Paxos Fat-Finger Error Mints $300 Trillion in PayPal’s PYUSD

Paxos, the issuer behind PayPal’s PYUSD stablecoin, accidentally minted a staggering $300 trillion worth of PYUSD today — more than the value of the entire global economy. The firm quickly burned the tokens and replaced them with a much smaller $300 million issuance, calling the incident a user error.

Paxos’ PYUSD Blunder

The error, which appeared briefly on the Ethereum blockchain, sent shockwaves through the crypto community. Analysts and developers quickly noticed the impossible sum, prompting speculation about a “fat-finger” mistake — a simple extra zero or two entered by accident.

Paxos later confirmed the incident was indeed an internal mistake rather than malicious activity, reassuring users that no funds were affected. Still, the firm’s quick fix did little to calm fears about the fragility of centralized stablecoin systems.

This blunder comes as PayPal expands PYUSD’s reach, adding new blockchain integrations and partnerships to grow adoption. Yet, incidents like this may undermine confidence not only in PYUSD but in the broader stablecoin industry.

A Wake-Up Call for Stablecoin Transparency

The minting accident has reignited debate over how stablecoins are issued — and the lack of on-chain proof-of-reserves mechanisms. Unlike decentralized protocols, most centralized stablecoin issuers can mint tokens without automatically proving they have corresponding reserves.

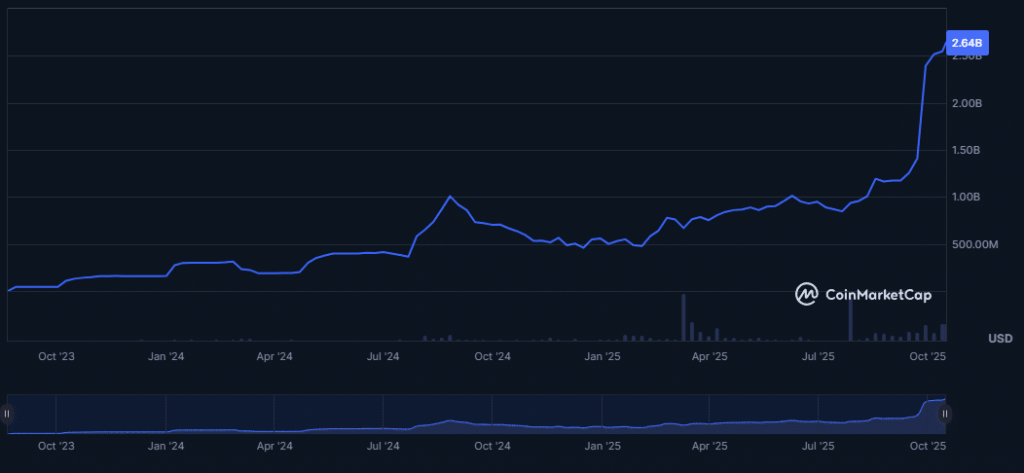

Paxos has faced regulatory scrutiny before, including investigations into its operations and oversight of stablecoin issuance. PYUSD itself saw a 40% market cap drop last year without clear explanation, raising suspicions about transparency and liquidity management.

PYUSD market cap (Source: CoinMarketCap)

The Bigger Picture: Fragility Across Stablecoins

While Paxos’ rapid correction may have prevented major fallout, the event highlights a broader issue within the stablecoin ecosystem. Even market giants like Tether (USDT) have yet to deliver a comprehensive third-party audit despite promises to do so.

Web3 developers have long proposed smart contract-based guardrails — automated systems that prevent excessive minting without verified reserves — but centralized issuers have been slow to adopt such solutions.

As stablecoins continue to play a growing role in both crypto and traditional finance, the Paxos incident may serve as a turning point — a reminder that transparency and automation aren’t optional in a digital monetary system.