Traditional Wealth Managers Under Pressure as UAE’s Rich Turn to Crypto

The traditional wealth management industry is facing a reckoning as wealthy investors in crypto hotspots like Dubai, Switzerland, and Singapore increasingly demand access to digital assets.

A new report from Swiss software firm Avaloq reveals that 39% of high-net-worth (HNW) investors in the UAE now hold digital assets, yet only 20% use traditional wealth managers to manage those assets — highlighting a major service gap in the private banking world.

Wealth Managers Face Crypto Demand From a New Generation

The findings, based on surveys of 3,851 investors and 456 wealth professionals in February–March 2025, show that the next generation of wealthy clients is driving the shift.

According to Avaloq’s data, 63% of UAE investors have switched or are considering switching wealth managers — largely because their questions about digital assets are being ignored.

“As crypto has evolved as an asset class, there has been a growing need among private banking relationship managers to cater to clients who are basically not being served,” said Akash Anand, Avaloq’s Head of Middle East and Africa. “Hence there has been a rush among traditional wealth managers to get equipped to offer crypto.”

Why Traditional Firms Lag Behind

Despite the strong appetite, most traditional financial institutions have been slow to adapt. Volatility, complex custody requirements, and regulatory uncertainty have made many banks hesitant to fully embrace digital assets.

According to Avaloq’s report, 38% of UAE investors who don’t hold crypto cited market volatility as the main reason, followed by 36% citing lack of knowledge and 32% citing distrust in exchanges.

Still, firms like Avaloq see opportunity in the disconnect. The company has been integrating crypto custody solutions for financial institutions in recent years, partnering with Fireblocks, BBVA, and Zurich Cantonal Bank to offer secure crypto asset management.

Crypto Custody Becomes a Competitive Edge

Avaloq’s integrated systems allow wealth managers to safely manage digital assets alongside traditional portfolios — a crucial advantage as more clients expect “one-stop shop” platforms. Anand said there’s now a “healthy pipeline” of banks and financial institutions seeking to customize their systems with Avaloq’s crypto custody technology or adopt its preconfigured platform.

“Firms are looking to create a one-stop shop integrated with their existing e-banking systems,” Anand added, underscoring how the line between traditional finance and crypto is rapidly blurring.

Millionaires Multiply as Market Rebounds

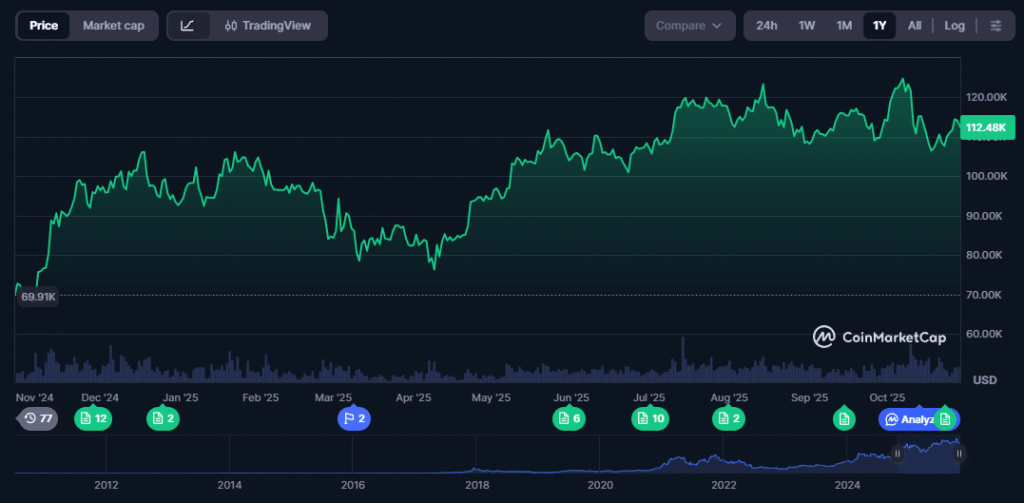

The growing demand comes amid a broader market recovery.

With Bitcoin hitting new all-time highs in 2025 and institutional interest surging, the number of crypto millionaires has soared to 241,700, up 40% from the previous year, according to the Crypto Wealth Report 2025 by Henley & Partners.

Bitcoin price chart (Source: CoinMarketCap)

The report ranks Singapore, Hong Kong, the U.S., Switzerland, and the UAE as the top global destinations for digital asset investors.

As digital assets mature beyond the volatility of its early years, it’s becoming too significant for private banks to ignore. “There have been some quite spectacular crashes involving certain crypto exchanges, and that has created a lot of trust issues,” Anand said. “Our research shows that there is an opportunity for banks and wealth managers to step in and provide that trust in the form of fully integrated, secure and compliant custody.”