BitMine Adds Another 82,300 ETH to Its Growing Ethereum Empire

BitMine Immersion Technologies has tightened its grip on Ethereum, purchasing another 82,300 ETH in the past week — a move that boosts its total crypto and cash holdings to $13.7 billion.

With the recent acquisition, the company now holds roughly 3.4 million ETH, worth $13.25 billion, securing its place as the largest corporate Ethereum holder in the world and the second-largest overall crypto treasury, trailing only Strategy Inc.

BitMine Surpasses 3.4 Million ETH and Marches Toward 5% of Ethereum’s Supply

According to BitMine’s announcement, the firm now controls 2.8% of Ethereum’s circulating supply, crossing the halfway point toward its goal of owning 5% of all ETH in existence — an objective Chairman Thomas “Tom” Lee dubbed the company’s “alchemy of 5%.” Lee highlighted that October’s market correction opened prime opportunities for large-scale accumulation.

BitMine’s aggressive purchases throughout October and early November reinforce that strategy. On Oct. 16, the firm bought 104,000 ETH worth $417 million through wallets linked to Kraken and BitGo. Additional blockchain data showed inflows of 27,316 ETH later that month, followed by the most recent 82,300 ETH this week.

Beyond crypto, BitMine’s portfolio includes 192 BTC, $389 million in cash, and a $62 million investment in Eightco Holdings — one of several “moonshot” bets in its diversification plan.

Wall Street Eyes BitMine’s Meteoric Rise

BitMine’s assertive expansion has made it one of Wall Street’s most-watched crypto stocks.

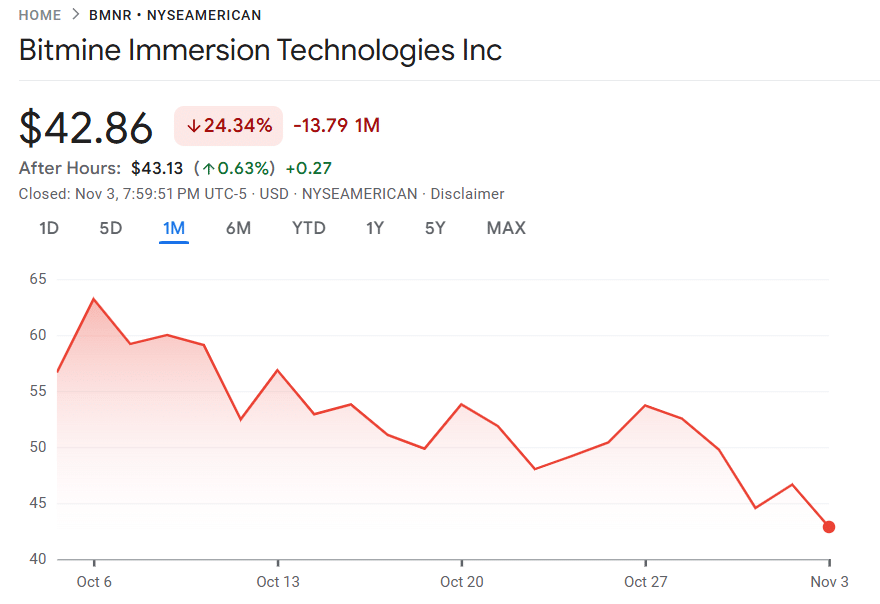

The company’s market capitalization currently stands at $12.49 billion, even with its shares dropping 25% over the past 30 days.

BitMine share price (Source: Google Finance)

Meanwhile, its earnings per share (EPS) surged 180%, supported by a strong cash position and a 1.03 MNAV, indicating solid profitability despite still being 55% short of its long-term ETH supply target.

Heavyweights such as ARK Invest, Founders Fund, Pantera Capital, Kraken, Galaxy Digital, Digital Currency Group, and Bill Miller III have thrown their support behind BitMine, further validating its aggressive accumulation strategy.

Trading data shows its growing prominence — BitMine’s U.S.-listed shares (BMNR) now rank among the top 60 most traded stocks nationwide, averaging $1.5 billion in daily trading volume. That places it just behind Walmart and ahead of Marvell Technology.

