Michael Saylor’s Strategy Adds $50 Million in Bitcoin as Jim Chanos Ends Short Bet

Billionaire Michael Saylor’s Bitcoin acquisition firm, Strategy, has once again bolstered its position as the world’s largest corporate holder of Bitcoin, adding another 487 BTC to its already massive treasury.

The purchase, revealed in a recent SEC filing, shows Saylor’s unwavering conviction in Bitcoin as a superior store of value and an essential reserve asset for the digital age — even as markets remain volatile.

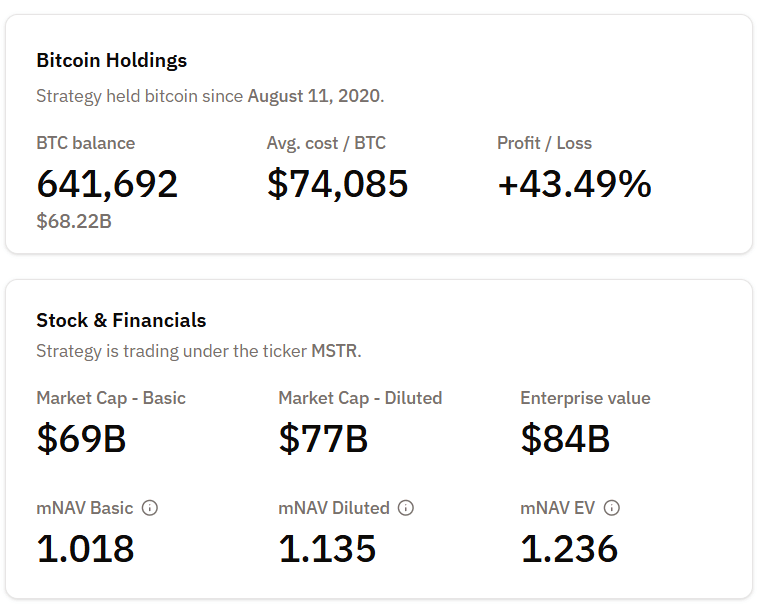

Between Nov. 3 and Nov. 9, Strategy purchased 487 Bitcoin for approximately $49.9 million in cash, at an average price of $102,557 per Bitcoin, inclusive of all fees and expenses. The move lifts the firm’s total holdings to 641,692 BTC, acquired for a cumulative $47.54 billion at an average purchase price of $74,079 per Bitcoin.

At current market valuations, Strategy’s Bitcoin portfolio is worth well over $65 billion, reinforcing its dominance as the largest corporate Bitcoin holder globally, far ahead of competitors such as Metaplanet and KindlyMD.

Funded Through Preferred Stock Offerings

The filing detailed that the purchase was funded entirely through proceeds from the sale of perpetual preferred stock under Strategy’s at-the-market (ATM) program. Between Nov. 3 and 9, the company raised roughly $50 million in net proceeds through four preferred share offerings—dubbed Series A Strife, Stretch, Strike, and Stride.

Unlike traditional fundraising that often involves issuing new common stock and diluting existing shareholder value, Strategy made no such issuance during this period. Instead, it strategically relied on preferred equity instruments to secure capital while preserving shareholder equity and maintaining balance sheet flexibility.

Also read: Strategy Eyes Global Credit Expansion as Bitcoin Treasury Evolves

That approach reflects a disciplined funding framework—one that allows Strategy to continue accumulating Bitcoin without the need to incur significant debt or reduce shareholder ownership. The reliance on perpetual preferred stock provides the company with recurring liquidity and a stable financing structure for its ongoing Bitcoin strategy.

Saylor’s Long-Term Vision

The consistent accumulation of Bitcoin, regardless of price fluctuations, aligns with Michael Saylor’s long-standing thesis that Bitcoin represents “the world’s first digital property.” According to Saylor, Bitcoin’s scarcity, decentralization, and immutability make it a superior form of money and a defense against inflation, currency devaluation, and systemic financial risk.

This latest acquisition marks yet another step in Strategy’s methodical accumulation campaign. The firm has continuously added to its Bitcoin treasury during both bull and bear markets, emphasizing long-term value creation over short-term speculation.

Saylor has also described Bitcoin as a monetary energy network and the “best long-term asset for preserving capital” in an era of monetary uncertainty.

Even during market corrections, Saylor has maintained that Bitcoin’s fundamentals remain intact. “Volatility is the price you pay for performance,” he has said in past interviews, echoing his belief that short-term dips represent opportunities for disciplined buyers.

