Maple Finance Ends Staking Era With MIP-019, Pioneering a New Model for On-Chain Credit

Maple Finance is reshaping the decentralized credit landscape with its latest governance overhaul, MIP-019, which replaces staking rewards with a buyback-based model — a decisive shift that ties token incentives directly to real financial performance.

The move marks a major milestone for Maple’s evolution into a sustainable, revenue-driven credit platform at the heart of the booming real-world asset (RWA) sector.

Maple Transitions From Staking to Sustainable Growth

Under MIP-019, Maple Finance has officially ended its staking program and introduced a new mechanism centered on SYRUP token buybacks. Instead of relying on inflationary staking emissions, the protocol will now use revenue generated from on-chain lending activities to repurchase SYRUP tokens from the open market.

According to Maple’s governance forum, the change “limits inflation, strengthens capital efficiency, and links value directly to protocol revenue.” By eliminating token dilution and rewarding long-term performance, Maple aims to mirror the capital discipline of traditional credit institutions while remaining natively on-chain.

This evolution aligns Maple with the broader RWA narrative sweeping through DeFi — one that prioritizes yield derived from real, off-chain assets rather than speculative farming.

Market Response and Institutional Momentum

Investor reaction has been immediate.

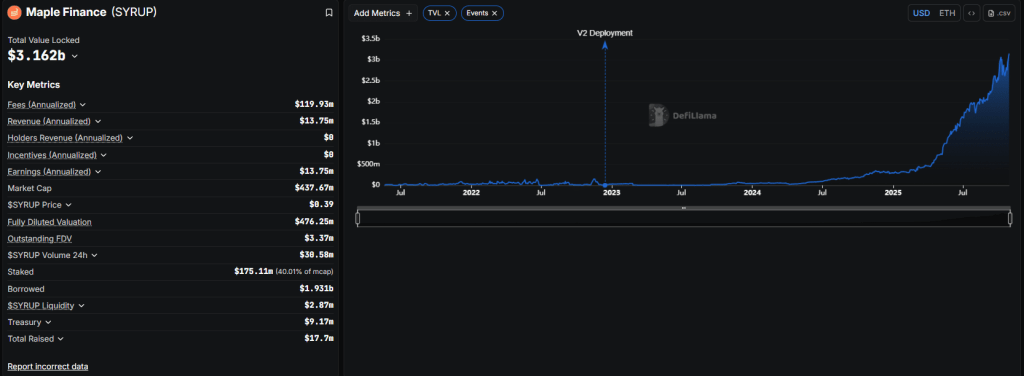

Maple’s total value locked (TVL) soared past $3.1 billion in late October, its highest level since 2022, according to DefiLlama. The surge reflects growing activity from institutional liquidity providers who are increasingly seeking exposure to tokenized credit markets.

Maple Finance TVL (Source: DefiLlama)

DeFi commentators have described MIP-019 as a watershed moment. RWA analyst @RWA_Guru called the proposal “ultra-bullish,” emphasizing that it “reduces inflation, caps supply growth, and introduces stronger governance incentives.”

The upgrade strengthens Maple’s identity as a bridge between decentralized finance and the global credit industry — a platform where institutional-grade lending meets transparent, programmable capital markets.

The RWA-Driven Credit Revolution

Maple’s strategic pivot comes as real-world asset tokenization accelerates across DeFi. Protocols such as Centrifuge, Ondo, and Clearpool are competing to attract institutional capital into on-chain credit instruments backed by tangible assets.

By replacing staking emissions with buybacks funded by actual yield, Maple is setting a precedent for revenue-backed governance in decentralized lending. This shift signals that DeFi protocols are maturing — moving from speculative incentives to structures based on measurable financial output.

Risks and Industry Outlook

While the move has been widely praised, analysts caution that Maple Finance’s buyback capacity now depends on macro credit conditions. A slowdown in RWA yields or institutional borrowing could constrain the protocol’s revenue base.

Nonetheless, market observers see this as a natural step in DeFi’s evolution toward on-chain credit infrastructure — where tokenomics are rooted in sustainable economics, not token inflation.

Maple’s governance transformation underscores how decentralized finance is converging with traditional capital markets. By anchoring token value to real-world credit flows, Maple Finance positions itself at the forefront of the RWA-driven on-chain lending revolution.