Ark Invest Loads Up on Coinbase, Circle, and Bullish in Fresh Multi-Million-Dollar Push

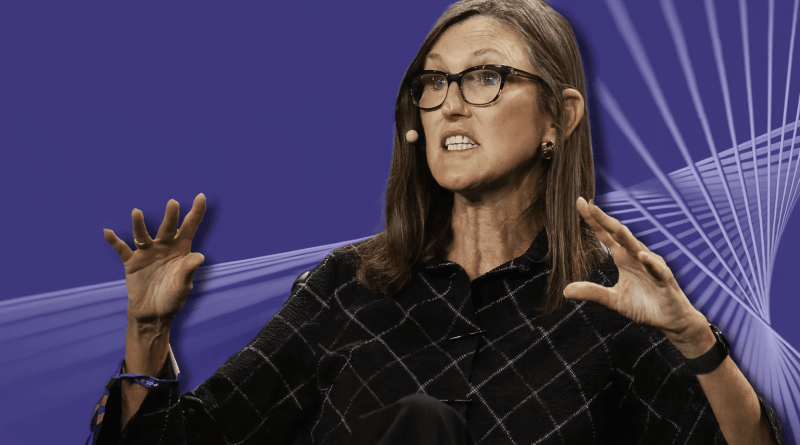

Cathie Wood’s Ark Invest is continuing its aggressive accumulation of crypto-linked equities, adding millions of dollars’ worth of Coinbase, Circle, and Bullish shares across two of its flagship exchange-traded funds on Tuesday.

The move further extends the firm’s weeks-long buying streak as Ark amplifies its exposure to digital-asset infrastructure amid rising institutional interest and improving fundamentals across the sector.

According to Ark’s Tuesday trade filing, the ARK Innovation ETF (ARKK) and the ARK Fintech Innovation ETF (ARKF) purchased a combined $3 million in Coinbase Global shares and $3.1 million in Circle Internet Group shares. ARKF also added $1.1 million worth of Bullish, the fast-growing crypto exchange backed by billionaire venture capitalist Peter Thiel.

The latest round of buying came even as market conditions remained relatively calm for crypto equities. Coinbase shares closed Tuesday down 0.82% at $261.79, while Circle inched up just 0.013% to $76.60, according to Google Finance data.

The flat trading session did little to slow Ark’s conviction in the sector, reflected in its steady campaign of loading up on digital-asset stocks.

Also read: ARK Invest Bets Big on Securitize as Tokenization Heats Up

Ark Invest’s Multi-Week Crypto Equity Accumulation Accelerates

Tuesday’s purchases were not an isolated move but part of a much broader accumulation strategy underway across Ark Invest’s basket of thematic ETFs.

On Monday, Wood’s firm bought $10.2 million worth of Bullish shares spread across three of its funds. That followed a heavy buying session last Thursday, when Ark purchased $7.28 million in Bullish, $15.56 million in Circle, and $8.86 million in BitMine, the expanding digital-assets infrastructure company known for its recent pivot into GPU-powered AI operations.

In total, Ark has allocated tens of millions of dollars to crypto-adjacent public companies over the past two weeks, signaling growing optimism in the profitability and strategic positioning of the industry’s most established firms.

Ark’s Broader Crypto Strategy

Ark Invest’s ongoing accumulation comes during a renewed period of structural interest in crypto infrastructure stocks. Even in periods of modest price action, these equities have seen heightened investor attention due to:

- increasing institutional usage of digital-asset platforms

- anticipated benefits from clearer U.S. crypto regulatory frameworks

- growing demand for stablecoin settlement and tokenized markets

- rising convergence between crypto exchanges and AI/HPC data-center businesses

Wood has long maintained that crypto and blockchain technologies will form a foundational layer of global financial markets, similar in magnitude to the internet’s impact on commerce and communications.

Her firm’s consistent buying streak demonstrates that Ark sees the current market environment as a moment of accumulation rather than caution.