Market Volatility and Strategy’s Accumulation Discipline

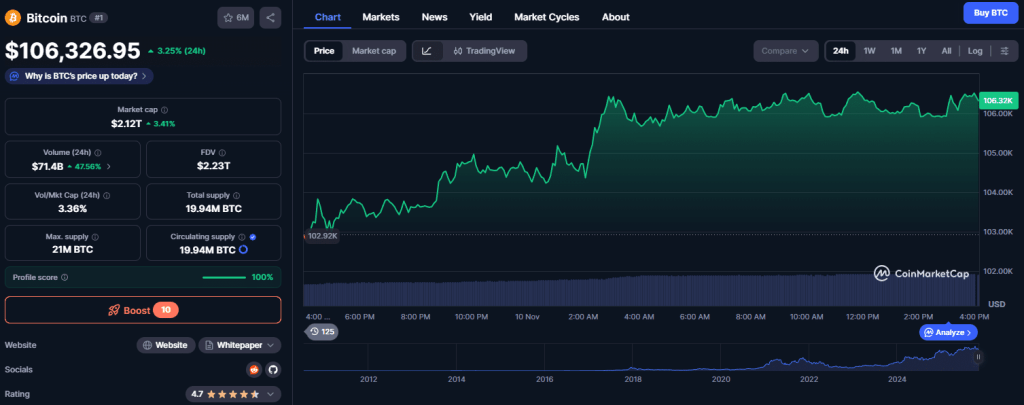

The timing of the new Bitcoin purchase coincides with a period of renewed optimism across the crypto market. Bitcoin recently surged past $106,000, fueled by easing political tensions and optimism around U.S. fiscal policy developments.

BTC price (Source: CoinMarketCap)

Despite recent volatility, institutional confidence appears to be rebounding, and Strategy’s purchase reinforces that sentiment.

Rather than trying to time the market, Strategy continues to accumulate during uncertainty, treating every dip as a strategic entry point. This methodical “dollar-cost averaging” style of buying aligns with the firm’s thesis that Bitcoin’s long-term value proposition is disconnected from short-term macroeconomic cycles.

Also read: Strategy (MSTR) Rallies as Q3 Earnings Beat Fuels Investor Optimism

A Dominant Position in the Bitcoin Economy

Strategy’s total holdings of 641,692 BTC represent an extraordinary concentration of value and influence within the Bitcoin ecosystem. With roughly 3% of Bitcoin’s total circulating supply, the company wields a structural presence in the digital asset landscape unmatched by any other publicly traded firm.

Strategy BTC holdings (Source: Bitcoin Treasuries)

The company’s balance sheet exposure to Bitcoin also serves as a proxy for broader institutional sentiment. As the market leader in corporate Bitcoin adoption, Strategy’s continued purchases are often interpreted as signals of confidence by investors and other corporations considering similar treasury diversification strategies.

In addition, the company still has $15.8 billion worth of Class A common stock available for issuance, providing significant headroom for future capital raises. This flexibility ensures that the firm can continue adding to its Bitcoin position should market conditions remain favorable.

Jim Chanos Closes His Short Position on Strategy

Adding another twist to the story, veteran short seller Jim Chanos, best known for predicting the collapse of Enron in 2001, announced that he has closed his short position on Strategy (MSTR), marking the end of an 11-month short MSTR/long Bitcoin trade.

In a post on X, Chanos revealed that Strategy’s multiple net asset value (mNAV) — a measure comparing the company’s enterprise value to its underlying Bitcoin holdings — had compressed from 2.5 to 1.23 during that period. MSTR shares fell roughly 50% from their 2025 peak, prompting Chanos to declare that the short thesis had largely played out.

Strategy’s share price performance in the last 6 months (Source: Google Finance)

Chanos initially shorted Strategy when its enterprise value far exceeded the value of its Bitcoin holdings, arguing that the stock was trading at an unsustainable premium.

As the valuation normalized, he opted to cover his position. While he noted that the mNAV could fall slightly further toward parity (around 1.0), he acknowledged that the major downside potential had already been realized.

The decision marks a notable moment for the Bitcoin treasury sector. Chanos’ move could be interpreted as a vote of stabilization, suggesting that the steep declines seen across Bitcoin treasury equities may have reached their exhaustion point.

The Broader Bitcoin Treasury Landscape

Chanos’ exit coincides with one of the most turbulent years for corporate Bitcoin holders. Companies like Metaplanet (3350) and KindlyMD (NAKA) have seen their stocks plunge more than 80% from their all-time highs, reflecting widespread volatility in the digital asset sector.

Strategy, however, has maintained its valuation premium even through this correction cycle. Unlike most other Bitcoin treasury firms, Strategy’s market capitalization has consistently traded above the value of its Bitcoin holdings, underscoring investor trust in its capital discipline, corporate structure, and Saylor’s vision-driven leadership.

Also read: Strategy Becomes First Bitcoin Treasury Firm Rated by S&P Global

This divergence has made Strategy not only a bellwether for Bitcoin treasury companies but also a barometer of institutional sentiment toward Bitcoin’s future role in the global financial system.

A Defining Moment for Corporate Bitcoin Adoption

Strategy’s relentless pursuit of Bitcoin as a reserve asset has not only transformed its balance sheet but also reshaped corporate finance norms.

What began as a controversial pivot in 2020 has evolved into a blueprint for companies seeking resilience against monetary debasement and inflation.

Whether or not Bitcoin maintains its current momentum, Strategy’s strategy remains clear: accumulate, hold, and wait. With a treasury valued at tens of billions and financing mechanisms that minimize dilution, the company appears well-positioned to weather short-term volatility and capitalize on Bitcoin’s long-term trajectory.