SharpLink Strengthens Its Ethereum War Chest in $76.5M Premium-Priced Deal

SharpLink Gaming (Nasdaq: SBET), the Minneapolis-based company that holds the second-largest Ether (ETH) treasury among publicly traded firms, has successfully raised $76.5 million through a direct stock offering priced above market, a move that underscores institutional confidence in its Ethereum-focused strategy.

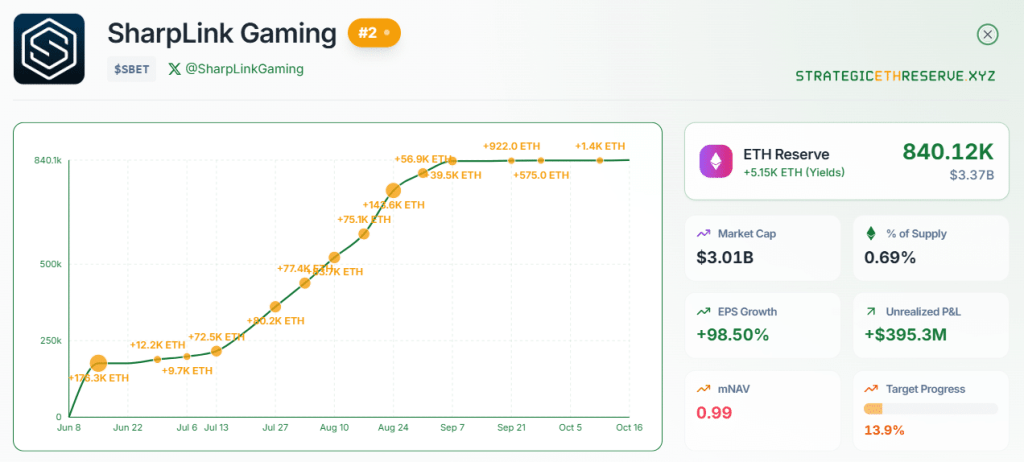

According to SharpLink’s announcement, the company sold 4.5 million shares at $17 per share, representing a 12% premium over its Oct. 15 closing price of $15.15. The offering price also exceeded the company’s net asset value (NAV) based on its 840,124 ETH holdings, signaling strong belief from investors in both the company’s direction and the long-term potential of Ethereum as a reserve asset.

A Strategic Investment from Institutional Backers

An unnamed institutional investor acquired the full allotment of shares and was granted a 90-day option to purchase an additional 4.5 million shares at $17.50 per share.

SharpLink described the outcome as an indicator of “strong institutional confidence” in its ETH-based treasury model. The move positions the company as one of the few publicly traded entities effectively using Ethereum as a corporate reserve, with its strategy now drawing comparisons to the Bitcoin accumulation playbooks of early adopters like Strategy.

SharpLink Second-Largest Ether Treasury Among Public Companies

The company’s Ether holdings—totaling 840,124 ETH—make it the second-largest Ethereum-holding public firm, trailing only BitMine Immersion Technologies (BMNR), which currently holds 3.03 million ETH. This distinction places SharpLink firmly at the center of a new wave of companies using digital assets as part of long-term balance sheet management and financial strategy.

SharpLink ETH holdings (Source: StrategicETHReserve)

In early Thursday trading, SBET shares climbed 32.05% to $15.46, mirroring a broader upswing in crypto markets as Ethereum reclaimed the $4,000 mark. The simultaneous rise in both the stock and ETH price adds weight to the argument that investors increasingly view Ethereum treasuries as a valuable and appreciating form of corporate liquidity.

SharpLink Gaming share price (Source: Google Finance)

While the investor behind the deal remains undisclosed, the fact that the offering was priced at a premium to both market price and net asset value suggests that major financial institutions are becoming more comfortable allocating capital to firms that integrate blockchain assets into their core business models.

Firms Stock Up On ETH

This capital raise follows a broader trend of companies diversifying their balance sheets with cryptocurrencies, particularly Ether, as decentralized finance continues to expand.

Analysts have noted that Ethereum’s position as the leading smart contract platform—and its integration into emerging financial applications—makes it an appealing long-term hold for firms looking beyond traditional asset classes.

By pricing its latest raise at a premium, SharpLink has not only secured new capital but also strengthened its market perception as a pioneer in institutional Ethereum exposure.

The company’s performance could serve as a barometer for how Wall Street evaluates crypto treasury models moving forward, especially as more corporations begin to treat blockchain-based assets as strategic reserves rather than speculative plays.

With its growing ETH holdings and successful funding round, SharpLink is solidifying its place in the evolving bridge between traditional finance and decentralized assets, positioning itself as a leading example of how public companies can merge corporate governance with blockchain innovation.