Trump-Backed American Bitcoin Now Holds Nearly $445 Million in BTC

American Bitcoin, the mining and treasury company co-founded by Eric Trump and Donald Trump Jr., has strengthened its position in the digital asset market by acquiring more than 1,400 Bitcoin.

According to a Monday announcement, the company purchased 1,414 BTC — worth around $163 million — bringing its total Bitcoin holdings to 3,865 BTC, valued at nearly $445 million at current prices.

The move reflects American Bitcoin’s commitment to expanding its on-chain reserves as part of its long-term accumulation strategy. The company’s growing treasury has positioned it among the largest corporate holders of Bitcoin in the United States, alongside firms like Strategy and Tesla.

Focusing on Bitcoin-Per-Share Growth

Eric Trump, who serves as American Bitcoin’s Chief Strategy Officer, said the firm’s key objective is to raise its “Bitcoin-per-share” ratio — a unique metric that measures how much Bitcoin backs each share of the company.

“We believe one of the most important measures of success for a Bitcoin accumulation platform is how much Bitcoin backs each share,” Trump stated. He added that American Bitcoin’s long-term strategy is centered on increasing direct exposure to Bitcoin rather than relying solely on speculative price appreciation.

This focus reflects a broader trend among Bitcoin-centric companies that see treasury-backed shares as a bridge between traditional finance and the emerging Bitcoin economy.

From Hut 8 Partnership to Nasdaq Listing

American Bitcoin’s rise has been rapid since its formation earlier this year.

The company came to life in March when Hut 8, one of North America’s leading Bitcoin mining firms, acquired a majority stake in exchange for its mining hardware. This partnership provided American Bitcoin with the mining infrastructure it needed to scale operations quickly and secure a steady stream of newly minted Bitcoin.

The company’s trajectory accelerated in August, when it merged with Gryphon Digital Mining, a Las Vegas–based publicly traded Bitcoin miner.

The merger allowed American Bitcoin to debut on the Nasdaq exchange in early September under the ticker symbol “ABTC.”

A Volatile But Strong Market Debut

American Bitcoin’s first day of trading on Nasdaq drew significant market attention.

The company’s stock surged by more than 16% by the end of the day and saw intraday gains of over 85% before multiple trading halts were triggered due to volatility.

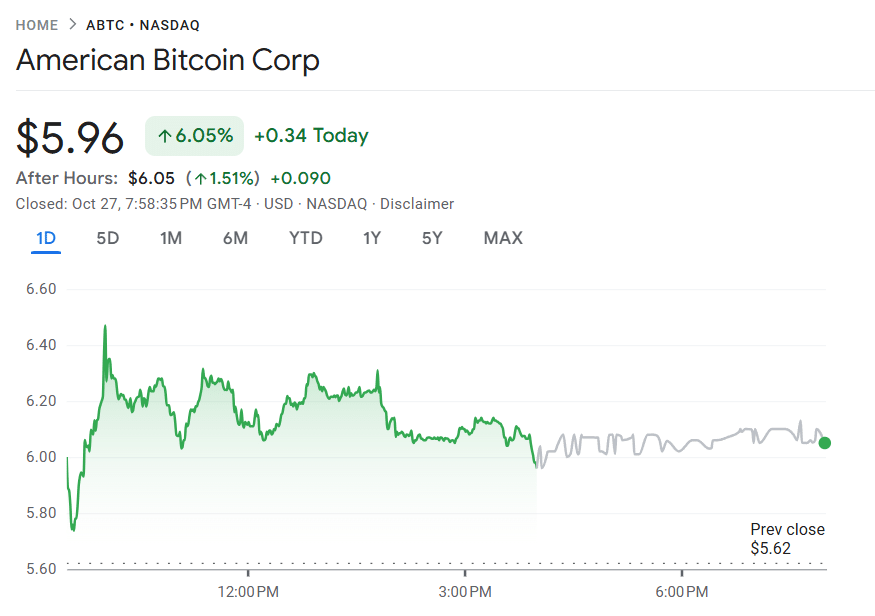

American Bitcoin share price (Source: Google Finance)

The listing followed a 230% rally in Gryphon’s stock ahead of the merger, signaling investor enthusiasm for the new entity. Despite the choppy debut, analysts viewed the launch as a milestone for Bitcoin-focused companies entering mainstream equity markets.

Political Connections and Growing Scrutiny

The company’s success has not come without controversy.

As the Trump family deepens its involvement in the digital asset industry, political scrutiny has intensified — particularly in the wake of President Trump’s pardon of Binance founder Changpeng “CZ” Zhao, who had pleaded guilty to violating U.S. Anti-Money Laundering laws.

The decision drew sharp criticism from Democratic lawmakers.

Representative Maxine Waters called the pardon “an appalling but unsurprising reflection of his presidency,” accusing Trump of “doing massive favors for crypto criminals” and using his office to advance personal financial interests.

Such criticisms have only amplified as reports suggest the Trump family’s wealth has ballooned during his second term, with Eric Trump recently remarking that profits from their digital asset ventures were “probably more” than the $1 billion publicly reported.

A New Era for American Bitcoin

Despite the political heat, American Bitcoin’s rapid expansion marks a defining chapter in the growing overlap between politics, finance, and digital assets.

The company’s hybrid model — combining Bitcoin mining with treasury accumulation — places it at the center of both market and political conversations surrounding America’s evolving crypto landscape.

As Eric Trump continues to position American Bitcoin as a symbol of “financial independence through hard money,” the company’s strategy of linking traditional equity to Bitcoin’s scarcity could reshape how investors perceive value in the era of digital assets.