Erebor Bank Gains Conditional Approval as Washington Signals Crypto Policy Shift

In a move marking a subtle but significant shift in U.S. financial policy, the Office of the Comptroller of the Currency (OCC) has granted preliminary conditional approval to Erebor Bank, a new institution backed by tech heavyweights Peter Thiel, Palmer Luckey, and Joe Lonsdale.

The decision makes Erebor Bank the first newly chartered national bank approved under Comptroller Jonathan Gould and signals a growing openness to crypto-linked banking in the Trump administration’s financial landscape.

Erebor Bank A New Kind of “Narrow Bank” for the Innovation Elite

Headquartered in Columbus, Ohio, Erebor Bank filed its OCC application on June 11 and received its approval following a four-month review process. In his announcement, Gould emphasized a “dynamic and diverse federal banking system” and noted that the OCC “does not impose blanket barriers to banks that want to engage in digital asset activities.”

That statement marks a turning point for federal regulators, who had largely taken a restrictive approach to crypto banking since the 2023 collapse of several digital asset–linked institutions. Erebor Bank’s conditional charter, however, suggests the OCC now sees room for responsible digital asset engagement under strong compliance standards.

Erebor aims to operate as a full-service national bank, offering deposit and lending services while maintaining a small but deliberate crypto presence — around $1 million in digital assets for transactional use. The approach appears designed to demonstrate compliance and stability, standing in contrast to the risk-heavy strategies that doomed some of its predecessors.

A source close to the company told the Financial Times that Erebor intends to be “a stable, low-risk, reliable bank doing normal banking things without screwing everyone over with undue risk.”

Filling the Void Left by SVB and Signature

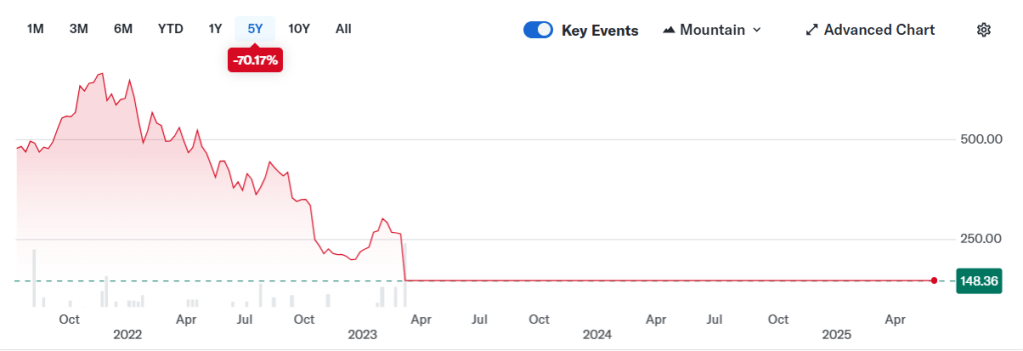

Erebor’s emergence comes in the aftermath of the 2023 collapses of Silicon Valley Bank, Silvergate, and Signature Bank — failures that left tech startups, venture funds, and crypto firms struggling to find reliable banking partners.

By targeting clients across AI, defense, manufacturing, digital assets, and payments, Erebor aims to restore stability to an ecosystem still rebuilding from those shocks.

With its blend of Silicon Valley backing and conservative structure, Erebor positions itself as a “narrow bank” for the innovation economy — catering to tech firms, payment processors, and trading companies while staying within tight regulatory lines.

Silicon Valley Bank share price (Source: Yahoo Finance)

Still, Erebor’s operations remain in the early stages. The OCC’s conditional approval requires the institution to complete capital adequacy, cybersecurity, and compliance reviews before receiving a full charter.

The Trump-Era Greenlight for Crypto Banking

Erebor Bank’s approval arrives as Washington signals a broader policy pivot toward crypto inclusion. President Donald Trump recently signed the GENIUS Act, establishing stablecoin oversight standards, while Congress continues debating broader crypto market structure rules and limits on a central bank digital currency (CBDC).

Earlier this year, the OCC also clarified that banks may buy, sell, and custody crypto assets on behalf of clients — a reversal from its earlier restrictive position. The policy shift allows financial institutions to outsource custody and execution to regulated third parties under strict supervision, providing new avenues for compliant digital asset operations.

Comptroller Gould’s appointment in June reinforced this direction. The former Bitfury executive and longtime OCC official, confirmed in a narrow 50–45 Senate vote, has moved swiftly to modernize the agency’s digital asset policies. Under his leadership, the OCC removed references to “reputation risk” from internal guidance — a change widely viewed as lowering barriers for crypto-focused banks.

Political Ties and Oversight Scrutiny

Erebor’s founding team includes politically connected figures aligned with the Trump administration, prompting concerns about regulatory favoritism. Thiel and Luckey’s long-standing relationships with Washington insiders have been cited as influential in the approval process.

In August, Senators Elizabeth Warren, Chris Van Hollen, and Ron Wyden urged Gould to examine potential conflicts of interest related to Trump’s involvement in crypto ventures — particularly the stablecoin USD1 issued by World Liberty Financial.

The senators questioned whether the OCC could remain impartial as it assumes primary oversight of stablecoin issuers under the GENIUS Act.

A Test Case for Crypto’s Banking Future

If Erebor secures full authorization, it could become a test case for federally chartered crypto banking — a model that integrates digital assets into the national banking framework without replicating past excesses.

Its conservative approach, combined with elite backing and favorable regulatory winds, positions Erebor as both a symbol of Washington’s evolving crypto stance and a potential blueprint for future digital-finance institutions.

Whether it becomes a lasting pillar of the post-SVB banking era or merely a politically charged experiment will depend on how Erebor balances innovation, compliance, and credibility in the months ahead.