Stablecoins Near a Breakout in Emerging Markets, Says Exodus CFO

Stablecoins may be on the verge of their most significant global shift yet — and emerging markets are set to lead it.

That’s the view of James Gernetzke, Chief Financial Officer of Exodus, who says the company is already tracking real-world metrics that signal stablecoins are moving beyond speculation and into everyday economic life.

In an email to Ecoinimist, Gernetzke described a landscape where rising inflation, weak local currencies, and costly payment rails are creating ideal conditions for digital dollars to flourish.

But while adoption is accelerating quickly, he cautioned that a full replacement of traditional payment rails will hinge on a few missing pieces.

Also read: Stephen Miran Says Stablecoins Are a ‘Multitrillion-Dollar Elephant’ for Central Banks

Adoption Is Rising Faster Than Perception

According to Gernetzke, the momentum behind stablecoins is no longer confined to crypto-native users.

“In many markets, stablecoins already function as payment rails — faster, cheaper, and more accessible than traditional systems,” he said.

The key shift Exodus is seeing is not just the issuance of stablecoins but actual spending volume — a signal that users are beginning to treat digital dollars as money, not merely a hedge. Merchants, he added, are increasingly aware of the operational advantages.

“The advantages merchants see in accepting stablecoins are obvious – low fees, instant settlement, improved working capital,” Gernetzke noted.

He believes the next phase of growth will be driven by merchants themselves offering incentives to attract retail users, which could “add fuel to adoption.”

Still, he emphasized that “overtaking” traditional systems fully will require regulatory clarity, reliable on- and off-ramps, and widespread merchant integration.

Also read: Stablecoins Now Capture 75% of Crypto Protocol Revenue, Outpacing All Other Sectors

Stablecoins as Digital Dollars — Not a Challenge to Sovereigns (Yet)

For countries battling persistent inflation or currency depreciation, stablecoins have taken on a different role entirely: they’re becoming digital stand-ins for the U.S. dollar.

Gernetzke emphasized that this is not a dramatic disruption but rather an evolution of what is already happening.

“The U.S. dollar is already more sought after, used, and depended on as a store of value than local currencies,” he said. In many markets, he added, citizens already “choose to use the U.S. dollar rather than their own fiat currency.”

Dollar-pegged stablecoins, then, are simply a more efficient mechanism for accessing something people already trust. While he acknowledged the possibility that national currencies could eventually take a backseat to cross-border digital units, he stressed that Exodus does not foresee “anything that transformative” happening quickly.

Merchant Adoption Could Be the Breakthrough Catalyst

One of the most revealing signals from Exodus is where the company is placing its own bets. Earlier this year, Exodus acquired Grateful — a move Gernetzke framed as a direct effort to accelerate merchant adoption.

“With our acquisition of Grateful we are looking to speed up merchant acceptance, moving more and more merchants to stablecoins as default,” he said.

The company is developing an app designed to let users transact in stablecoins without navigating the complexities typically associated with crypto payments.

“We’re building toward an app where users are transacting in stablecoins, but without the technical hassle of switching between coins, blockchains or fiat currencies,” Gernetzke explained.

If successful, this abstraction of blockchain complexity could push stablecoin usage further into mainstream consumer behavior — especially in markets where banking access is fragmented or unreliable.

Also read: Stablecoins to Reshape Post Trade Markets Within Five Years:Citi Report

Trust Is No Longer the Barrier It Once Was

Despite past concerns around volatility, depegs, and regulatory scrutiny, Gernetzke says trust among emerging-market users has reached a turning point.

“We wouldn’t have acquired Grateful or focused so much of our innovation on payments and stablecoins if they weren’t already a trusted source of transacting and storing value,” he said.

However, he acknowledged that education remains a priority — particularly for users who are not digitally native.

Exodus’ strategy, he said, is to make stablecoins “easier and more intuitive” so consumers can benefit from them without needing to understand blockchain itself.

A Quiet Shift with Global Consequences

The biggest takeaway from Gernetzke’s comments is a sense that stablecoin adoption is no longer waiting for a breakthrough moment — it is quietly happening in the background, transaction by transaction, vendor by vendor.

If merchant incentives accelerate and regulatory pathways continue to open, 2026 may indeed be the year stablecoins become the default payment method in parts of the world where traditional financial systems have failed to keep pace.

For now, the signal from Exodus is clear: stablecoins are no longer a crypto experiment — they’re rapidly becoming infrastructure.

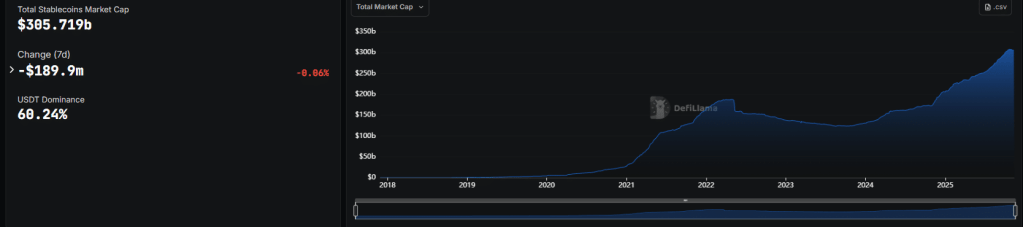

Stablecoin Market Soars Above $300 Billion

Gernetzke’s comments come as the broader stablecoin landscape reaches a turning point, underscoring why companies like Exodus are leaning deeper into the sector.

This year, the global stablecoin market cap surpassed US$300 billion for the first time, according to DefiLlama data — a milestone that reflects one of the fastest expansions in the industry’s history.

Stablecoin market cap (Source: DefiLlama)

Meanwhile, reports have highlighted that stablecoin supply has climbed roughly 72% year-to-date, driven by a combination of institutional demand, regulatory clarity, and record issuance volumes across major and emerging networks.