Analyst Calls Hut 8 a “Flexible Call Option” on Bitcoin, AI, and HPC

Wall Street broker Benchmark says Hut 8 (NASDAQ: HUT) has evolved far beyond its roots as a bitcoin miner.

In a report released Tuesday, analyst Mark Palmer described the company as an emerging energy infrastructure player uniquely positioned to benefit from the surging demand for artificial intelligence (AI) and high-performance computing (HPC).

Palmer reaffirmed his buy rating on Hut 8 and more than doubled his price target to $78 from $36, citing a sum-of-the-parts valuation that factors in the company’s energy pipeline, its 64% ownership in American Bitcoin Corp. (ABTC), and its 10,264 BTC holdings as of June 30.

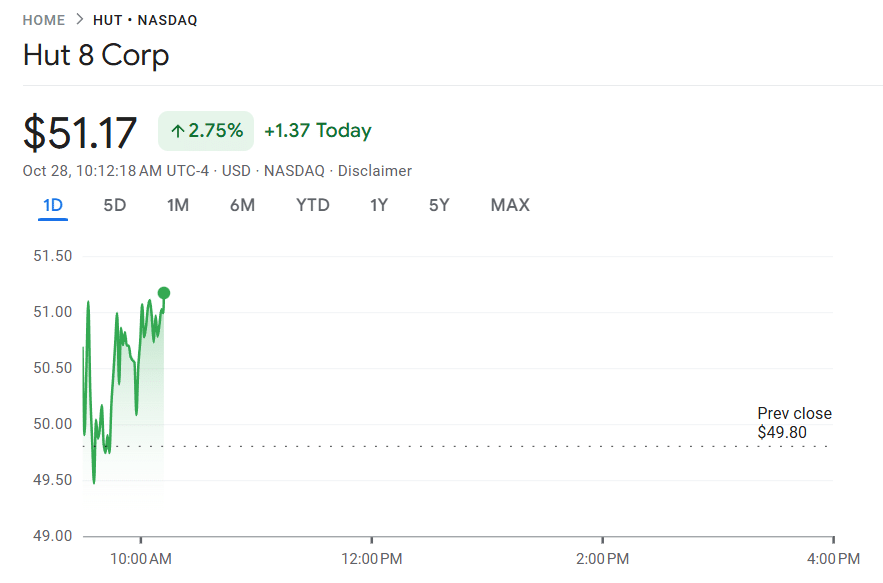

Following the optimistic forecast, shares rose slightly in early trading, increasing 2.75% to $51.17.

Hut 8 share price (Source: Google Finance)

Hut 8 A Flexible Bet on Bitcoin, AI, and HPC

Palmer described the miner’s stock as a “flexible call option” — a unique play that captures upside not just from Bitcoin but also from the rapidly expanding AI and HPC sectors.

The company, he said, is transitioning into a platform that can channel energy toward the most profitable use cases as market dynamics shift.

Under the leadership of CEO Asher Genoot, who assumed the role in February 2024, Hut 8 has focused on acquiring and developing low-cost power infrastructure that can flexibly support various high-energy workloads.

Palmer highlighted that the company has 1,530 megawatts (MW) of capacity under development, much of it aimed at data centers serving AI and HPC applications.

Market Confidence in Genoot’s Strategy

Since Genoot’s appointment, investors have embraced the company’s transformation.

The firm’s stock has more than quadrupled in the past six months — a reflection of growing market confidence in its pivot from mining to infrastructure.

Even so, Palmer argues that Hut 8’s intrinsic value remains above its current market capitalization, suggesting room for further appreciation.

The analyst emphasized that Hut 8’s diversified business model could insulate it from Bitcoin’s price volatility while positioning it to benefit from broader tech sector growth.

Upcoming Catalysts and Growth Drivers

Benchmark identified several catalysts that could propel the next phase of Hut 8’s growth. Among them is a potential tenant signing at the company’s River Bend site in Louisiana, a development that could validate its entry into the AI data center market.

Longer-term expansion, the report noted, could come from replicating the success of the Vega facility in Texas, which has become a blueprint for Hut 8’s scalable, power-efficient infrastructure model.

Palmer also pointed to Hut 8’s 1,255 MW of capacity under exclusivity and 6,815 MW under diligence, neither of which are currently included in his valuation. Benchmark values Hut 8’s ongoing projects at about $6 million per megawatt — roughly 50% below the industry average, underscoring the company’s cost advantage.

The Bottom Line

Benchmark’s latest analysis paints Hut 8 as a company in transition — one that’s redefining its identity from a pure bitcoin miner to a next-generation energy infrastructure firm bridging digital assets and AI.

Palmer’s bullish outlook reflects growing confidence that Hut 8’s focus on scalable, power-efficient infrastructure could make it one of the few crypto-native companies positioned to thrive across both the blockchain and AI revolutions.