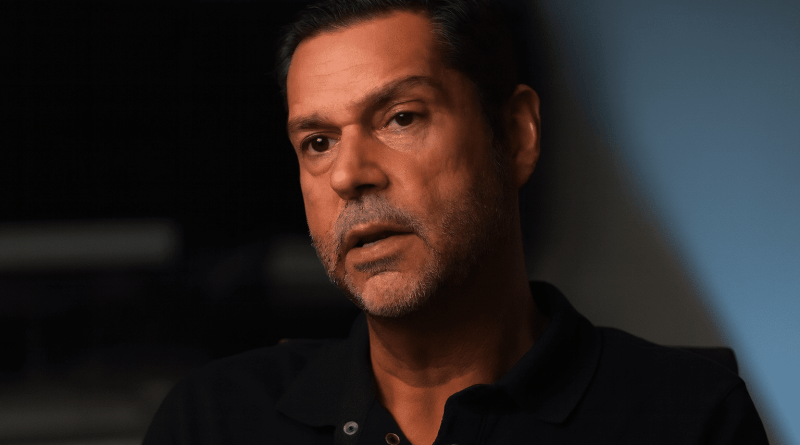

Raoul Pal Calls Out Fearful Crypto Investors: “You’re Not Serious People”

Macro investor and Real Vision co-founder Raoul Pal issued a stark message to shaken crypto traders on Sunday, warning that emotional reactions to routine market drawdowns are a sign of poor strategy — not market failure — as digital assets continue to retrace from recent highs.

In a lengthy post shared on X, Pal addressed what he described as rising fear and frustration across the crypto community.

“I know many of you are scared, worried you fucked it up and think you’ll never make it,” he wrote, adding that too many market participants abandon discipline at the first sign of volatility.

Pal’s comments come as Bitcoin falls more than 24% from its cycle peak and altcoins extend deeper losses — a pattern he insists is entirely typical in crypto bull markets. His message to investors: zoom out, toughen up, and stay focused on long-term allocation.

BTC price (Source: CoinMarketCap)

“Every Correction Is an Existential Drama to You”

Pal, who has been active in crypto markets for over a decade, said many newcomers are ignoring what he calls the “DFTU rules,” a mindset centered on extending time horizons and cultivating patience.

“You need to extend your time horizon and levels of patience. You are clearly not doing that,” he wrote. “Every correction is an existential drama to you. That is a sign you are fucking it up.”

He reminded followers that he has personally lived through some of the industry’s most brutal market cycles. “I’ve gone through two big drawdowns (-85% and -70%). I’ve had 95% drawdowns in ETH and SOL. I’ve sold too early too,” he said. “It all works out over time if you have the right asset allocation.”

Routine Retracements, Not Structural Failure

Pal emphasized that steep corrections are part of the historical rhythm of crypto markets.

“Remember — when BTC goes down 30%, quality alts go down 60%+. It’s normal. BTC normally has 5+ 35% corrections,” he wrote, noting that previous bull markets saw even more extreme moves.

He referenced the performance of the “OTHERS” index — a basket of non-Bitcoin large-cap cryptos — which endured “a couple corrections of 80% and still hit new highs,” though he cautioned that past index recoveries do not guarantee similar results for individual tokens.

Pal’s broader message: volatility is not evidence of weakness, and a cycle cannot be judged by a single downturn.

On Conviction, Blame, and Overtrading

Pal also criticized traders who rely on social media influencers for guidance or attempt to actively trade volatile markets without a clear strategy.

“You also can’t rent someone’s conviction on X and hope to win,” he wrote. “You can’t trade frequently and hope to win (you’ll get nailed by taxes too). You can’t blame someone else for your mistakes. They are yours alone.”

Instead, Pal urged investors to build personal conviction and stick to long-term accumulation strategies, even during periods of uncertainty.

DCA as a Path Through Fear

For those convinced that the current cycle may be nearing an end, Pal argued that dollar-cost averaging remains a viable and historically resilient strategy.

“You may think the cycle is over. Well if it is, just keep DCA’ing into weakness and your future self will thank you,” he said. “It takes time to play out and one cycle is not the game.”

He added a blunt but motivational warning: “It’s not too late to Unfuck your future.”

“You Are Not Serious People”

One of Pal’s most pointed criticisms was directed at what he described as incessant complaining from traders who entered the market without realistic expectations for volatility.

“All the people bitching on the timeline … YOU ARE NOT SERIOUS PEOPLE,” he wrote.

He closed his message by reminding investors that markets operate independently of individual hopes or timelines.

“Please don’t fuck this up,” Pal said. “I’m looking directly at you… this is the greatest performing asset class of all time, over time. The market gives zero fucks about your time horizon.”

As crypto prices continue to slide from recent highs, Pal’s comments underscore a broader industry debate: whether the ongoing retracement marks the beginning of a deeper correction or just another routine shakeout in an otherwise intact bull cycle.