Trump’s Pro-Crypto Pivot Drives $1 Trillion Surge in U.S. Crypto Transactions: Report

The first half of this year has seen an unmistakable revival in U.S. crypto activity.

As President Donald Trump reversed years of cautious resistance to digital assets, crypto transaction volumes surged by roughly 50%, clearing the $1 trillion mark, according to a Tuesday report from TRM Labs.

For an industry that spent much of the last decade battling regulatory uncertainty, the Trump administration’s sudden embrace of crypto has proven catalytic. The president’s vow to make the U.S. the “crypto capital of the world” wasn’t just campaign rhetoric — it’s translating into tangible economic activity.

Institutions Return to the Table

The TRM Labs report highlights a confluence of forces behind the boom.

Institutional investors are pouring capital into stablecoins, attracted by their consistent yields and new regulatory clarity. Others are turning to exchange-traded funds (ETFs) — products that now enjoy a formal legal footing in the U.S. market.

Much of this growth reflects a “more favorable political and regulatory climate,” said Ari Redbord, TRM’s global head of policy.

“It’s difficult to say how much of this is due to offshore activity returning onshore, but the trend aligns with growing confidence, clearer rules, and renewed capital formation.”

Crypto Goes From Uncertainty to Clarity

During the Biden administration, the SEC and banking regulators had kept crypto at arm’s length, concerned about financial-system risks. Industry advocates argued that this stance was pushing innovation overseas. Under Trump, the tone has flipped:

- The White House has issued multiple executive orders promoting digital-asset innovation.

- The SEC has established a dedicated crypto task force.

- Congress has passed legislation governing stablecoin issuers, while a broader market-structure bill has already cleared the House.

Although that bill has since stalled in the Senate, it marked the most significant legislative progress for digital assets in U.S. history.

Confidence Returns to the Crypto Market

TRM Labs also found a 30% increase in U.S. web traffic to crypto-service providers in the six months following the 2024 presidential election — a period when investors began anticipating friendlier policies.

That renewed confidence has translated directly into capital inflows, pushing trading volumes to record levels and reviving domestic market depth.

This trend suggests a reversal of the offshoring effect that plagued the industry in prior years. As regulation turns from restrictive to enabling, both liquidity and innovation appear to be migrating back to U.S. soil.

A Global Landscape Still in Motion

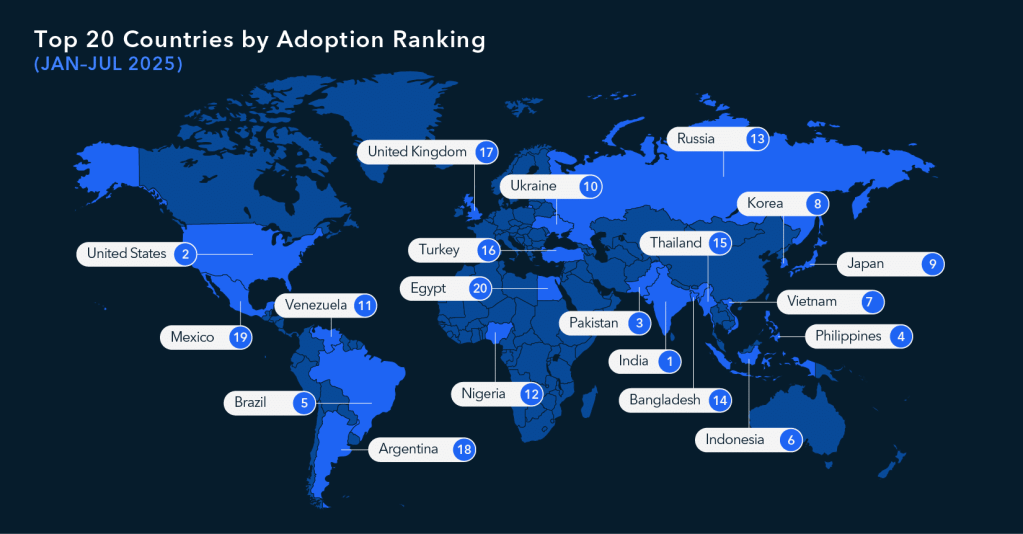

Despite the U.S. rebound, India continues to dominate TRM’s country-adoption index for the third straight year, followed by Pakistan, the Philippines, and Brazil — a reminder that crypto remains a global phenomenon.

Top 20 countries by crypto adoption (Source: TRM Labs)

Yet the U.S. uptick is symbolically important: it signals that one of the world’s largest economies is once again open for blockchain business.

Whether this surge marks the beginning of a sustainable expansion or a temporary rebound remains to be seen. But the combination of clear policy direction, institutional participation, and executive-level support has rekindled the idea that America could lead the next wave of crypto growth.

If the momentum continues, 2025 may well be remembered as the year the U.S. stopped merely regulating crypto — and started competing in it.