Peter Schiff Calls Strategy a “Fraud” as Bitcoin Falls — Saylor Hints at New BTC Buy

Gold investor Peter Schiff reignited his long-running feud with the crypto industry on Sunday, taking direct aim at Strategy (MSTR) and its executive chairman Michael Saylor.

In a series of posts on X, Schiff labeled the company’s debt-powered Bitcoin treasury model a “fraud” and challenged Saylor to a public debate at Binance Blockchain Week in Dubai this December.

Schiff — a long-time critic of digital assets and one of the gold market’s most visible advocates — accused Strategy of building its business on unsustainable financial engineering.

“MSTR’s business model relies on income-oriented funds buying its ‘high-yield’ preferred shares,” Schiff claimed. “But those published yields will never actually be paid. Once fund managers realize this, they’ll dump the preferreds.”

According to Schiff, that would trigger a liquidity crisis severe enough to unravel Strategy’s entire capitalization structure. If preferred-share buyers exit en masse, he argued, the company would be unable to issue additional debt — the foundation of its Bitcoin-accumulation strategy — ultimately leading to what he described as a “death spiral.”

The remarks landed at a sensitive moment for the crypto-treasury sector. Bitcoin dropped below $99,000 over the weekend, extending a correction that has erased more than 20% from its early-October all-time high above $125,000.

The downturn has amplified concerns about the financial resilience of publicly traded companies whose valuations now closely track the price of Bitcoin.

At the same time, gold has surged back above key psychological levels, reclaiming territory over $4,000 per ounce after briefly dipping below the threshold earlier this month. The renewed strength has emboldened Schiff’s long-held view that Bitcoin’s volatility makes it unsuitable as a reserve asset — particularly for corporations borrowing against their balance sheets to acquire it.

Bitcoin, Strategy Slide as Gold Holds Firm

The contrast between the two assets has become increasingly stark. Gold’s price performance has maintained upward momentum through much of the fourth quarter.

Meanwhile, Bitcoin’s chart reflects widening swings driven by macro uncertainty, tech-stock weakness, and cascading liquidations across leveraged crypto markets.

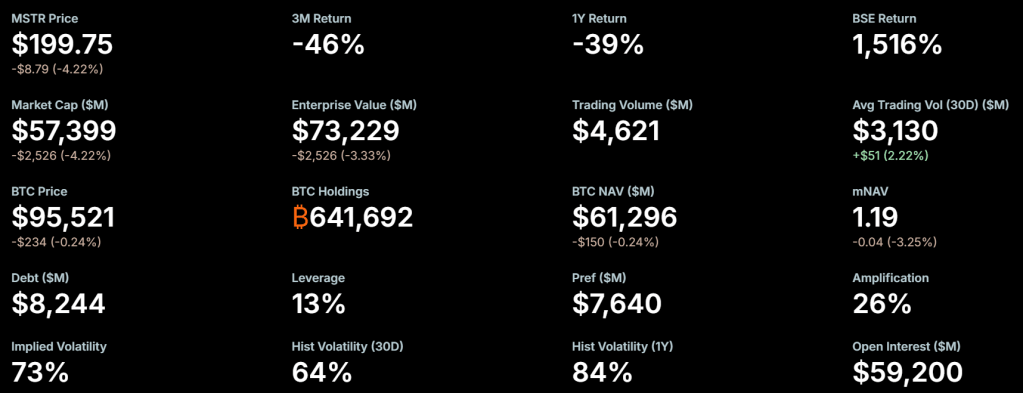

Strategy has been hit particularly hard. The company’s mNAV — a metric reflecting the premium of its market capitalization over the value of its underlying Bitcoin holdings — briefly fell below 1 in early November. While it has since rebounded to 1.19, the figure remains far below the 2.0 level that many institutional investors consider a sign of strength for a Bitcoin-treasury-focused company.

MSTR metrics (Source: Strategy)

Despite the partial recovery, Strategy’s stock price has cratered. Shares are down more than 50% since July and are currently trading near $199.

Strategy share price (Source: Google Finance)

Analysts note that the company’s dependence on capital markets to expand its Bitcoin position leaves it highly sensitive to shifts in investor sentiment, especially when risk appetite deteriorates across the broader crypto sector.

Gold, by contrast, is trading at around $4,085 per ounce at the time of writing — comfortably above its key support level. The metal reached a record high of approximately $4,380 per ounce in October, briefly pushing its total market capitalization above $30 trillion before moderating to current levels.

Schiff Doubles Down — But Saylor Prepares a Counterpunch

The public challenge adds a new chapter to Schiff’s years-long rivalry with Saylor, who has positioned Strategy as the world’s leading corporate Bitcoin holder through an aggressive series of debt raises, stock sales, and convertible note issuances.

Saylor has consistently argued that Bitcoin is a superior long-term asset compared to gold, describing BTC as “digital energy” and “the future of money” in past interviews.

While Saylor has not directly responded to Schiff’s accusations, he hinted in a recent X post that Strategy is preparing another Bitcoin purchase announcement.

The move would continue the company’s pattern of buying dips — a strategy that has earned it praise from Bitcoin advocates but scrutiny from analysts concerned about leverage.

Whether a public debate between the two outspoken industry figures actually takes place remains to be seen. But amid market turbulence, Schiff’s criticisms have found a renewed audience, while Saylor appears poised to double down yet again on his conviction that Bitcoin remains the ultimate long-term store of value.

For now, the battle lines are clear: as Bitcoin and crypto-treasury stocks struggle, gold sits comfortably above its psychological threshold — and Peter Schiff is ready to remind the industry why he believes that matters.