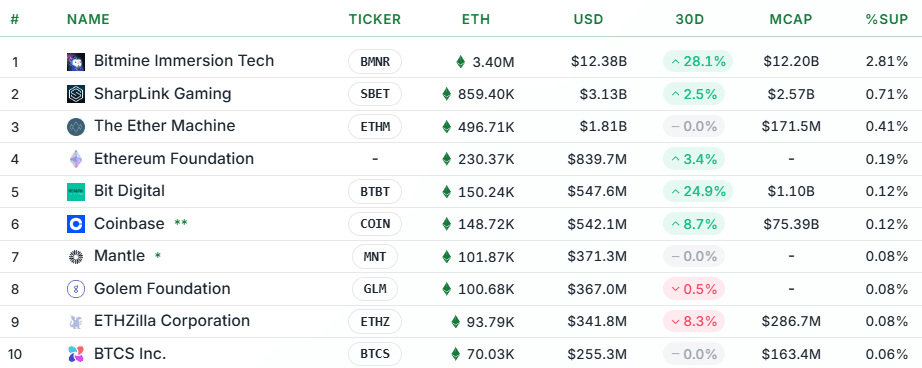

Ethereum’s Institutional Landscape

Data from StrategicETHReserve shows how dominant BitMine’s position has become. The next two largest corporate holders — SharpLink Gaming and The Ether Machine — hold 859,400 ETH ($3.12 billion) and 496,710 ETH ($1.81 billion) respectively. The Ethereum Foundation itself retains roughly 230,370 ETH, while Coinbase’s treasury stands at around 148,720 ETH.

Top 10 largest corporate ETH holders (StrategicETHReserve)

In total, the top 71 institutional and corporate holders collectively own about 6.06 million ETH — around 5% of Ethereum’s total supply — worth approximately $22.4 billion.

Recent tracker data also shows renewed movement among major entities. Coinbase added about 12,000 ETH, while the Optimism Foundation increased its balance by 3,600 ETH. Conversely, Zentry and Status reduced their holdings, and PulseChain saw outflows of roughly 160,000 ETH.

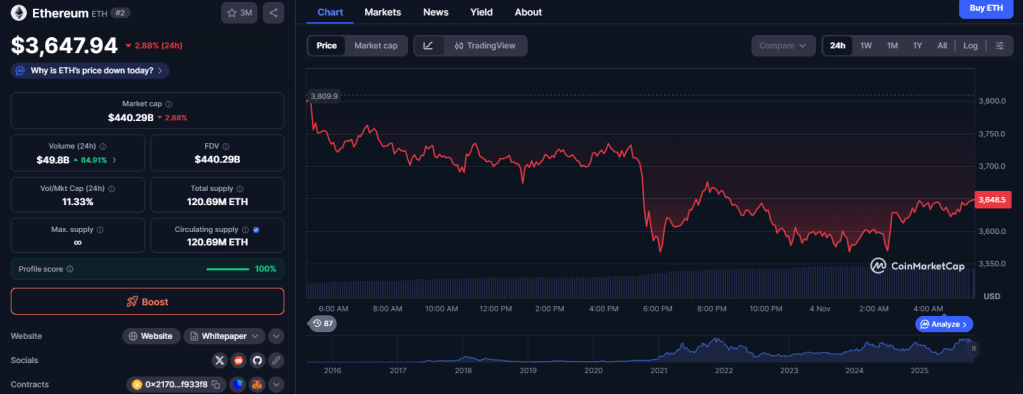

Ethereum’s Price Faces Short-Term Pressure

Despite growing institutional interest, Ethereum’s market price has been under pressure. At the time of writing, ETH traded around $3,587 — down 3.5% in the past hour, 6.8% in 24 hours, and nearly 20% over the past month.

ETH price chart (Source: CoinMarketCap)

Still, BitMine’s continued conviction underscores its belief that Ethereum’s current weakness offers long-term value opportunities — a stance increasingly shared by institutional players betting big on the network’s role in the next phase of digital asset adoption.