Robinhood’s Crypto Revenue Soars 339% in Q3 as Bitstamp Deal Boosts Global Expansion

Robinhood (HOOD) reported a massive 339% year-over-year surge in cryptocurrency trading revenue for the third quarter, signaling the trading platform’s deepening commitment to digital assets and international growth.

The company’s crypto revenue reached $268 million, compared to just $61 million during the same period last year, driven by heightened trading volumes and the integration of its newly acquired crypto exchange Bitstamp.

In total, Robinhood processed $80 billion in crypto trades for the quarter — a clear sign that retail and institutional investors alike are returning to the market.

Strong Financial Results and Expanding Horizons

Overall, the firm exceeded Wall Street expectations with adjusted earnings per share of $0.61, topping estimates of $0.53. Total net revenue climbed to $1.27 billion, also beating analyst forecasts of $1.21 billion.

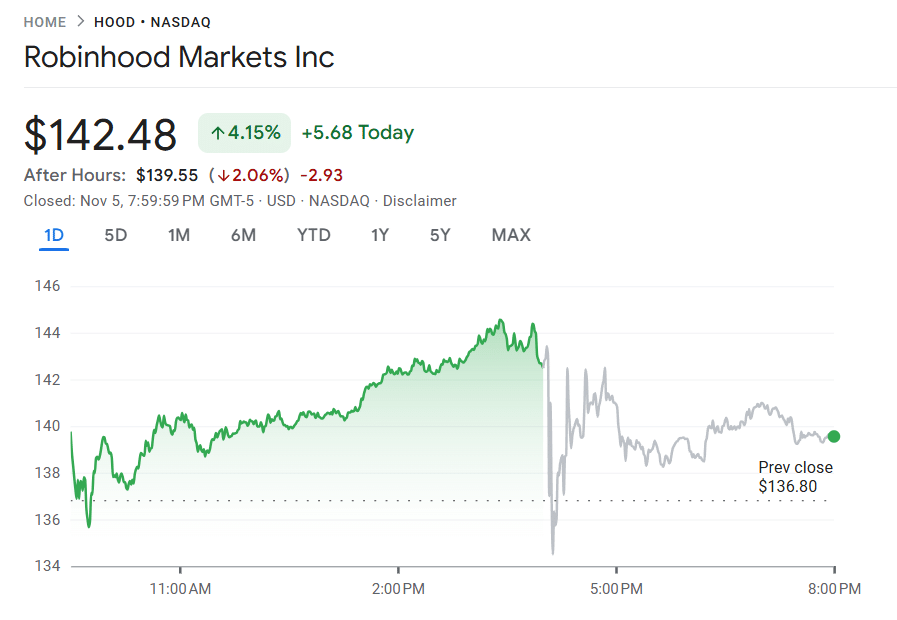

Despite the strong results, shares of Robinhood slipped 2% in after-hours trading, though the stock remains up 260% year-to-date, reflecting the company’s sharp turnaround from its 2022 slump.

HOOD price (Source: Google Finance)

“Q3 was another strong quarter of profitable growth, and we continued to diversify our business, adding two more business lines — Prediction Markets and Bitstamp — that are generating approximately $100 million or more in annualized revenues,” said CFO Jason Warnick.

He added that October has seen record trading volumes across equities, options, futures, and prediction markets — a sign that Robinhood’s multi-asset model is gaining traction among traders seeking exposure across traditional and digital markets.

Bitstamp and Global Crypto Expansion

Robinhood’s acquisition of Bitstamp earlier this year marked a major step in its global expansion strategy. The deal not only extended Robinhood’s reach to more than 50 countries but also strengthened its regulatory footing in key jurisdictions such as the UK and the European Union — regions that are increasingly setting the tone for crypto regulation.

The integration of Bitstamp has also given Robinhood a direct pathway into institutional trading services, expanding its client base beyond the retail investors that made it famous.

Beating Rivals as Crypto Revenues Rebound

With a market capitalization now at $126 billion, Robinhood has overtaken rival Coinbase (COIN), which also reported strong earnings last week.

Both firms are benefiting from the recent rebound in crypto trading activity, driven by renewed interest in Bitcoin, Ethereum, and tokenized assets amid improving market sentiment.