Ethereum Leads Crypto’s Q3 Comeback with DeFi Revival: CoinGecko

Ethereum emerged as the clear frontrunner in crypto’s third-quarter rebound, outpacing Bitcoin as capital rotated toward altcoins, DeFi protocols, and tokenized real-world assets, according to a new report by CoinGecko.

Ethereum Takes the Lead

The broader cryptocurrency market added more than half a trillion dollars in value in Q3 — marking its second consecutive quarter of meaningful growth.

But unlike previous rallies, Bitcoin wasn’t the one leading the charge. Instead, investors turned their focus to Ethereum and other large-cap tokens, helping ETH climb to a new all-time high before a brief pullback.

ETH price chart (Source: CoinGecko)

At the start of the quarter, Bitcoin appeared poised to dominate once again. Its early-July rally was fueled by strong retail participation and institutional inflows through spot exchange-traded funds (ETFs).

By September, however, momentum had shifted. ETF demand, a growing appetite for tokenized assets, and renewed attention from corporate treasuries propelled Ethereum’s rise — signaling a broader evolution in crypto market dynamics.

DeFi and Altcoins Stage a Comeback

After two consecutive quarters of declining trading activity, spot volumes across centralized and decentralized exchanges surged. But what stood out was where this trading activity was concentrated. DeFi protocols saw total value locked (TVL) climb sharply, marking a resurgence of interest in decentralized lending and staking.

Meme coins also reemerged, with tokens like M capturing investor attention. Stablecoins such as USDe gained momentum, and several previously obscure altcoins entered the top 30 by market capitalization — underscoring the diversification of investor appetite beyond Bitcoin and Ethereum.

The Rise of Tokenized Real-World Assets

One of the defining narratives of Q3 was the acceleration of tokenized assets — from on-chain stocks to blockchain-based bonds. Protocols like Ondo Finance and Backed Finance gained traction with investors seeking exposure to real-world yield within decentralized frameworks.

According to CoinGecko analysts, this trend represents a maturing phase in crypto, where blockchain technology increasingly overlaps with traditional finance. The growth of tokenized real-world assets has become a key driver for Ethereum’s ecosystem, as most of these protocols are built on the Ethereum network.

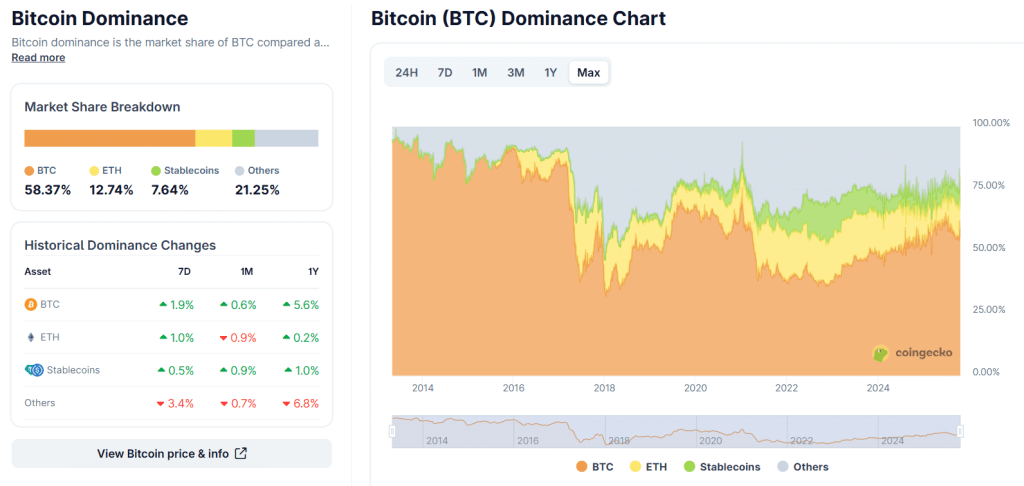

Shifting Market Dynamics

Bitcoin’s dominance fell during the quarter — a clear indicator that investors were reallocating capital toward new opportunities. Interestingly, Bitcoin also began decoupling from the S&P 500 for the first time in over a year, suggesting that the crypto market is becoming a more independent asset class.

Bitcoin dominance (Source: CoinGecko)

Meanwhile, Bitcoin miners thrived despite losing the spotlight. Hashrates hit record highs, and miner-focused ETFs posted strong returns. Yet the narrative belonged to Ethereum’s resurgence and the reawakening of decentralized finance.

As CoinGecko’s report concluded, the third quarter marked a transition period for crypto — one defined by innovation, diversification, and Ethereum’s reestablishment as the network driving the next wave of digital asset growth.