Securitize to Go Public in $1.25B SPAC Deal, Bringing Tokenized Shares to Nasdaq

Tokenization specialist Securitize announced on Tuesday that it will go public through a merger with Cantor Equity Partners II (CEPT), marking one of the most significant milestones yet for blockchain-based finance.

The deal values the company at $1.25 billion, and once finalized, Securitize will list its shares on the Nasdaq under the ticker “SECZ.”

But the firm isn’t stopping there. In a move that shows its commitment to blockchain technology, Securitize also plans to tokenize its own equity, allowing its shares to be traded and transferred on-chain.

That would make Securitize the first publicly listed U.S. company to offer end-to-end tokenization infrastructure for securities — effectively blending the traditional and digital capital markets it has long sought to connect.

Securitize: From Private Platform to Public Pioneer

Securitize has spent years establishing itself as a leader in real-world asset (RWA) tokenization, working with major institutions like BlackRock, Apollo, and VanEck to digitize everything from private equity to real estate.

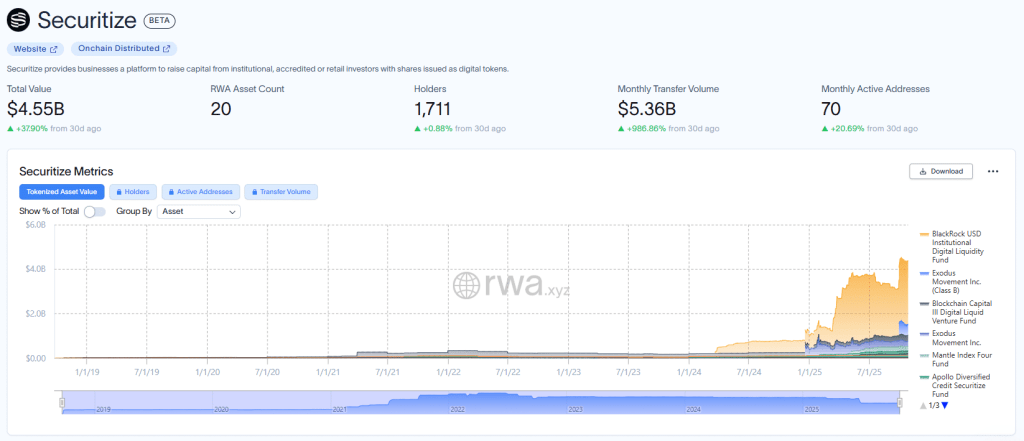

According to data from RWA.xyz, the firm has already facilitated more than $4.5 billion worth of on-chain securities.

Securitize on-chain securities (Source: RWA.xyz)

Now, with the backing of some of the world’s most influential investors — including ARK Invest, BlackRock, and Morgan Stanley Investment Management — Securitize’s next chapter will unfold in the public arena.

Those existing shareholders will roll their entire stakes into the newly combined company, signaling long-term confidence in its mission to modernize capital markets through blockchain.

Institutional Support Anchors the Deal

The merger includes a $225 million private investment in public equity (PIPE) round, bringing together new and existing institutional investors such as Arche and ParaFi Capital.

The fresh capital will strengthen Securitize’s balance sheet as it transitions into a public company and scales its operations globally.

Bridging Finance and Blockchain

Securitize’s listing represents more than a corporate milestone — it’s a signal of how traditional finance and blockchain technology are converging.

By tokenizing its own equity, the company aims to demonstrate the efficiency, transparency, and accessibility that blockchain-based markets can offer.

If successful, Securitize’s Nasdaq debut could serve as a blueprint for other fintech and blockchain firms looking to bridge the gap between regulated financial infrastructure and decentralized innovation.

The Road Ahead

As Securitize prepares for its public listing, the spotlight will be on how effectively it can execute this ambitious integration of Wall Street and Web3. With a growing roster of institutional clients and a clear regulatory framework, the company is positioning itself not just as a tokenization platform, but as a catalyst for the next phase of financial market evolution.

If its plan to bring tokenized equity to Nasdaq succeeds, Securitize could redefine what it means to be a public company in the digital age.