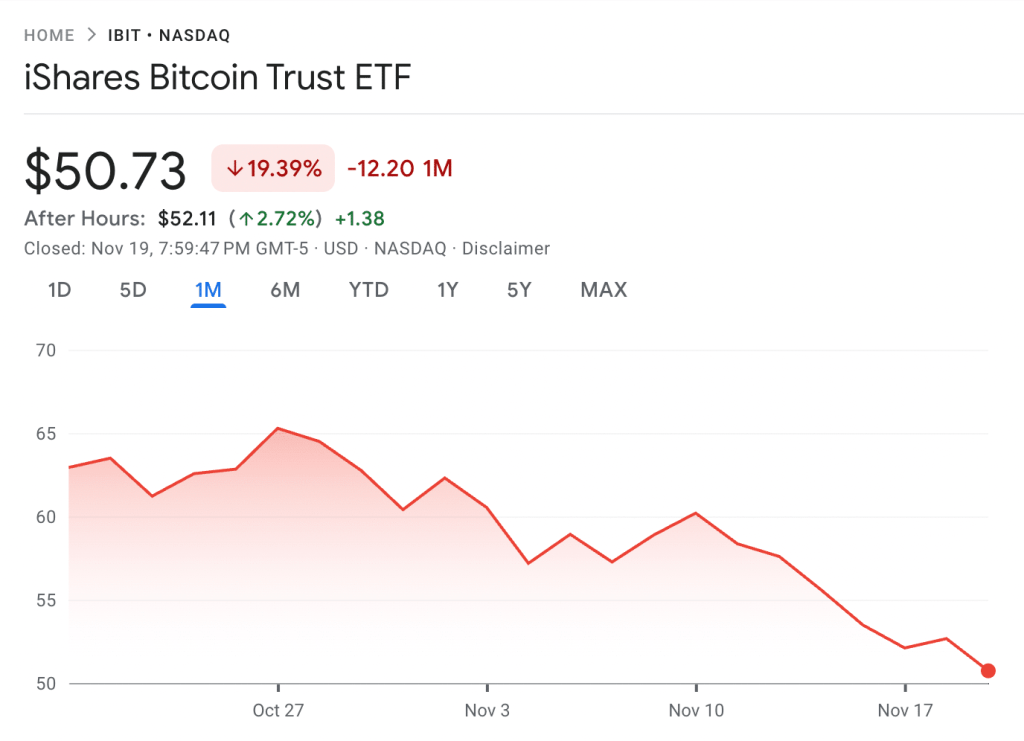

That decline has pressured IBIT as well. The ETF climbed to $71 per share on Oct. 6 but has since fallen sharply, closing Wednesday at $50.71. According to Google Finance, IBIT is down more than 19% over the last 30 days and 23% since the end of Q3.

IBIT’s stock price is down over 19% in the past 30 days (Source: Google Finance)

Despite the price swings, many observers say ADIC’s move demonstrates rising institutional confidence in the digital asset sector.

Zayed Aleem, treasury manager at crypto investment platform M2, called the investment “fantastic to see,” adding that it underscores how the UAE continues to cement itself as a global digital-asset hub.

Crypto commentator MartyParty echoed the sentiment, describing the accumulation as a “strategic bet on BTC’s role as a store of value.”

IBIT Faces Record Outflows Amid Bitcoin’s Latest Pullback

The expansion of ADIC’s position comes as IBIT experiences heightened pressure. On Tuesday, the ETF recorded its largest single-day outflow since launching in January 2024, shedding $523.2 million as Bitcoin briefly fell to $88,000, according to Farside Investors.

US spot BTC ETF flows (Source: Farside Investors)

Bitcoin has since recovered slightly, according to CoinMarketCap, but the pullback has weighed heavily on ETF performance across the board.

Bloomberg ETF analyst Eric Balchunas noted that IBIT is undergoing an “ugly stretch,” even though its year-to-date flows remain extremely strong.

“YTD flows are still at an astronomical +$25b (6th overall). All told $3.3b in total outflows past month from BTC ETFs, which is 3.5% of AUM,” he said.

Since its January launch, IBIT has recorded roughly $63.12 million in net inflows, according to Farside.

Analysts Split on Bitcoin’s Next Move

Bitcoin’s latest downturn has left analysts divided on whether the market is entering a deeper correction or setting up for a rebound. A pseudonymous analyst known as VICTOR suggested the current price zone may present a compelling opportunity for long-term investors, calling it “the close your eyes and bid type of range.”

While short-term sentiment remains mixed, ADIC’s bold expansion into Bitcoin highlights the broader shift underway in global capital markets. With sovereign wealth funds and major financial institutions allocating more aggressively to digital assets, the UAE continues to position itself as a heavyweight in the industry—regardless of short-term price turbulence.